|

Trigon ends bidding war

|

|

November 30, 2000: 11:29 a.m. ET

Health insurer decides not to counter WellPoint's $700M offer for Cerulean

|

NEW YORK (CNNfn) - Health insurer Trigon Healthcare Inc.'s top executive Thursday defended his company's decision not to raise its bid for Cerulean Companies Inc. after its $675 million merger offer was trumped by WellPoint Health Networks Inc.

Trigon Chairman and CEO Tom Snead said the decision not to raise its bid for Cerulean, the parent of Blue Cross Blue Shield of Georgia, the state's largest health insurance company, was made after the company determined that at a higher price the merger would not add to its earnings within the first 18 months.

"While we are certainly disappointed in this outcome, we remain comfortable in our decision not to raise our bid further," Snead told analysts and investors on a conference call Thursday morning.

Cerulean accepted a revised $700 million all-cash acquisition offer from WellPoint late Wednesday evening, ending a bidding war that was sparked last weekend by Trigon's $675 million cash bid.

WellPoint (WLP: Research, Estimates) first agreed to acquire Atlanta-based Cerulean in July 1998 for $500 million in cash and stock. The approval process for that merger dragged on as the companies gradually eased regulatory concerns and settled several legal challenges, the last of which was resolved just last month. WellPoint (WLP: Research, Estimates) first agreed to acquire Atlanta-based Cerulean in July 1998 for $500 million in cash and stock. The approval process for that merger dragged on as the companies gradually eased regulatory concerns and settled several legal challenges, the last of which was resolved just last month.

As the two sides were preparing to close their merger, Richmond, Va.-based Trigon (TGH: Research, Estimates) swept in over Thanksgiving weekend with its offer, hoping to accelerate its long-stated goal of creating a regional health insurance power stretching from the Mid-Atlantic through the Southeast.

Under the terms of its original agreement, however, WellPoint retained the right to counter any unsolicited offer for Cerulean within four business days, which the company did Tuesday with its $700 million bid.

"We knew in initiating our pursuit of Cerulean that it would be a tough battle, Snead said. "WellPoint, under its 2-1/2-year-old agreement, had some built-in advantages, including its contractual right to match."

Tom Byrd, Trigon's chief financial officer, said Trigon had drawn "a line in the sand" at $800 million, above which it would not make a bid for Cerulean. Byrd said any bid above the $700 million offer, including such considerations as change in control payments, would have crossed that line.

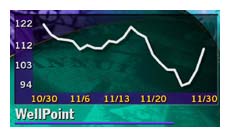

Trigon shares jumped $3.13 to $70.63 in late morning trading, still well below the $78.25 the stock was trading at before its bid was disclosed. WellPoint shares soared $9.81 to $100.31.

|

|

|

|

|

|

|