|

IDC trims PC forecast

|

|

December 7, 2000: 12:08 a.m. ET

Worldwide PC shipments expected to reach 40.1 million units in fourth quarter

|

NEW YORK (CNNfn) - The information technology research firm IDC trimmed its fourth-quarter forecast of personal computer sales growth in the U.S. and worldwide in response to signs of weakness in the consumer PC market.

IDC, based in Framingham, Mass., lowered its estimate for worldwide PC sales growth in the fourth quarter to 19.6 percent from 20.3 percent. At the same time, it cut its estimate for the U.S. to 15.8 percent from 17.1 percent.

IDC now expects worldwide PC shipments to reach 40.15 million units in the fourth quarter. The firm's revised forecast calls for total PC shipment growth to slip to 16.6 percent worldwide for 2001, down from 18.8 percent in 2000. Worldwide growth is expected to slow further in the longer term, as both business and consumer market saturation increases, and growth in emerging markets moderates.

"Although it is clear that consumer demand in the U.S. is weakening, buying in other regions remains strong," said Loren Loverde, director of IDC's Worldwide PC Tracker program. "PCs remain the dominant means of accessing the Internet, and a lot of people out there are still buying PCs to get online."

Loverde said that the slowing in PC demand is the result of both industry and non-industry forces.

"Outside of the industry, there is the stock market decline, concerns about economic trends, oil prices, and the presidential election. Within the industry, consumers are not yet in the upgrade cycle for Windows Millennium Edition, and there aren't really applications demanding faster processors and upgrades," Loverde said.

The market for portable computers remained strong in the third quarter, with shipments up 33 percent year-over-year, IDC said. The firm expects the fourth quarter growth rate for laptops to be 32 percent worldwide.

In the third quarter, Compaq (CPQ: Research, Estimates) was the leading seller of PCs worldwide, with a 14 percent market share. Dell (DELL: Research, Estimates) was in second place with an 11.6 percent share, Hewlett-Packard (HWP: Research, Estimates) in third with 7.8 percent, and IBM (IBM: Research, Estimates) in fourth place with 7.3 percent.

Follows warnings from PC makers

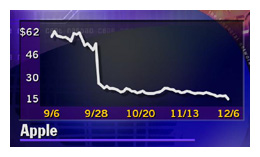

The reductions in IDC's forecast will come as no surprise to most tech investors. Several PC companies, including Gateway (GTW: Research, Estimates) and Apple (AAPL: Research, Estimates), already have warned about their revenue and earnings in the December quarter.

Apple warned Tuesday of a huge shortfall in revenue for the quarter ending Dec. 30, which will cause the company to report its first quarterly loss in three years. The company expects to report revenue of about $1 billion and a net loss, excluding investment gains, of between $225 and $250 million when actual results are announced on January 17, 2001.

Merrill Lynch Global Technology Strategist Steven Milunovich told CNNfn.com Wednesday that he sees no near-term catalyst that will revive consumer and corporate PC demand.

"Many corporations upgraded their PCs in preparation for Y2K, which boosted demand last year," Milunovich said. "If you figure on a three-year upgrade cycle, companies will not feel a need to upgrade in 2001. Corporate IT budgets are focused more on adapting to the Internet, which includes networking hardware, storage, and e-commerce software."

"The PC is not the driver of technology anymore," Milunovich added. "We are big believers, however, in handheld devices, such as those made by Palm and Research in Motion. A lot of applications are going to migrate to handhelds."

Over the longer term, the rise of peer-to-peer computing could help boost PC demand, Milunovich said. Peer-to-peer is the sharing of files between individual computer users, instead of accessing files stored on a central server. The Napster music sharing service is one of the most prominent examples of peer-to-peer computing in operation today.

|

|

|

|

|

|

|