|

Greenspan hints at rate cut

|

|

December 5, 2000: 2:11 p.m. ET

Fed chief implies that central bank will ease policy if economy slows too much

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - In his first admission that the U.S. economy is slowing, Federal Reserve Chairman Alan Greenspan said Tuesday that growth has "moderated appreciably" and that the central bank must be on alert to "excessive softening" in demand -- a sign the Fed may be ready to lower interest rates.

In a speech to a group of community bankers in New York, Greenspan said the economy already has slowed substantially from the breakneck pace recorded earlier this year, even as consumer confidence holds up and as businesses continue to spend on capital investment. In a speech to a group of community bankers in New York, Greenspan said the economy already has slowed substantially from the breakneck pace recorded earlier this year, even as consumer confidence holds up and as businesses continue to spend on capital investment.

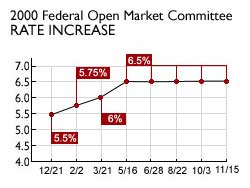

All the same, the Fed chief admitted for the first time that he and his colleagues now see a broad-based slowdown in the U.S. economy -- one that may be more than they bargained for when they embarked on their series of interest rate increases back in June 1999 that lifted official short-term rates 1.25 percentage points to 6.5 percent.

"In an economy that already has lost some momentum, one must remain alert to the possibility that greater caution and weakening asset values in financial markets could signal or precipitate an excessive softening in household and business spending," Greenspan said.

"More recently, the pace of expansion of economic activity has moderated appreciably, in part as tighter financial conditions have had some impact on interest-sensitive areas of the economy," he said.

A standing ovation for Alan

"I think he is getting the market ready for an easing," said Cary Leahy, chief U.S. economist with Deutsche Bank Securities. "For the Fed to move more quickly, they would need to see the unemployment rate moving up substantially and consumer confidence drop further. But all in all, I think the market got a little more than they wanted from him today."

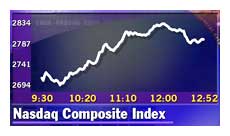

Indeed, stocks surged after his comments as investors interpreted that the Fed will ease its inflation-fighting stance by shifting its assessment of economic conditions away from concerns about overheating and toward a more balanced view that would include acknowledging the possibility of excessive slowing in activity. Bonds also extended gains as investors concluded the next Fed move will be a rate cut. Indeed, stocks surged after his comments as investors interpreted that the Fed will ease its inflation-fighting stance by shifting its assessment of economic conditions away from concerns about overheating and toward a more balanced view that would include acknowledging the possibility of excessive slowing in activity. Bonds also extended gains as investors concluded the next Fed move will be a rate cut.

"If I read this literally, and I think if it were up to him, his sense seems to be that the downside risks now outweigh the inflation risks," said David Reseler, chief economist with Nomura Securities. "My sense is that the verbiage devoted to downside risks is a lot more extensive than the verbiage devoted to concerns about inflation."

And verbiage is what Greenspan is all about. From his infamous "irrational exhuberance" comment back in 1996 that sent stock markets into a tizzy to more recent remarks about the risks of accelerating inflation, financial markets hang on every word he utters.

Prepping financial markets

But these words offered something not heard on Wall Street in some time -- a clear assessment of the current state of the economy and a clear change of heart concerning how the Fed feels about the pace of the U.S. economy, now into its record 10th year of uninterrupted expansion.

Greenspan's comments come against the backdrop of a radical reassessment of economic risks in financial markets. Expectations have raised substantially for at least one rate cut in the months ahead to ensure the current economic slowdown doesn't go too far and turn into a recession -- two consecutive quarters of economic contraction, rather than growth. Greenspan's comments come against the backdrop of a radical reassessment of economic risks in financial markets. Expectations have raised substantially for at least one rate cut in the months ahead to ensure the current economic slowdown doesn't go too far and turn into a recession -- two consecutive quarters of economic contraction, rather than growth.

"Chairman Greenspan's comments went further than previous Fed commentary on recognizing the degree of slowing in the economy and clearly pave the way for the Fed to switch to a neutral directive at the Dec. 19 meeting," said Wayne Angell, chief economist with Bear Stearns. "Moreover, his comments further encourage us in our belief that the Fed will lower rates in the first quarter of next year."

The Fed's policy-setting arm, the Federal Open Market Committee, next gathers to discuss rates on Dec. 19. While it is widely expected to leave key short-term rates unchanged, many on Wall Street now believe the committee will at least discuss the possibility of lowering rates early next year -- and probably move on that effort in January.

To be sure, not all on Wall Street saw Greenspan's remarks as a green light that rates are headed lower next year, and that the economy will gently glide to the soft landing many observers are predicting.

Not so fast, Wall Street

"We're a bit baffled by the strongly favorable reaction to Mr. Greenspan's speech, in which he clearly suggested that the Fed needs to see evidence of a further slowing before easing rates," said Ian Shepherdson, chief U.S. economist with High Frequency Economics. "He acknowledged an 'appreciable' slowdown, but, critically, he said that the tighter conditions in the credit markets are 'no way comparable' to 1998."

| |

|

|

| |

|

|

| |

We're a bit baffled by the strongly favorable reaction to Mr. Greenspan's speech, in which he clearly suggested that the Fed needs to see evidence of a further slowing before easing rates.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Ian Shepherdson, High Frequency Economics |

|

Back in 1998, when lenders refused to nibble on corporate bonds at almost any price, the Fed swooped in and lowered short-term interest rates three times in as many months to ease investors' fears about a credit crunch and restore calm to jittery financial markets.

"By implication, Mr. Greenspan thinks similar action is not required now," Shepherdson said.

As for the stock market, which has been mired in a rut for much of the year, Greenspan noted that the unbridled optimism prevalent as late as the beginning of this year has "given way to some reassessment of risks and opportunities." He said some profit and growth expectations, especially in high-tech industries such as computer equipment and fiber- optics, had indicated that there had been some "overreaching" in profit expectations.

Terra firma for stocks

But that's not necessarily a bad thing "as the market begins to draw firmer conclusions about which firms will be able to establish a long-lived market niche and which will not," Greenspan said, adding that the decline in stocks has helped "significantly" reduce the wealth effect that has spurred strong consumer spending in recent years.

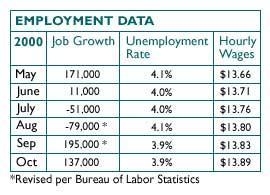

On the issue of the tight job market, which Greenspan has consistently expressed as a threat to the economy's health, the Fed chief noted that labor markets "have remained tight" but that a recent increase in initial jobless claims and the level of insured unemployment "may be an early harbinger of an easing of these conditions." (163KB WAV) (163KB AIFF) On the issue of the tight job market, which Greenspan has consistently expressed as a threat to the economy's health, the Fed chief noted that labor markets "have remained tight" but that a recent increase in initial jobless claims and the level of insured unemployment "may be an early harbinger of an easing of these conditions." (163KB WAV) (163KB AIFF)

Evidence of whether or not that's true will come Friday, when the Labor Department releases its latest tally on the nation's employment situation. Economists polled by Briefing.com expect that the U.S. economy generated 150,000 new positions in November compared with 137,000 in October, and that the jobless rate edged up to 4 percent from 3.9 percent.

The employment numbers are key because, while higher interest rates and stock market gyrations have prompted some consumers to clutch their dollars a little tighter, job security along with rising wages and benefits have continued to fuel overall consumer spending. Consumer spending accounts for more than two-thirds of total economic output.

|

|

|

|

|

|

U.S. Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|