|

Quaker hot on Pepsi talk

|

|

November 28, 2000: 5:01 p.m. ET

Gatorade maker soars on rumors that Pepsi's $14B offer is alive - again

|

NEW YORK (CNNfn) - Shares of Quaker Oats once again reached a boiling point Tuesday on unconfirmed speculation that the cereal and sports drink maker had restarted merger discussions with PepsiCo Inc.

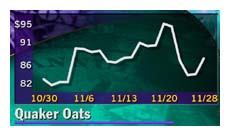

Quaker (OAT: Research, Estimates) shares climbed as high as $88.44 in afternoon trading before closing at $87.44, up $3.44, or 4 percent, for the day.

Shares in the Chicago-based company had tumbled during the last week as Coca-Cola Co. (KO: Research, Estimates) and French food conglomerate Danone (DA: Research, Estimates) both publicly said they were no longer interested in acquiring the maker of Captain Crunch and Gatorade sports drinks.

Pepsi (PEP: Research, Estimates) likewise has already walked away once from merger talks with the company, but left a nearly $14 billion acquisition offer on the table that many analysts thought Quaker would eventually reconsider.

Pepsi and Quaker Oats officials were not immediately available for comment. Pepsi and Quaker Oats officials were not immediately available for comment.

Pepsi, the world's No. 2 soft drink concern, first approached Quaker Oats about a merger earlier this month, offering to swap 2.2 shares of its stock for each Quaker Oats share, a ratio that valued the food conglomerate at $103.54 per share, or roughly $13.7 billion, at that time.

Pepsi walked away from the discussions after Quaker Oats demanded a "collar," or price protection mechanism to guard its shareholders against a sudden drop in Pepsi's stock, as part of any agreement.

Based on Pepsi's closing price of $45.13 Tuesday, the same ratio would value Quaker Oats at a slightly lower $99.28 per share, or $13 billion. But analysts believe Quaker Oats has little option to renew its courtship of Pepsi now that the company has placed itself up for sale.

"Pepsi clearly wants Quaker for strategic reasons," said John O'Neil, a food industry analyst with UBS Warburg. "Their offer is still a substantial premium to where Quaker Oats is trading. The reason they walked away the first time is because they had Coca-Cola waiting in the wings. They no longer have that luxury."

Pepsi's initial failure to complete a deal opened the door for rival Coca-Cola, which also ultimately walked away from an agreement when its board balked at taking on Quaker's slow-growth food operations in addition to Quaker's prize gem, the fast-growing Gatorade.

Swiss food conglomerate Nestle SA, the world's No. 1 food company, has also publicly hinted it might be interested in Quaker, but analysts still consider Pepsi to be the most viable suitor.

|

|

|

|

|

|

Quaker Oats Co.

PepsiCo

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|