|

Top retirement plans

|

|

December 18, 2000: 10:06 a.m. ET

Looking for a job with rich retirement benefits? Consider the public sector

|

NEW YORK (CNNfn) - If you're dragging your feet saving for retirement or those 401(k) contributions don't seem to be adding up to much, you might want to consider a job with rich benefits that will do the work for you.

While the trend is toward "self-directed" retirement plans that require you to take the initiative with saving, there are still a few occupations that offer the kind of traditional pension benefits that your father got along with the gold watch.

Some jobs have such plush plans that you can expect to get 80 percent of your salary for life. And that doesn't include what you'll get from Social Security.

At the top of the list are jobs in the public sector, like government workers, police and firefighters, said Barry Barnett, a principal at Unifi Network, a unit of PriceWaterhouseCoopers in Teaneck, N.J.

So-called "old economy" jobs are also the place to be for great retirement plans, Barnett said.

"The old Fortune 50 companies have great benefits," Barnett said.

Aerospace firms like Lockheed Martin, pharmaceutical companies and regulated companies like utilities also offer good packages, he said. Some may have pensions as well as 401(k) plans.

How a pension works

A traditional pension plan rewards workers for longevity with a company, offering the bulk of benefits at the end of their careers. Benefits are based both on years of service and average salaries for the last few years of employment when, presumably, they make the most money. Professional money managers decide how to invest the dollars.

By contrast, a 401(k) plan requires workers to contribute to their own retirement. Companies often will match a portion of the contributions for the length of their employment. Employees decide how to invest the money.

Perhaps it's no surprise that new economy jobs are at the other end of the spectrum, Barnett said. Perhaps it's no surprise that new economy jobs are at the other end of the spectrum, Barnett said.

A lot of the dot.com companies offered stock options and the possibility of riches as compensation.

Companies like IBM had to change their ways in order to compete, Barnett said.

IBM in 1999 switched from a traditional pension to a cash-balance pension, where benefits are accrued at a steady pace throughout one's tenure. The company said at the time it could better compensate employees with the new plan, and that any savings would be funneled back to employees in other ways, such as bonuses and stock options.

The price of a fat pension: Your time

Of course, there is a catch. In order to get a great pension you need to say in the same job, sometimes as long as 30 years.

"Longevity is the key to this," Barnett said.

Dee Lee, a retirement expert and author of "The Complete Idiot's Guide to 401(k)s," acknowledged that 20 years is a lifetime to most people in the work force these days. Dee Lee, a retirement expert and author of "The Complete Idiot's Guide to 401(k)s," acknowledged that 20 years is a lifetime to most people in the work force these days.

But she pointed out that a firefighter or a police officer who starts the job at 21 can retire after 20 years still relatively young. Then, with a fat pension for life, and perhaps lifetime health benefits, the retiree can go on to another career.

"State, county and federal governments have fabulous retirement plans," Lee said. "If you have cost of living increases in your pension, you're pretty much set for life."

How to manage your future

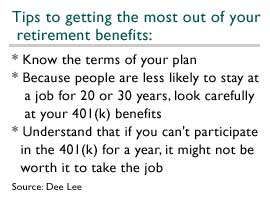

Still, Lee said people shouldn't necessarily count on a great pension in the private sector. A lot can change at a company in 20 or 30 years, she said.

Most people should pay more attention to the 401(k) benefits since fat pensions are getting more and more rare.

Even though it's a matter of thousands, if not hundreds of thousands of dollars, most people don't think enough about their retirement benefits.

In some cases, they don't realize it can make a huge difference if they have to wait a year to be eligible to join a 401(k) plan, Lee said.

Do you need help planning for retirement? E-mail experts at CNNfn.com your questions at retirment@nnfn.com.

"The key is to know the benefits you've got," Lee said. "It's never too early to be thinking about retirement. You should be thinking about it with your first job."

|

|

|

|

|

|

|