|

U.S. spending edges up

|

|

December 22, 2000: 10:15 a.m. ET

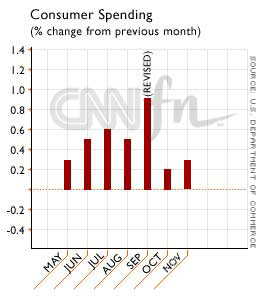

Consumer spending up 0.3 percent; durable goods orders also rise

|

NEW YORK (CNNfn) - Consumer spending edged higher in the United States last month, though at a slower pace than the month before, while orders for cars, computers and other "durable goods" also rose, the government reported Friday.

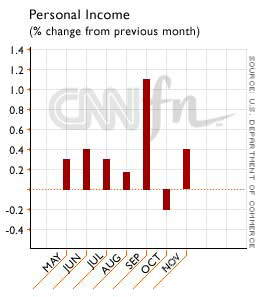

Consumer spending was in line with Wall Street forecasts with a 0.3 percent rise to $6.90 trillion in November, the month the holiday shopping season gets underway, after a 0.4 percent rise in October, the Commerce Department said. Personal incomes rose 0.4 percent, the department said, also matching forecasts. The savings rate hit a new record low at a negative 0.8 percent.

So far, merchants say holiday sales have been lackluster as consumers have grown cautious amid reports the economy is slowing down.

Separately, durable goods orders rose 2.3 percent in November to a seasonally adjusted $210.94 billion, the department said, above forecasts for a 1.5 percent rise. Orders for all durable goods, which also include refrigerators, washing machines and other things meant to last at last three years, fell a revised 6.5 percent in October.

Manufacturers have been hurt by weaker consumer demand as the economy slows.

"I think things are going to get worse for a little while, but I do think we're pretty close to the bottom," Bruce Barlett, senior fellow with the National Center for Policy Analysis told CNNfn's "Before Hours" Friday. "And a lot of it depends on what the Fed does, we started to talk about whether the Fed would ease in advance of its next meeting, and I think the odds are very, very high that they will."

Excluding the volatile transportation sector, durable goods orders rose just 0.4 percent. Transportation orders, about a fifth of all the orders, rose 9.1 percent after slumping 17.3 percent in October.

Financial markets showed little reaction to the reports.

Wages increased by $17 billion in November, significantly lower than the $32.1 billion increase in October

New orders for durable goods, such as refrigerators, toasters and washers, increased $4.7 billion in November to $210.9 billion, the Commerce Department reported Thursday.

However, shipments of durable goods decreased $2.6 billion, or 1.2 percent, to $207.3 billion in November.

The slower pace offers economists further signs of an economic slowdown, renewing expectations that Fed Chairman Alan Greenspan may announce an interest rate cut before the economic policy-making arm meets in January.

On Tuesday, Greenspan announced the Fed has shifted its outlook away from inflation risks, but passed on cutting interest rates, disappointing investors and sending the markets tumbling to record lows. On Tuesday, Greenspan announced the Fed has shifted its outlook away from inflation risks, but passed on cutting interest rates, disappointing investors and sending the markets tumbling to record lows.

Barlett said he envisions the Fed cutting interest rates by a quarter point sometime in the next few weeks and then an additional quarter point when it meets at the end of January.

He believes the final nudge on an interest rate cut could come when retailers report their December sales shortly after the new year. Retailers are expected to post lower sales for December.

|

|

|

|

|

|

|