|

Rockefeller Center sold

|

|

December 22, 2000: 10:09 a.m. ET

NYC developer, Chicago family to buy Rockefeller Center for $1.85B

|

NEW YORK (CNNfn) - A wealthy Chicago family has joined forces with New York real estate developer Jerry Speyer in a $1.85 billion deal to buy Rockefeller Center.

Speyer's company Tishman Speyer Properties, along with the Crown family of Chicago, will buy out the interest of their fellow partners, including Goldman Sachs and David Rockefeller, in the landmark property.

The deal expected to close in spring of 2001.

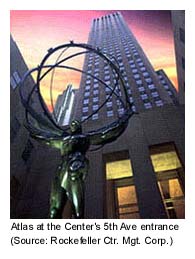

The deal severs the Rockefeller family's last ties to the office building complex, which was built in the heart of Manhattan more than 70 years ago during the Depression era. The limestone, art deco-style landmark has become an international symbol of commerce and capitalism.

"Rockefeller Center is that singular real estate asset which has transcended time to become one of the country's enduring architectural and cultural treasures," said Jerry Speyer, Tishman Speyers president and CEO, in a statement. "We are proud of what we have accomplished with our partners over the past four years and look forward to continuing our stewardship of one of the world's great landmarks." "Rockefeller Center is that singular real estate asset which has transcended time to become one of the country's enduring architectural and cultural treasures," said Jerry Speyer, Tishman Speyers president and CEO, in a statement. "We are proud of what we have accomplished with our partners over the past four years and look forward to continuing our stewardship of one of the world's great landmarks."

The sale price is well below what the owners reportedly sought. Rockefeller Center Properties Inc. Trust, which paid $1.2 billion for the complex four years ago, had asked for as much as $2.5 billion when it put the center up for sale in May.

Speyer and the Chicago Crown family, which already own jointly a 5 percent stake in the complex, will buy out their partners in the property, who include David Rockefeller, the Goldman Sachs Group, the Whitehall Fund, the Agnelli family of Italy and the estate of the Greek shipping magnate Stavros Niarchos.

"Tishman Speyer, which was part of the original investment partnership and the manager of the property, possessed the requisite experience with the property and confidence in its future potential to meet the seller's price expectation," Whitehall Fund Chairman Daniel Neidich said in a statement. The Whitehall fund currently owns 50 percent of the property.

The deal will sever the Rockefellers' last ties to the historic complex, which includes the 70-story GE Building, formerly the RCA Building, Radio City Music Hall and the skating rink and plaza where hundreds of thousands of holiday tourists flock each year to visit the famous Christmas tree.

The center has doubled in value since Goldman Sachs bought it in 1996 for the equivalent of $900 million. The deal follows a four-year refurbishment and a real estate boom after the property had sunk into bankruptcy: the former owner, Japan's Mitsubishi family, walked away from the property amid the recession of the early 1990s.

Newer tenants at Rockefeller Center include Christie's auction house and a variety of high-end retailers.

|

|

|

|

|

|

|