|

FedEx, USPS set pacts

|

|

January 10, 2001: 7:23 p.m. ET

FedEx will haul Postal Service express mail, put drop boxes at USPS offices

|

NEW YORK (CNNfn) - FedEx Corp. and the U.S. Postal Service approved an alliance Wednesday that could bring FedEx $7 billion in sales, ending weeks of speculation that the two rivals were in talks over a deal to share some package delivery services.

Under the two seven-year agreements, FedEx Express, a subsidiary of Memphis, Tenn.-based FedEx, will transport postal service express shipments by air beginning in late August. That deal is expected to bring in $6.3 billion in revenue for FedEx over the seven years.

Separately, FedEx Express will have the option to place a self-service drop box in every postal service location. The company will test this service beginning in February before placing more than 10,000 drop boxes nationwide over the next 18 months, the company said. FedEx expects to bring in $900 million in drop-box revenue.

FedEx, which makes most of its money in overnight package delivery, will hire an additional 500 pilots and about 200 new aircraft mechanics to handle the new service, which will make up the bulk of the $350 million-to-$400 million startup costs it expects to incur, FedEx Chief Financial Officer Alan Graf told analysts during a conference call Wednesday. FedEx, which makes most of its money in overnight package delivery, will hire an additional 500 pilots and about 200 new aircraft mechanics to handle the new service, which will make up the bulk of the $350 million-to-$400 million startup costs it expects to incur, FedEx Chief Financial Officer Alan Graf told analysts during a conference call Wednesday.

But contract terms call for the post office to reimburse FedEx for most of that cost. The postal service will also sort and bag all its packages, as well as transport them to and from the airports, which will also help FedEx preserve margins and keep costs down, Graf said in an interview with CNNfn.com.

"We believe our product offerings are complementary. We have virtually no presence in the lightweight preferred market, so we don't really compete with the postal service there," Graf said.

FedEx, which can carry 20 million pounds of freight a day, plans to ship postal service packages during the day, mostly small, lightweight priority mail documents, when its planes are idle. FedEx said this fits in with its business plan since it does not carry a substantial amount of small package business.

Postal service business would amount to about 3.5 million pounds of airlift capacity each day, or the equivalent of about 30 wide-body DC10 aircraft.

Graf said the additional flights, occurring during the day, will not shorten the lifespan of the plane. He did acknowledge the higher maintenance costs. However, the postal service is expected to reimburse FedEx for most of those costs.

Graf also said the terms of the contract protect the companies from the slowing economy by imposing minimum package delivery requirements on the postal service.

The postal service, in turn, said it expects to save more than $1 billion over the life of the agreements.

Check out how transportation stocks are doing today.

FedEx, which has annual revenue of $19 billion, said during a conference call with analysts Tuesday that another rival package carrier, Emery Worldwide, sought a temporary restraining order against the postal service on Jan. 5 to prevent it from entering an agreement with FedEx. But the U.S. Court of Federal Claims declined to issue a temporary injunction on the deal. A final decision should come in early March, FedEx said.

"We think that the postal service violated their own regulations about procurement, so therefore we think the single-source contract with FedEx is illegal, unfair and anticompetitive," said Nancy Colvert, a spokeswoman for Emery, which is owned by Palo Alto, Calif.-based CNF Inc. (CNF: Research, Estimates).

However, terms of the deal permit the postal service to enter similar air carrier or drop-box agreements with other competitors, FedEx said.

FedEx and the USPS will continue to operate competitively, maintaining separate services.

Doug Brockel, a transportation analyst with ING Barings, said he doesn't think FedEx's close rival United Parcel Service (UPS: Research, Estimates) would be put off by the deal.

"I don't think it presents a problem so much for UPS. Again it's more an opportunity for Federal," Brockel told CNNfn's "In the Money" Wednesday. (346K WAV) (346K AIFF)

UPS Spokesman Donald Black said the company was initially concerned that FedEx would sign an exclusive carrier deal with a government agency, which UPS would have fought in the courts. However, since that turned out not to be the case, he said UPS would seriously explore whether it also would be interested in placing drop boxes at post offices.

Bear Stearns Analyst Edward Wolfe said the deal makes FedEx stock dramatically more of a risk as the potential for positive returns remain subdued.

However, he added that risk could work in favor of UPS and Airborne.

FedEx also hopes to take advantage of some of the 72,000 walk-in customers it handles each day on average at every location.

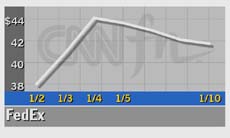

Shares of FedEx (FDX: Research, Estimates) closed down 8 cents to $42.19 on Wednesday.

|

|

|

|

|

|

|