NEW YORK (CNNfn) - Treasurys rose in thin trading Thursday, responding to the government's weekly report on new jobless claims and waiting for a mid-morning report on consumer confidence.

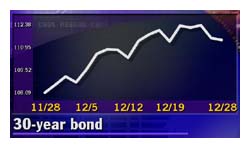

Shortly after 8:30 a.m. ET, benchmark 10-year notes gained 2/32 to 104-30/32, yielding 5.09 percent. Thirty-year bonds added 14/32 to 112-2/32, yielding 5.42 percent.

Five-year notes were unchanged at 103-8/32, yielding 4.99 percent, while two-year notes were unchanged at 100 even, yielding 5.12 percent. Five-year notes were unchanged at 103-8/32, yielding 4.99 percent, while two-year notes were unchanged at 100 even, yielding 5.12 percent.

Dealings were light as the market continued to consolidate after a strong bond market rally last week.

Trading desks remained thinly staffed, with many traders on vacation during the shortened week between the Christmas and New Year's holiday weekends.

Stocks looked set to open weaker after rising Wednesday on year-end bargain hunting.

Traders watch economic reports

The market watched reports on weekly jobless claims, consumer confidence and existing home sales Thursday.

Jobless claims numbers came in lower than expected Thursday, with the government reporting 333,000 new claims in the week ended Dec. 23, down from 356,000 in the Dec. 16 week and well below the consensus estimate of 351,000 compiled by Reuters.

Economists surveyed by Briefing.com estimated that the Conference Board's consumer confidence measure fell to 128 in December from 133.5 in November.

Consumer confidence waning

A weak consumer confidence reading would echo the sharp drop in the University of Michigan's consumer sentiment index in December. That confidence index fell to 98.4 in December from 107.6 in November and economists said it implied that the Conference Board's number would also be sharply lower.

Consumer confidence is important because of its influence on consumer spending, which in turn accounts for about two-thirds of gross domestic product growth.

The Federal Reserve, which is expected to begin cutting interest rates no later than its Jan. 30-31 meeting, is also paying close attention to consumer confidence measures.

The text of the statement released by the central bank at the end of its last policy meeting listed "eroding consumer confidence" second in the list of factors suggesting that economic growth may be slowing further.

Traders said a startling drop in the Conference Board's consumer confidence measure could revive talk of a Fed rate cut before its next scheduled monetary policy meeting.

Dollar continues to drub yen

The dollar edged up against the yen on concerns that Japan's chance for an economic recovery may be slipping away.

The dollar traded at 114.55 yen, up 0.49 yen from late Wednesday in Tokyo and also above its late New York level of 114.35 yen. The dollar also advanced against the euro, with the euro slipping to 92.82 cents from 93.01 cents Wednesday. The dollar traded at 114.55 yen, up 0.49 yen from late Wednesday in Tokyo and also above its late New York level of 114.35 yen. The dollar also advanced against the euro, with the euro slipping to 92.82 cents from 93.01 cents Wednesday.

The dollar built on its 16-month high against the yen on recent evidence that Japan's economy may be losing momentum. The U.S. currency last traded at 114 yen in Tokyo on Aug. 18 of last year.

The dollar began a rally against the yen Tuesday after the Japanese government said unemployment rose to a near-record high of 4.8 percent in November.

-- from staff and wire reports

|