|

Immelt to be next GE CEO

|

|

November 27, 2000: 3:26 p.m. ET

Immelt, 44, will succeed Welch next year, ending race for CEO spot

|

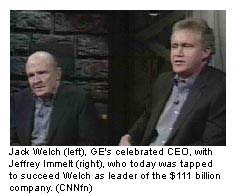

NEW YORK (CNNfn) - Jeffrey Immelt won the executive jackpot on Monday after General Electric Co. picked the 44-year-old to succeed John "Jack" Welch, the manufacturing conglomerate's acclaimed outgoing chairman and chief executive.

Immelt, who had been president and CEO of GE's Medical Systems business, ascends to perhaps one of the most coveted, yet feared, corporate jobs in the world. He will become leader of the Fairfield, Conn.-based company, an $111 billion American icon with its fingers in industries ranging from TV sitcoms to jet engines. But Immelt must fill the gigantic shoes of Welch, a man nearly deified for his executive abilities.

GE's board of directors named Immelt president and chairman-elect, effective immediately. He will succeed Welch at the end of 2001 -- a move that was no surprise to many industry analysts.

Originally scheduled for the end of this year, Welch's retirement was delayed so that he could oversee the company's upcoming merger with Honeywell International Inc. (INC: Research, Estimates). Originally scheduled for the end of this year, Welch's retirement was delayed so that he could oversee the company's upcoming merger with Honeywell International Inc. (INC: Research, Estimates).

Immelt was one of three GE executives in the running for the top spot. The others were Robert Nardelli, president and CEO of GE Power Systems, and W. James McNerney, head of GE Aircraft Engines.

"Jeff Immelt is a natural leader and ideally suited to lead GE for many years," Welch said in a statement. Immelt has headed up the $7 billion Medical Systems unit since 1997. Since 1982, he has held various jobs at GE in marketing, sales and global product management.

"The announcement was in accordance with GE's timetable ... and Mr. Immelt was considered to be one of the major contenders for the job so it comes as no surprise," Martin Sankey, an analyst with Goldman Sachs, said.

Click here for Edward Jones analyst Bill Fiala's thoughts on GE's move

Last July, when Immelt, Nardelli, and McNerney were being touted for Welch's job, in a Reuters poll of nine analysts and GE watchers, six predicted Immelt would get the nod.

Analysts and friends say the 6-foot-4-inch Immelt possesses not only the commanding physical presence of a college football player, but also the intellectual strength necessary to inspire management and workers at GE, which makes everything from light bulbs to medical equipment and owns the NBC broadcast network.

He has a fine sense of humor and an ability to present himself well to both Wall Street and the average worker, not unlike Welch.

Sankey said that GE intended from the start to name a young successor to Welch who can help lead the company into the future. Welch himself became CEO at age 46. He turns 65 next month. Sankey said that GE intended from the start to name a young successor to Welch who can help lead the company into the future. Welch himself became CEO at age 46. He turns 65 next month.

"I've said before about the value of having someone in the job a long time," Welch told reporters at a press conference in New York. "I believe in: 'You make your mess you clean it up.'"

Welch revealed that six years ago a plan was laid out to name a successor in December 2000.

|

|

VIDEO

|

|

CNNfn's Bill Tucker takes a look at the future of GE. CNNfn's Bill Tucker takes a look at the future of GE. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Asked about any sudden fragility in his well-nurtured management structure, now that two of his best executives have been denied the prize, Welch said the company was prepared for all contingencies, noting that qualified people were in place as understudies to Nardelli and McNerney.

Welch said that those two men would be "pursued very aggressively from the outside, and they are evaluating their options. They will be courted by every smart company in the world. All of our employees are free agents."

Welch credited with transforming GE, growing profits

Immelt takes GE's reigns from a man whose name is surely uttered in business schools whenever the topic of "how to run a company properly and profitably" arises. He is as recognized in the corporate arena as the hottest rapper or athlete would be to teenagers.

Welch is widely credited with transforming GE, a company once best-known for light bulbs and appliances, into an empire with operations in aircraft engines, entertainment, financial services and more. He shook up GE's management structure and sold major divisions, including the air conditioning and semiconductor businesses.

In his 20 years as chairman, profits have risen to $10.7 billion in 1999 from $1.6 billion. In his 20 years as chairman, profits have risen to $10.7 billion in 1999 from $1.6 billion.

His name is also valuable. In July, Time Warner Trade Publishing, a division of Time Warner Inc., agreed to pay Welch a $7.1 million advance for a book due after he retires. The advance, which Welch intends to donate to charity, is believed to be the largest ever paid for a non-fiction book.

Indeed, these are big shoes to fill. But Immelt insists he's prepared for the challenge.

"I don't worry at all about my capacity to lead," he said at the press conference. Afterward, he added, "I don't worry about following this guy [Welch] I just concentrate on running GE."

Welch said he expected no kinks during the transition for Immelt, a graduate of Dartmouth and Harvard who has spent his entire career with the company.

"We have known each other for a long time," Welch said. "This is easy, this is a very comfortable relationship, and Jeff will be doing more and more every day."

Added Immelt, "There's a lot I can learn from Jack. I think the transition is going to be natural. Both of us are always guided by doing what's best for the company."

"My job is to set the tone for the company, pick great people putting them in place, making sure the value and initiatives are right and driving leading edge initiatives," Immelt said.

The new job will also bring Immelt, as Welch put it, "one hell of a raise," in pay, though he gave no specifics. In 1999, Welch earned total compensation of $93.1 million, including a salary-and-bonus package of $13.3 million.

Honeywell deal extends Welch's tenure

Welch's announcement that he would stay an extra year helped seal the deal for Honeywell, whose executives had concerns about the issue of Welch's departure.

Welch's agreement to stay on allowed GE to snatch Honeywell away from United Technologies (UTX: Research, Estimates), which was about to sign its own deal with Honeywell.

In October, Welch recounted how he was standing on the floor of the New York Stock Exchange on the Thursday before the deal, when he saw Honeywell's stock price jump about $10 on the ticker. When he got wind of the United Technologies bid, he said, GE mobilized immediately to make an offer.

Deals such as those add to the lore of Welch, who took over GE in April 1981 when GE had a market capitalization of $13.9 billion. Today, the company is worth roughly $490 billion.

In October, six of GE's seven business segments reported double-digit profits for the third quarter.

For the third quarter, the company reported net income of $3.18 billion, or 32 cents per share, up about 20 percent from income of $2.65 billion, or 27 cents per share, in the 1999 third quarter. Quarterly revenues jumped about 18 percent to $32 billion from $27.2 billion in the year-ago third quarter.

Stock of GE (GE: Research, Estimates), one of 30 in the Dow Jones industrial average, rose 56 cents to $49.94 in late afternoon trade on the New York Stock Exchange.

|

|

|

|

|

|

|