|

Fed sparks January rally

|

|

January 3, 2001: 4:59 p.m. ET

Surprise rate cut triggers heavy stock buying, setting up for a strong month

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - Fans of Wall Street's "January effect" phenomenon can thank Federal Reserve Chairman Alan Greenspan for giving the month a hefty boost Wednesday by announcing a surprise interest rate cut.

Just two days into the New Year, the Nasdaq composite index is up almost 6 percent and the Dow is up almost 1.5 percent. But experts say Wednesday's gigantic gains don't necessarily mean the January effect will hold true this year.

"You won't know for a couple of weeks," said Hugh Johnson, chief investment officer with First Albany. "History says they (the Fed) need to cut rates more than one time but I am encouraged."

The surprise rate change, coupled with a new president touting a tax cut plan entering the White House Jan. 20, may just be enough to neutralize the negative sentiment and set off the "January effect" on Wall Street.

The phenomenon, which usually leads to a stock market rally at the start of the year, typically comes after year-end tax selling abates and bonus money goes to work in retirement funds, like 401(k) plans and IRAs.

"The idea is to invest it early in the year," said John Manley, investment strategist with Salomon Smith Barney. "There's a reason for money to go into the market in January, and that's what tends to give January the reputation for being strong."

Wednesday's Fed announcement brought the bulls stampeding back into the stock market, leading to the Nasdaq's biggest rally in history and a powerful surge for the Dow Jones industrial average as well.

Analysts were not surprised that stocks reacted positively to the interest rate cut, which came four weeks ahead of the Fed's regularly scheduled policy meeting at the end of the month.

"It was a surprise although we thought it was a 50-50 chance the Fed would cut before the January meeting," Al Goldman, chief market strategist with AG Edwards told CNNfn's market coverage. "The Fed made a dramatic move today and it was needed. The Fed is now our friend." (329K WAV) (329KAIFF) "It was a surprise although we thought it was a 50-50 chance the Fed would cut before the January meeting," Al Goldman, chief market strategist with AG Edwards told CNNfn's market coverage. "The Fed made a dramatic move today and it was needed. The Fed is now our friend." (329K WAV) (329KAIFF)

Time to put some steam back into the economy

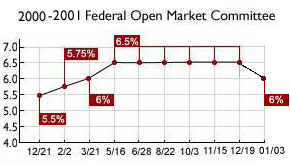

Six interest rate hikes from June 1999 through May 2000 had tempered a surging economy but late last year evidence that the slowdown might be much faster and deeper than anticipated, triggered concerns among investors and led many on Wall Street to worry about the possibility of a recession.

"We think the Fed easing will overwhelm some of the short-term negatives in the market just like, last year, the Fed tightening eventually won over a strong stock market and booming earnings," said David Katz, chief investment officer with Matrix Asset Advisors.

In its midday decision, the Fed cut the federal funds rate by a half-percentage point to 6 percent and lowered the discount rate by a quarter-percentage point to 5.75. It was the first time the central bank lowered borrowing costs since 1998. "These actions were taken in light of further weakening of sales and production, and in the context of lower consumer confidence," the Fed said in its statement.

The market's reaction Wednesday was swift. The Nasdaq composite index surged 324.82 points, or more than 14 percent, to 2,616.68. That jumped topped the previous record, a 10.48 percent gain on Dec. 5, 2000. The market's reaction Wednesday was swift. The Nasdaq composite index surged 324.82 points, or more than 14 percent, to 2,616.68. That jumped topped the previous record, a 10.48 percent gain on Dec. 5, 2000.

The Dow Jones industrial average rallied 299.60 points, or nearly 3 percent, to 10,945.75. The S&P 500 advanced 64.30, or almost 5 percent, to 1,347.57.

"Everyone knew the Fed was going to come in and do something sooner or later," said Salomon's Manley. "We're no longer speculating on whether the Fed is going to cut rates. My guess is we are at the point where every move by the market will be answered by the Fed."

Don't fight the Fed

Traditionally, analysts have advised investors not to fight the Fed and not to fight the tape, but the in the current divergent environment you have to choose and analysts are choosing in favor of the Fed.

"The Fed is not targeting the market with these rate cuts but it is targeting the economy – the economy will not respond to rate cuts for another six months so what will the Fed look to for the next six months to give them a sense of whether these rate cuts are succeeding," said Salomon's Manley. "My answer is 'the market'. Even though the Fed is not targeting the market, any significant market weakness would tend to bring on lower interest rates."

Investors were more than relieved to bid farewell to 2000 – a year dominated by skittishness over corporate revenue growth which has been hurting stocks in the major indexes.

And the excesses to the downside were severe. The tech-heavy Nasdaq suffered most of its biggest annual decline in its 30-year history between March 10 and Dec. 20, when the index bottomed at 2,332.78.

The Nasdaq ended down 87.24 points, or 3.4 percent, at 2,470.52 on Dec. 29, its last trading day of the year -- less than half of its March 10 peak and 39.3 percent lower than it started the year.

Click here for a closer look at CNNfn's year-end report

The Dow fell 81.91 points on Dec. 29 to end 2000 at 10,786.85, losing 6.2 percent from the start of the year and down 8 percent from its record high of 11,722.98 on Jan. 14. The S&P 500 shed 13.94 to 1,320.28, falling 10.1 percent from the start of the year.

What should an investor do?

Despite the staggering losses suffered in 2000, analysts still see pockets of opportunity.

"I would say start with some of the core holdings in technology," Elizabeth Mackay, chief investment strategist with Bear Stearns, told CNNfn's market coverage. "I think the technology stocks that will do well are the ones that haven't disappointed with earnings."

Click here to see how tech sectors are performing

Analysts also say that January will be the start of a sustained rise in stocks and, along with select tech issues, the financial sector likely will be a beneficiary of a cut in interest rates.

"January has historically been a better month in the market overall, especially pronounced in terms of companies that have had poor prior years -- after tax selling abates, they're due for a very strong bounce in January," said Matrix's Katz.

| |

|

|

| |

|

|

| |

January should be good and it should have legs

|

|

| |

|

|

| |

|

|

| |

|

|

| |

David Katz

chief investment officer

Matrix Asset Advisors |

|

Both Manley and Katz agree that financial stocks should perform well as interest rates are cut, and they also suggest putting a bit more emphasis on "old economy" consumer cyclical issues.

"We think it's oversold on a technical basis and we think, on a valuation basis, companies are reasonably priced," said Katz. "We think the Fed will be easing and that is a good environment for stocks – January should be good and it should have legs."

An inaugural effect?

When president-elect George W. Bush gets sworn into office Jan. 20, analysts expect little reaction from the market, mostly due to the closeness of the presidential race although Bush's tax cut plan could be another positive for investors to hang their hats on.

"The inauguration is a non-event," said Katz.

Manley agreed. "What usually happens is we have a honeymoon period when a president comes into office, but due to the closeness and contentiousness of the election, I don't think that will happen this time."

So, it boils down to the Fed and if more rate cuts will come along with tax cuts and investor sentiment.

"Is the possibility of a tax cut and a rate cut enough to eliminate or neutralized the concerns about the economy and earnings, letting the January effect play out," questioned First Albany's Johnson. "Watch the overall market and if the shift from defensive stocks to economically-sensitive stocks continues, it may be enough to turn the tide."

|

|

|

|

|

|

|