|

AOL looks ahead, but stock drops

|

|

January 12, 2001: 4:55 p.m. ET

Shares slide in first day after FCC conditionally approves media merger

By Staff Writers Franklin Paul and Tom Johnson

|

NEW YORK (CNNfn) - Gerald Levin and Bob Pittman on Friday put the construction of AOL Time Warner behind them and looked ahead to an even greater challenge: growing their newly formed media conglomerate in a exceptionally challenging economic environment.

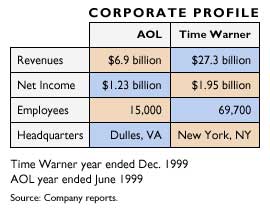

The company, created by America Online's $111 billion purchase of Time Warner, boasts an extensive list of assets including the nation's top Internet service company, the No. 2 cable TV outfit, and a plethora of media properties ranging from the WB, CNN and HBO TV networks to a music label and film studio. The company, created by America Online's $111 billion purchase of Time Warner, boasts an extensive list of assets including the nation's top Internet service company, the No. 2 cable TV outfit, and a plethora of media properties ranging from the WB, CNN and HBO TV networks to a music label and film studio.

But, like its peers, it also must find ways to grow during a slowdown in U.S. economy, and a slumping advertising environment that has already crippled many Internet companies.

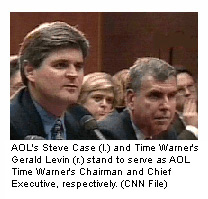

Levin and Pittman, AOL Time Warner's chief executive and co-chief operating officer, respectively, said that the company's strong brands are the kind that advertisers turn to even when corporations cut back on marketing expenditures, thereby lessening the blow of a slowdown.

"At times when people cut back media expenditures, they're not cutting everybody back, they're cutting the tertiary and secondary buys out," Pittman told CNNfn's Market Call. "They tend to consolidate into their big players and the people who really give them the horsepower. The good news is, this company has got those kinds of TV networks, those kinds of magazines." (500K WAV, 500K AIFF)

Click here to see how other media stocks are doing.

Levin stood by the company's projection that its annual revenues are going to be above $40 billion, growing at 12 percent to 15 percent a year. Cash flow, a key measure of fiscal health used by media companies, is seen at $11 billion, growing at 25 to 30 percent, he said.

In first day as combined company, stock drops

Despite the executives' optimism, investors sold stock of AOL Time Warner (AOL: Research, Estimates), pushing the shares down 76 cents to close at $46.47 in heavy trade. The shares rose by more than one dollar just after the market opened.

Time Warner shareholders woke up Friday owning 1.5 shares of AOL Time Warner for every Time Warner share they previously owned, while America Online shareholders start the day with one share of AOL Time Warner for every AOL share they previously owned. Time Warner shareholders woke up Friday owning 1.5 shares of AOL Time Warner for every Time Warner share they previously owned, while America Online shareholders start the day with one share of AOL Time Warner for every AOL share they previously owned.

But market experts attributed the decline to some profit-taking after a recent rally in the shares of the two companies.

"I think it was likely to falter because of the amount of people who bought in anticipation of the approval," said Bill Meehan, chief market analyst with Cantor Fitzgerald.

Shares of AOL surged 42 percent in the first 9 trading days of 2001 to $42.73. Time Warner shares climbed 49 percent during that time, and closed at $71.19 on Thursday. With the merger's closing, Time Warner shares no longer trade.

Just three weeks ago, Time Warner trimmed its profit growth forecast, citing weaker-than-expected music, cable advertising and movie sales. It warned that earnings before interest, taxes and other items, are likely to grow 11 percent for the full year 2000, rather than its previous forecasts of 12 to 13 percent.

Despite Friday's drop, which came amidst a general slump in blue chip stocks on the New York Stock Exchange, analysts cheered the pact, citing its potential to benefit from its unique combination of dynamic content and massive distribution, particularly over the Internet.

"The biggest effect is you are going to see extraordinary opportunities to what the Internet can do and what the Internet can't do," said Christopher Dixon, a media analyst with UBS Warburg. "The real issue here is there is no question that the demand for information and the demand for entertainment delivered across a broad array of digital devices is continuing to accelerate.

"The real promise of AOL and Time Warner is that if anybody can pull this off, these guys can," he said.

Deal closed Thursday, shortly after FCC approval

The companies sewed up the $111 billion deal late Thursday, shortly after the Federal Communications Commission approved the pact, the final hurdle to creating a conglomerate with more than $34 billion in annual revenue and a wealth of brand name properties such as Time Magazine, Warner Brothers film studio, People magazine, and the AOL Internet service.

