|

Web infrastructure dives

|

|

December 28, 2000: 3:33 p.m. ET

Web infrastructure stocks hit by earnings warning from F5 Networks

|

NEW YORK (CNNfn) - The stocks of companies that manage the flow of content over the Web dove Thursday afternoon after one firm in the area warned that its fiscal first-quarter revenue will be below expectations and that it will report a loss for the period.

Web infrastructure companies -- such as Foundry (FDRY: Research, Estimates), F5 Networks (FFIV: Research, Estimates) and ArrowPoint Communications – make hardware and software to monitor and manage the flow of content over the Web, directing traffic to the server that is best able to handle a user's request for information from a site. In a similar manner, CacheFlow (CFLO: Research, Estimates) and Inktomi (INKT: Research, Estimates) make products that speed the delivery of information over the Web by storing it close to the end user.

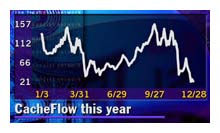

Almost all Web infrastructure stocks have been pounded this year after rising to astronomical valuations in 1999, as their revenue and earnings growth have failed to live up to expectations. Inktomi, for example, is down 91 percent from its 52-week high.

That pounding continued Thursday after F5 Networks said that its fiscal first-quarter revenue will be below analyst expectations and that it will report a loss because of slowing spending by its customers on Web-infrastructure equipment.

F5 Networks said that revenue for the quarter ending Dec. 31 is now expected to be in the range of $24 million to $26 million. A loss before taxes of approximately 48 cents to 50 cents per share, exclusive of restructuring charges, is expected. F5 also said that it will revise its fiscal year 2001 guidance on revenue and earnings when it issues its earnings report for the first quarter.

Analysts had expected F5 Networks to report a profit of 17 cents per share on revenue of $36.8 million, according to First Call, which tracks earnings estimates.

"Sales in the current quarter have trailed our expectations mainly due to the slowdown in purchasing of infrastructure-related equipment," said John McAdam, president and CEO of F5 Networks, in a statement. "Market conditions in North America have softened rapidly, but we are confident that our ability to compete in the Internet traffic management and content delivery market will remain strong."

In late afternoon trading, F5 Networks' stock was down $3.06 at $10.69, a 22 percent loss. CacheFlow also plunged in sympathy with F5, losing $8.62, or 27.5 percent, to $22.75. CacheFlow's stock is now about 86 percent below its 52-week high.

Also in late afternoon trading, Inktomi was down $1.69, or 7.5 percent, at $20.62, while Foundry was off 63 cents at $15.

|

|

|

|

|

|

|