|

Fewer funds, more diversity

|

|

January 19, 2001: 6:11 a.m. ET

Bank employee should build more aggressive portfolio around core

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - Just because you can put money in nearly every fund in your 401(k) doesn't mean you should. By doing so, you're not guaranteeing effective diversification or reduced risk.

That's a lesson two certified financial planners want to impart on Kathy, a 44-year-old institutional accounts manager at a bank in St. Paul, Minn., who has a $150,000 retirement portfolio, which includes $105,000 in 401(k) investments and $45,000 in a cash-balance pension plan.

Kathy wants to retire between the ages of 55 and 59, and would be happy if her investments could yield 85 percent of her $55,000 salary. But that may not be realistic given how much she has saved to date and how she is presently configuring her investments, which includes a large stake in company stock, said CFP Debra Neiman of Wakefield, Mass.

Portfolio Rx is a regular CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review a reader's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a regular CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review a reader's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information.

As Kathy's investments stand now, Neiman figures she will have $630,000 if she retires at 57. That figure was derived from several assumptions: she will get an average annual return of 8 percent on stocks and 6 percent on bonds; she will continue to contribute 16 percent of her salary plus company match to her 401(k); and she will continue to receive a 3 percent contribution to her pension plan.

But if she lives to age 90, that means she'll only be able to withdraw about $26,000 per year, Neiman said. Adjusted for 4 percent inflation, that $26,000 will only be worth about $15,000 in purchasing power, she added. And Kathy may need to draw more out her portfolio in the first five years of retirement, since she won't be able to collect Social Security until age 62.

Streamline strategy

The scenario improves vastly if Kathy chooses to do at least two of the following: delay full retirement, invest more aggressively, or streamline her investments while diversifying them more effectively.

Currently, Kathy, whose choice of 401(k) funds is limited to those offered by First American, has spread her money unevenly among 10 funds plus a company-stock fund, which alone accounts for more than a third of her 401(k) balance.

Other big balances include about $31,000 in a general equity index fund, $13,000 in a small-cap growth fund, and $9,000 in a mid-cap growth fund.

Of her contributions going forward, however, she has allocated: 25 percent to a money market fund; 20 percent to the equity index fund; and another 15 percent to the company stock fund. In addition, she has allocated 10 percent to a mid-cap growth fund and 5 percent each to large-cap growth, small-cap growth, small-cap value and international stock funds, as well as two asset allocation funds: income, and growth and income.

Identify a core

That's too many funds for too little effect, Neiman said. "I recommend she use the equity index fund as a core holding and build around it," she said.

She also recommends Kathy cease contributing to the company stock fund, since Neiman doesn't like clients to have any more than 15 percent of assets tied to one equity; the asset allocation funds, since Kathy can create her own; and the money market fund, since that's not a good investment for long-term growth. She also recommends Kathy cease contributing to the company stock fund, since Neiman doesn't like clients to have any more than 15 percent of assets tied to one equity; the asset allocation funds, since Kathy can create her own; and the money market fund, since that's not a good investment for long-term growth.

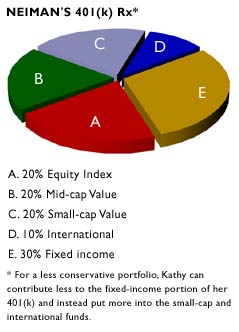

Instead, Neiman would rather Kathy reallocate her portfolio and her future contributions so that ultimately she has 20 percent of her money in the equity index fund; 20 percent in mid-cap value; 20 percent in small-cap value; 10 percent in international; and 30 percent in fixed income.

If Kathy, who said she doesn't know much about investing but recognizes the need to be somewhat aggressive with long-term savings, is willing to take more risk, she might consider putting less into a fixed income fund and more into her international and small-cap options.

Mind the averages

CFP Joel Bruckenstein of Pleasantville, N.Y., took a slightly different approach. For starters, he suggested that Kathy reduce the roughly $8,800 she contributes annually to her 401(k) and put $2,000 after-tax into a Roth IRA.

"Diversification is not just about investing across asset allocation but across tax-advantaged investments," Bruckenstein said, noting that a Roth IRA has no minimum required distributions, offers more investment choice and greater withdrawal flexibility.

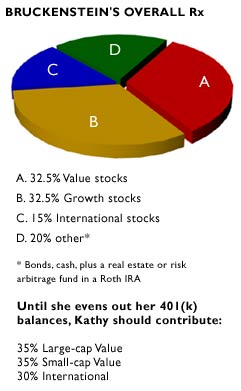

Since Kathy's current portfolio is heavily weighted toward growth stocks he would like to see her bump up her value holdings. Until her balances are more in line with his recommended allocation of roughly 33 percent U.S. growth stocks, 33 percent U.S. value stocks and 15 percent international stocks, he suggests her near-term 401(k) contributions be as follows: 35 percent into growth funds, 35 percent into value funds and 30 percent into the international fund.

In her Roth IRA, Bruckenstein suggested she choose an investment that runs contrary to the equity markets, such as a high-yield or junk bond fund, a real estate fund, or a risk arbitrage fund that offers steady returns for less risk than most stock funds. This will offer her more diversification and a better capital preservation strategy. In her Roth IRA, Bruckenstein suggested she choose an investment that runs contrary to the equity markets, such as a high-yield or junk bond fund, a real estate fund, or a risk arbitrage fund that offers steady returns for less risk than most stock funds. This will offer her more diversification and a better capital preservation strategy.

"If in the first couple of years after she retires, there's a down market and she is invested the same way (she is now), she'll be in trouble," he said, explaining that while she may assume an average annual return on investment, if her asset base is drastically reduced around the time she stops working, that average return will yield much less and, since she won't be contributing anymore, she won't be able to recoup the money quickly.

In other words, he said, "If your head's in the oven and your feet are in the freezer, your average temperature may be moderate, but you're not going to be comfortable."

Among his fund recommendations for her Roth: Merger, a risk arbitrage fund; Columbia Real Estate, Third Avenue Real Estate; and Pioneer High Yield, Loomis Sayles High Yield, or Janus High Yield.

Enter retirement debt-free

Kathy might also consider making a more aggressive choice with her pension plan money, if she would like to yield a higher return, Bruckenstein said. Instead of Balanced Income, one of three investment strategies her company has offered, she might choose Balanced Growth & Income, which has a heavier equity weighting.

Likewise, she should stop contributing $100 a month to a $4,000 savings bonds account and use that money instead to pay down a $6,000 checking account loan, since she's paying 12 percent on the loan but only earning about 5 percent on the bonds, Bruckenstein said. Once that loan is paid off, she might consider bumping up her payments on a $10,000 home equity loan on which she pays 8.5 percent interest.

And, both planners said, given that she will pay off her $35,000 mortgage in seven years, she would be in better shape financially if she did not purchase a more expensive house, something she has been considering.

Said Neiman: "Her best case scenario is to enter retirement without any debt to service."

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. Please include a daytime phone number so that we may reach you. If we choose your portfolio, we will use your information, including your name in an upcoming story.

* Disclaimer

|

|

|

|

|

|

|