|

Autos in hard landing?

|

|

December 15, 2000: 6:29 p.m. ET

Analyst says consumer wariness would doom automakers for 2-3 years

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - The automobile industry is already in a "hard landing," according to a leading Wall Street auto analyst, and if consumer confidence wanes, the industry could be in for a two-to-three-year downturn.

John Casesa, the Merrill Lynch analyst who made the comment, cautioned that he's not ready to say the auto industry is slated for a recession, but he said the University of Michigan's latest consumer confidence index is cause for concern. It showed a preliminary reading of 97.4 in December, compared with 107.6 in mid-November.

"The lynchpin determining whether this three-quarter inventory correction becomes a typical three-year downturn is consumer confidence," he told Merrill Lynch customers in a conference call Friday. "It's too much to make of a 15-day number, but if all of December is down, and we continue to see this kind of drop in February and March, I think there's a pretty good bet we're going to be in for an extended downturn in autos." "The lynchpin determining whether this three-quarter inventory correction becomes a typical three-year downturn is consumer confidence," he told Merrill Lynch customers in a conference call Friday. "It's too much to make of a 15-day number, but if all of December is down, and we continue to see this kind of drop in February and March, I think there's a pretty good bet we're going to be in for an extended downturn in autos."

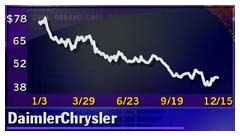

The recent drop in sales have prompted U.S. automakers to cut production levels and idle some North American plants temporarily to deal with rising inventories. The most recent move came late Friday when DaimlerChrysler (DCX: Research, Estimates) added to previous plant closing plans by saying it would extend the shutdown of three plants into the first week of next year, and add to it a fourth plant, the Dodge Ram and Dakota plant in Warren, Mich.

The Big Three automakers have all been forced to lower earnings forecasts in recent months as well. DaimlerChrysler lost money on its Chrysler unit in the third quarter and warned losses will continue in the current period and early next year, prompting the German executives who run the company to replace the North American Chrysler veterans who had been running the operation here.

Automakers say alarm bells premature

Still, despite these problems, officials from the leading automakers say that they understand Casesa's analysis, but think he's premature in ringing the alarm bell.

They say that his current projections of between 16 million and 16.3 million light vehicles sold in the United States in 2001 would constitute the fourth-best sales year in the industry's history, not a so-called "hard landing" into a recession. But they agree that the coming months will be difficult ones for the industry as it tries to adjust production from the red-hot levels of 12 months ago.

"A 16 million sale rate is a rate we can live with," said George Pipas, a sales analyst at Ford Motor Co. (F: Research, Estimates) "The transition period going from high point to low, that's always going to be difficult. There's a lot of white water, but it looks worse than it is."

Pipas and Paul Ballew, general director, global market and industry analysis at General Motors Corp. (GM: Research, Estimates), both argue that overall economy is more important to overall auto sales than simple consumer confidence, and they believe the economy is not looking like it's poised for a recession. Pipas and Paul Ballew, general director, global market and industry analysis at General Motors Corp. (GM: Research, Estimates), both argue that overall economy is more important to overall auto sales than simple consumer confidence, and they believe the economy is not looking like it's poised for a recession.

They say oil prices are starting to come down, and that low inflation and a government surplus gives federal policy makers like Congress and the Federal Reserve the flexibility they need to keep the economy out of recession through tax cuts or interest-rate cuts.

"Anytime you're looking at the prospect for a soft landing, there's going to be uncertainty and risks," said Ballew. "If what we're talking about is a prelude to an economic downturn, the industry will suffer over a two-to-three-year time. But the economy has shown a high degree of resiliency."

One expert who also believes the industry's situation is not dire is Mike Flynn, director of office for study of automotive transportation at the University of Michigan.

"I wouldn't call it a hard landing," said Flynn. "I think it will be tough to make money, but to me a hard landing is when not everyone is losing money, closing plants and jobs are being lost. This is a record year. I would really hate to think they need a new level of record sales to stay profitable because I don't think that's sustainable."

Auto stocks seen as lagging even in best case

Casesa agrees that if consumer confidence rebounds in the coming months, then the industry should be able to adjust its inventories and production in the next two to three quarters and be back on track for profitability. But he doesn't believe the stocks of the automakers or their suppliers will necessarily come back right away, even under that more optimistic scenario.

"It's very tough to make money in these stocks in a restructuring unless volumes are going up," he said. "We think the fundamentals will get worse before they get better. We don't expect the group to outperform [the market] until they hit bottom. They could bottom in three quarters if this is just an inventory correction, but it could be far longer if consumer confidence, as we're beginning to fear, falls off." "It's very tough to make money in these stocks in a restructuring unless volumes are going up," he said. "We think the fundamentals will get worse before they get better. We don't expect the group to outperform [the market] until they hit bottom. They could bottom in three quarters if this is just an inventory correction, but it could be far longer if consumer confidence, as we're beginning to fear, falls off."

Casesa's colleague who follows auto suppliers stocks, Steve Haggerty, said the outlook is similar for that sector while the automakers sort out their production needs. Earnings estimates for leading suppliers are being downgraded almost daily in the sector, Haggerty said, and the current low price/earnings multiples for the stocks aren't enough to make them attractive to investors in the current environment.

"What investors want to see is some stability in the market, some stability in earnings estimates, and take a closer look at some of these stocks and valuation maybe in the second half of the year," said Haggerty.

Shares of GM lost 13 cents to $53.81, while Ford shares fell 75 cents to $22.50 and the American depository receipts of DaimlerChrysler gained 49 cents to $43.49 in U.S. trading Friday.

Click here to send mail to Chris Isidore

|

|

|

GM cuts jobs, Oldsmobile division - Dec. 12, 2000

Visteon warns on 4Q - Dec. 5, 2000

Auto sale fall hits profits, production - Dec. 1, 2000

GM cuts November sales target - Nov. 20, 2000

Daimler lowers Chrysler forecast - Nov. 17, 2000

Ford Explorer sales off - Oct. 31, 2000

DaimlerChrysler operating profit skids 80% as Chrysler Group sales slump - Oct. 26, 2000

Ford 3Q beats estimate, but falls from year-ago figure - Oct. 18, 2000

GM earnings forecasts hit the skids - Oct. 13, 2000

GM posts record 3Q EPS - Oct. 12, 2000

|

|

|

|

|

|

|

|