All five FCC commissioners granted approval, although conditions were imposed regarding open Internet access, instant messaging and the divestiture of AT&T's stake in Time Warner Entertainment.

|

|

VIDEO

|

|

CNNfn's Patty Davis reports from Washington on AOL Time Warner merger. CNNfn's Patty Davis reports from Washington on AOL Time Warner merger. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

FCC Chairman William Kennard said that because of the size and scope of the two companies involved, the commission "balanced the need to protect the public against the danger that any one company would become so big and so dominant, against our concern that we not intervene in an overly regulatory way in the marketplace."

At a Friday news conference expounding upon the FCC's views, Kennard said the three conditions were aimed at protecting consumers. He also announced his resignation, effective January 19, a move that was expected.

To read the FCC's statement, click here

The first condition ensures open access to AOL's high-speed Internet cable lines to rival Internet service providers, and requires that AOL allow unaffiliated ISPs to control the first pop-up screen.

Second, the FCC also is requiring that AOL Time Warner open up the instant messaging platform to at least three competitors and make it interoperable with competing messaging services.

Lastly, regulators also are calling for AT&T (T: Research, Estimates) to divest its stake in Time Warner Entertainment.

"These conditions are designed to protect the open competitive nature of the Internet," Kennard said. "These conditions are designed to protect the open competitive nature of the Internet," Kennard said.

"There is a danger that one company would be allowed to dominate that essential database that people need to communicate with each other over instant messaging," he added.

"So we have imposed some very narrowly-tailored, minimally intrusive conditions, to make sure that as this technology grows and develops it grows in a competitive environment." (592K WAV, 592 AIFF)

The FCC declined to place conditions on the development by AOL Time Warner of interactive television, whose applications and use by consumers so far has been limited. Instead, the regulatory body promised to keep a watchful eye as the technology emerges.

Public interest groups applauded the merger decision. Gene Kimmelman, co-director of the Washington office of Consumers Union, said the government had "transformed a merger that threatened competition into one that could actually expand consumers' choices for high-speed Internet and interactive TV services. What could have been a disaster for consumers now holds the potential to promote competition and consumer choice."

But the cable industry in recent months has balked at the open Internet access plan, asserting that it is too early for the government to evaluate the emerging technology.

Merger seen as boon to technology development

Steve Case, now chairman of AOL Time Warner, said the merger will help the company "lead the convergence of the media, entertainment, communications and Internet industries."

"This is a historic moment for consumers everywhere, and a tremendous step toward our goal of becoming the world's most respected and valued company," he added.

FCC chairman Kennard said the merger could foster competition.

"When I look at this merger, there are some clear potential benefits: I see the ability to roll out technologies faster, and further. This is clearly a merger of convergence, and that provides some possibilities for exciting new technologies and innovation," he said. "But those benefits could be the proverbial silver lining."

Last month, the Federal Trade Commission approved the merger after the companies agreed to a series of unprecedented concessions aimed at protecting competition in the high-speed Internet access market.

When the deal was announced Jan. 10, 2000, it was worth $164 billion, excluding debt and options. However, AOL shares closed on Thursday at $47.23 apiece, putting the value of the deal at about $111 billion including debt. AOL Time Warner is the parent company of CNN and CNNfn.

The company currently has nearly 29 million Internet subscribers -- 26 million on AOL and 2.8 million on its CompuServe system – or 50 percent of all Net subscribers in the United States, and 20 percent of all cable television subscribers. The company's two instant messaging services, AOL Instant Messenger and ICQ, have more than 140 million registered users, easily surpassing rival services offered by Microsoft and Yahoo!

Debate over conditions

Approval of the deal was delayed because FCC officials continued to wrangle over placing conditions on AOL's instant messaging service.

The FCC has focused on instant messaging because the technology is expected to blossom from a fast way to send short notes to a platform for sending large amounts of data, such as video and music files. AOL rivals Yahoo! (YHOO: Research, Estimates), Microsoft (MSFT: Research, Estimates) and others also offer instant message services.

Among the panel's three Democrats, Kennard supported approving the transaction, but was pushing for placing limited conditions on AOL's Instant Messenger service. Among the panel's three Democrats, Kennard supported approving the transaction, but was pushing for placing limited conditions on AOL's Instant Messenger service.

Democrat Gloria Tristani, who had been arguing for instant messaging conditions for weeks, had tentatively voted against approving the merger, believing that the limited conditions Kennard supported didn't go far enough, but then changed her mind.

"Though I advocated for even more forceful conditions, the strengths and conditions go a long way to protect consumers," Tristani said at the press conference. "In the end, voting in favor of the decision serves consumers better than lodging a dissent."

|

|

|

|

|

|

AOL Time Warner

AOL

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|