|

Abbott buys $6.9B Knoll

|

|

December 15, 2000: 12:58 p.m. ET

Drugs firm pays cash for BASF unit, expands in Europe and Asia

|

LONDON (CNNfn) - Abbott Laboratories Inc. Friday agreed to buy the Knoll pharmaceutical business from Germany's BASF AG for $6.9 billion, giving it access to new drugs and markets.

Abbott (ABT: Research, Estimates) beat out rival U.S. pharmaceutical firm Eli Lilly & Co. previously tipped as the frontrunner for the unit, to get its hands on potential blockbuster D2E7, a drug currently being tested as a treatment for rheumatoid arthritis.

Germany's BASF is selling its drugs unit to concentrate on chemicals, a business in which it is one of the world's three biggest players along with DuPont Co. (DD: Research, Estimates) of the U.S. and domestic rival Bayer AG.

Acquiring Knoll, "enhances Abbott's position as a global pharmaceutical company... in particular across Europe and in Japan," said Abbott Chief Executive Miles D. White. Acquiring Knoll, "enhances Abbott's position as a global pharmaceutical company... in particular across Europe and in Japan," said Abbott Chief Executive Miles D. White.

"The acquisition will bring leading monoclonal antibody technology and a strong research presence in immunology with a high-potential product, D2E7, for the treatment of rheumatoid arthritis," White added.

Analysts believe the medicine could have annual sales of $500 million or more.

"BASF could have got a lot more if they had waited a year or two," Anthony Cox, an analyst at Dresdner Kleinwort Benson in London told CNNfn.com. "We rekon they would have got an extra billion if they waited for D2E7 to come out. We had a sum-of-the-parts valuation of $6.5 billion on Knoll." Cox has a "hold" recommendation on the stock.

Fund managers and investors have encouraged chemical and drug conglomerates to split their businesses to focus on a single discipline.

Drug, chemicals companies reshuffle

BASF's arch rival, Bayer AG (FBAY) said last week it has appointed investment banks Credit Suisse First Boston and Deutsche Bank to advise it on various strategic options, amid speculation that Roche Holding AG of Switzerland will make a hostile bid. Drugs companies Novartis AG and Aventis SA (PAVE) are getting out of chemicals to become pure pharmaceuticals companies.

The Knoll purchase deal comes a day after leading U.S. chemical company DuPont Co. approved a plan that could lead to a similar spin-off or sale of its sagging drugs business.

Ludwigshafen, Germany-based BASF plans to use the proceeds of the sale to buy back shares, to reduce debt and strengthen its core businesses.

Abbott said it would finance the acquisition, which is expected to close in the first quarter of 2001, out of existing resources and borrowings. It warned the deal would reduce earnings per share by $0.12 in 2001. Abbott said it would finance the acquisition, which is expected to close in the first quarter of 2001, out of existing resources and borrowings. It warned the deal would reduce earnings per share by $0.12 in 2001.

"Abbott may have to wait four or five years before it sees many of Knoll's drugs coming through," Cox said.

But Abbott said it sees the deal being accretive to earnings after 2001.

Knoll employs almost 11,000 people and is expected to generate about $2.1 billion in annual revenue, with a drug portfolio including Meridia, a treatment for obesity.

Abbott's product range includes drugs for HIV/AIDS, high blood pressure, cancer, infections and brain disorders. The BASF unit brings Abbott a significant new research capability with particular strength in monoclonal antibody drugs for autoimmune and inflammatory diseases.

Aside from Eli Lilly (LLY: Research, Estimates), U.S.-based drugmaker Bristol-Myers Squibb Co. (BMY: Research, Estimates) and France's Sanofi-Synthelabo (PSAN) had also been tipped as possible bidders for Knoll.

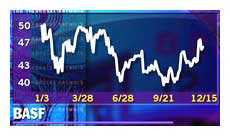

Abbott shares fell $1 to $47 in afternoon trading in New York Friday, Lilly lost 44 cents to $89.31 and Bristol-Myers dropped 38 cents to $68.25. Shares in BASF rose 2.5 percent to  47.25 in Frankfurt Friday afternoon. 47.25 in Frankfurt Friday afternoon.

|

|

|

|

|

|

|