|

Hughes 4Q sales gain

|

|

January 16, 2001: 12:32 p.m. ET

Revenue beats forecasts amid report News Corp. is preparing bid

|

NEW YORK (CNNfn) - Hughes Electronics reported better-than-expected fourth-quarter sales Tuesday on the heals of a published report that News Corp. is preparing to make a $40 billion bid for the General Motors Corp. division.

Hughes, whose primary operation is its DirecTV satellite television unit that News Corp. craves, saw revenue rise 21.3 percent to $2.1 billion. Analysts surveyed by earnings tracker First Call expected revenue of only $1.9 billion. The division had revenue of $1.4 billion a year earlier.

Because Hughes (GMH: Research, Estimates) is a tracking stock of GM, First Call does not track earnings per share forecasts for the unit, nor does Hughes release earnings on that basis. But the company said its earnings before interest, taxes, depreciation and amortization (EBITDA) was $153.8 million, compared with a loss on that basis of $173 million a year earlier. Because Hughes (GMH: Research, Estimates) is a tracking stock of GM, First Call does not track earnings per share forecasts for the unit, nor does Hughes release earnings on that basis. But the company said its earnings before interest, taxes, depreciation and amortization (EBITDA) was $153.8 million, compared with a loss on that basis of $173 million a year earlier.

DirecTV added a record 527,000 net subscribers in the United States in the quarter, and ended the period with a backlog of more than 110,000 customers who purchased DirecTV systems and scheduled a professional installation. Weather and a demand for multi-receiver systems was responsible for the backlog. The new customers brought the U.S. subscriber base up to 9.5 million subscribers, in addition to 1.3 million in Latin America.

The Financial Times reported Tuesday that News Corp. is preparing to make a bid of up to $40 billion for DirecTV, and that News Corp. Chairman Rupert Murdoch had ordered a freeze on new investments and is considering disposing of News Corp. assets in order to fund the purchase.

GM announced three months ago it was examining options for the Hughes unit as a way of unlocking shareholder value. The Hughes tracking stock has a market capitalization of $21.7 billion, while all of GM has a market cap of only $31 billion.

Andrew Butcher, a spokesman for News Corp., couldn't comment on the timing of a bid for DirecTV or a price, but said the company's interest in the unit is nothing new.

"We've said publicly we're interested in DirecTV and interested in talking to GM," he said. "We've always been cautious but opportunistic investors, and that remains the case."

He said cost-cutting moves such as a hiring freeze a month ago and the cut of jobs in the company's digital media unit announced earlier this month were separate issues and had nothing to do with a possible bid for DirecTV.

At the auto show in Detroit last week, GM CEO Rick Wagoner said the company continues to consider options for Hughes and DirecTV, but said no immediate decision is pending.

"It's getting plenty of high-level attention. We've talked to a lot of people and narrowed the list somewhat as to who seems to offer Hughes the most interesting opportunity," he said. "It's going to take a while longer. I don't have a specific endpoint, but I think it's moving at a pretty good clip right now. There are factors like stock market valuations that play into it and influence the players, so I can't narrow it down to a specific quarter, but it's moving pretty quickly."

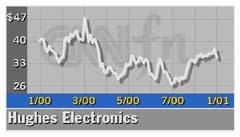

Shares of Hughes gained $2.10 to $26.05 in trading Tuesday, while shares of GM (GM: Research, Estimates) rose $2.31 to $55.19 and News Corp. (NWS: Research, Estimates) ADRs lost 6 cents to $38.81.

|

|

|

|

|

|

|