|

Nasdaq soars record 10.5%

|

|

December 5, 2000: 5:12 p.m. ET

Who let the bulls out? Greenspan, with the prospect of a rate cut

By Staff Writer Jake Ulick

|

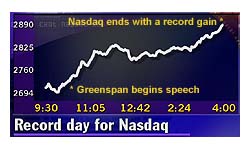

NEW YORK (CNNfn) - U.S. stocks rocketed higher Tuesday, catapulting the Nasdaq composite index to a record gain, after Federal Reserve Chairman Alan Greenspan suggested the economy may be slowing enough to cut interest rates next year.

In remarks unusual for their content and clarity, Greenspan's speech to a banking group in New York turbo-charged a rally that began with signs the presidential impasse may be nearing and end.

"This (Greenspan speech) is certainly a dose of good news, coupled with the fact that we may be getting closer to a resolution to the election," Walt Czaicki, senior portfolio manager at Banc of America Capital Management, told CNNfn's In the Money.

The Nasdaq rose 274.05 points, or 10.5 percent, to 2,889.80, shattering the previous record: a 7.94 percent surge on May 30.

The Dow Jones industrial average gained 338.62, or 3.2 percent, to 10,898.72 while the S&P 500 jumped 51.57, or 3.9 percent, to 1,376.54.

For a market hammered by White House uncertainty, weak profits and a slowing economy, the developments offered much-needed relief. Some analysts now say the worst may now over for a market that has fallen steadily since Labor Day.

"I think this market can hold on to this rally and start trending higher," Art Hogan, chief market strategist at Jefferies & Company, told CNN's Street Sweep.

It's about time. The Nasdaq is down 12 percent since Election Day. And the index has fallen 31 percent since the end of August, when a series of tech companies began lowering their earnings' outlooks.

More stocks rose than fell Tuesday. Advancing issues on the New York Stock Exchange beat declining ones 2,085 to 839 on trading volume of 1.3 billion shares. Nasdaq winners topped losers 2,873 to 1,195 as more than 2.4 billion shares changed hands, the fifth busiest day in Nasdaq history. More stocks rose than fell Tuesday. Advancing issues on the New York Stock Exchange beat declining ones 2,085 to 839 on trading volume of 1.3 billion shares. Nasdaq winners topped losers 2,873 to 1,195 as more than 2.4 billion shares changed hands, the fifth busiest day in Nasdaq history.

In other markets, the dollar rose against the euro and was little changed versus the yen. Treasury securities rallied.

Highest rates behind us?

In a sharp reversal, Greenspan said the economy "has lost some momentum," breaking from his past warnings about tight labor markets and rising inflation.

Analysts said his mid-morning speech opened the door for lower interest rates, a development that could help stem the tide of corporate earnings warnings that have haunted the markets this fall.

"Greenspan's speech puts an exclamation point on the market's notion that the Fed will eventually have to cut rates in response to the rapid deceleration in the economy," said Tony Crescenzi, bond market strategist at Miller, Tabak & Co. "Greenspan's speech puts an exclamation point on the market's notion that the Fed will eventually have to cut rates in response to the rapid deceleration in the economy," said Tony Crescenzi, bond market strategist at Miller, Tabak & Co.

The Federal Reserve raised interest rates six times between June 1999 and May of this year to keep rising inflation from derailing a record expansion. The tightenings brought the Fed funds rate, the central bank's target rate, to 6.5 percent, the highest since January 1991.

Since May, companies such as Dell Computer, Gillette and Intel have lowered their earnings outlooks, sending a chill through the market. Late Tuesday, Apple Computer (AAPL: Research, Estimates) became the latest computer maker to issue a warning, telling investors it will post a fiscal first quarter operating loss of between $225 million and $250 million next month.

For investors, Greenspan's words may have given clues that borrowing costs could fall.

"...In an economy that already has lost some momentum, one must remain alert to the possibility that greater caution and weakening asset values in financial markets could signal or precipitate an excessive softening in household and business spending," Greenspan told a conference sponsored by America's Community Bankers.

Hours earlier, as if on cue, the latest economic data showed moderating weakness. Factory orders for October fell 3.3 percent, the government said.

|

|

VIDEO

|

|

Walt Czaicki, senior portfolio manager at Banc of America Capital Management, chats with CNNfn about Greenspan and the stock rally. Walt Czaicki, senior portfolio manager at Banc of America Capital Management, chats with CNNfn about Greenspan and the stock rally. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Financial stocks, ever-sensitive to higher interest rates, surged. J.P. Morgan (JPM: Research, Estimates) jumped $13.13 to $151.63 and Citigroup (C: Research, Estimates) gained $2.94 to $50.75.

"This is all Greenspan," Bill Meehan, chief market analyst at Cantor Fitzgerald, said of the rally. "He's made it very clear that the Fed will go to neutral bias."

Meehan said any the resolution of the election "was going to get us kick started in the right direction."

In the latest news from Florida, Leon County Circuit Court Judge Sanders Sauls late Monday denied Vice President Al Gore's request for a limited vote recount. The decision, if it holds, means that Bush's lead in the state remains intact and makes him the likely winner of the state's crucial 25 electoral votes.

Gore appealed the decision to Florida's Supreme Court. But that didn't stop many of the so-called "Bush stocks," or companies seen better off if he occupies the White House, from rallying.

Philip Morris(MO: Research, Estimates), a tobacco company that may face fewer restrictions with a Bush White House, gained 94 cents to $38.56. Microsoft (MSFT: Research, Estimates), whose antitrust troubles are seen as possibly easing under Bush, jumped $3.44 to $59.88.

Some of the biggest gainers were large technology stocks.

Cisco Systems (CSCO: Research, Estimates) jumped $6.63, or 14 percent, to $52.13 and Oracle (ORCL: Research, Estimates) advanced $3.31, or 12 percent, to $31.50

With portfolio managers having amassed a lot of cash during the autumn sell-off, Meehan said he believes this rally could be sustained.

Still, disappointments emerged. 3Com (COMS: Research, Estimates) tumbled $3.34 to $10.03 after saying weaker-than-expected revenue would mean wider-than-anticipated losses for the networking equipment maker.

Blaming slowing capital equipment spending by telecom companies, 3Com said it expected losses of 19 cents to 23 cents in its fiscal second quarter, compared with a previously targeted net loss of 7 cents to 9 cents per share.

But the day's session held more positives than negatives. Oil prices, whose gains have increased costs for consumer and business while slowing their spending, fell Tuesday. The price of light crude for January delivery tumbled$1.69 cents to $29.53 a barrel.

A technical analyst, Richard Suttmeier, chief financial officer at Joseph Stevens, uses chart patterns, not fundamentals, to forecast the markets. And the chart patterns, he said, look good

"I think we've set the stage for a year-end rally," Suttmeier told CNNfn's market coverage.

He said any Nasdaq close above 2,812 bodes well for further gains ahead. The index shattered that finish Tuesday.

|

|

|

|

|

|

|