|

Firms reiterate 4Q outlook

|

|

January 8, 2001: 5:22 p.m. ET

PepsiCo, Verizon among companies indicating they met 2000 profit targets

|

NEW YORK (CNNfn) - Amid widespread worries about corporate profits, several major corporations bucked the trend Monday and reiterated their earnings targets for the recently completed fourth quarter.

PepsiCo Inc., Amazon.com, Verizon Communications Inc. and Marriott International Inc. all said they expect to post results that met or exceeded Wall Street's targets for the quarter ended Dec. 31. The companies also said they are on pace to meet their 2001 goals. Software maker i2 Technologies announced it expects to beat fourth-quarter earnings results, while consumer products maker Dial Corp. and advertising firm Interpublic Group of Companies said they expect to match full-year 2000 expectations.

Click here to read more about quarterly earnings

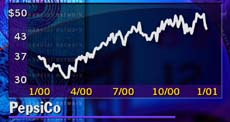

PepsiCo Inc. (PEP: Research, Estimates) said it expects to meet earnings targets for the fourth quarter. The Purchase, N.Y.-based maker of soft drinks and snack food is expected to post earnings of 38 cents per share for the period, according to analysts polled by earnings monitor First Call Corp.

The company also said it is confident it can reach its target of 12-to-13 percent growth for 2001. Analysts surveyed by First Call anticipate the company will earn $1.64 per share in 2001, up from a projected $1.45 per share in 2000. The company also said it is confident it can reach its target of 12-to-13 percent growth for 2001. Analysts surveyed by First Call anticipate the company will earn $1.64 per share in 2001, up from a projected $1.45 per share in 2000.

Meanwhile, PepsiCo also announced plans to expand the company's snack food business in the Middle East, forming a joint venture in Egypt with local snack food maker Chipsy, and acquiring Saudi Arabian-based Tasali Snack Foods.

PepsiCo shares finished the day up 75 cents at $46.06.

Dial Corp. (DL: Research, Estimates) said at an investment conference late Monday that it is on track to meet analysts' earnings forecasts for 2000 and 2001. The company is expected to report earnings before one-time items of 47 cents to 50 cents per share for full-year 2000, and 57 cents to 65 cents for 2001.

Dial had 1999 profits of $1.17.

Dial shares edged up 13 cents to $12.06 in Monday trading prior to the comments.

Meanwhile, Verizon said it expects to post fourth-quarter results that "met or exceeded" key operating targets and that it expects to meet its 2001 earnings targets.

The New York-based telecommunications company is expected to post a profit of 78 cents per share for the fourth quarter of 2000 and $2.91 for all of 2000, according to the First Call estimates. For 2001, Verizon is expected to earn $3.14 per share.

Verizon (VZ: Research, Estimates) said it finished the year with about 540,000 DSL (digital subscriber line) subscribers, outpacing its year-end target of 500,000. Verizon, formed by the merger of Bell Atlantic and GTE, also ended the year with roughly 1.4 million long-distance customers in New York, an estimated 20 percent share of the state's residential long-distance marketplace in one year of serving the market. Verizon (VZ: Research, Estimates) said it finished the year with about 540,000 DSL (digital subscriber line) subscribers, outpacing its year-end target of 500,000. Verizon, formed by the merger of Bell Atlantic and GTE, also ended the year with roughly 1.4 million long-distance customers in New York, an estimated 20 percent share of the state's residential long-distance marketplace in one year of serving the market.

"We have an expanding position in the growth markets of the future – wireless, data, broadband, long distance – and we're executing extremely well in these areas," said President and co-CEO Ivan Seidenberg.

Verizon stock lost 31 cents to $54.25.

After the closing bell, i2 Technologies (ITWO: Research, Estimates), a supply-chain management software maker, said it expects to post fourth-quarter profit and revenue that exceed Wall Street's forecast.

After the announcement, shares of the Dallas-based company shot up to $48.50 in after-hours trading from its official close of $41.94.

i2 Technologies said it expects to post fourth-quarter revenue of at least $370 million, compared with market expectations of $342 million. The company did not provided an earnings figure. However, analysts polled by First Call Corp. anticipate profit of 8 cents per share.

Marriott International (MAR: Research, Estimates), the largest U.S. hotel chain, said it expects to post fourth-quarter earnings in line with the First Call consensus forecast of 58 cents per share. Marriott International (MAR: Research, Estimates), the largest U.S. hotel chain, said it expects to post fourth-quarter earnings in line with the First Call consensus forecast of 58 cents per share.

The company said it expects to match analysts' consensus forecasts of $2.17 per share for full-year 2001.

Marriott shares rose $1.81 to $46.69, hitting a fresh 52-week high of $46.81 during the session.

New York-based Interpublic (IPG: Research, Estimates) said it expects to announce at an investment conference Tuesday morning that it will post 2000 results between $1.49 and $1.51 per share. The First Call consensus estimate is $1.51 per share.

The company made the announcement after the closing bell. Prior to the news, Interpublic shares closed down 25 cents at $43.44 on the New York Stock Exchange.

-- from staff and wire reports

|

|

|

|

|

|

|