|

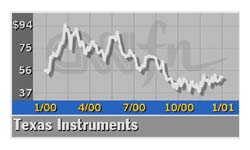

TI's 4Q falls short

|

|

January 22, 2001: 6:29 p.m. ET

Chip maker misses estimates, lowers first-quarter revenue guidance

|

NEW YORK (CNNfn) - Semiconductor maker Texas Instruments Inc. on Monday turned in a fourth-quarter operating profit that missed the Street's expectations and said its revenue in the first quarter is likely to be 10 percent below the fourth-quarter level.

Excluding special items, TI (TXN: Research, Estimates) said its operating profit was $549 million, or 31 cents per share. That's 2 cents below the 33 cents per share analysts had generally expected, according to a survey conducted by First Call. At $3.03 billion, TI's fourth-quarter revenue was up 15 percent from the same period a year earlier, but slightly below the $3.1 billion the Street expected, according to First Call.

Texas Instruments shares fell to $46.63 in after-hours trade Monday, from the $48.56 close at 4 p.m. ET.

In a teleconference Monday evening, William Aylesworth, TI's chief financial officer, told analysts to expect the company to log first-quarter revenue that is about 10 percent below the $3.03 billion it reported in the fourth quarter.

Prior to that, they generally had expected TI's first-quarter revenue to rise slightly to $3.2 billion, according to the First Call survey.

Aylesworth attributed the projected revenue shortfall primarily to a glut of inventory among TI's semiconductor customers who make wireless handsets, many of which struggled through what turned out to be a disappointing holiday selling season.

"Wireless is expected to decline as certain of our customers are entering the seasonally weaker first quarter with excess inventory," he said. "Wireless is expected to decline as certain of our customers are entering the seasonally weaker first quarter with excess inventory," he said.

The Dallas-based company's chips are used in roughly two-thirds of the world's mobile phones, an area where there recently have been clear signals of slowing growth.

Motorola (MOT: Research, Estimates), the world's second-largest supplier of wireless handsets, when it reported its latest results earlier this month said it was experiencing a slowdown in mobile-phone orders and ratcheted down its outlook for total wireless handset production in 2001.

Earlier, Nokia (NOK: Research, Estimates), the world's leading mobile-phone maker, said its mobile phone sales in 2000 had come in about 9 percent lower than what many analysts had expected. Nokia is expected to report its latest results on Jan. 30.

Dan Niles, an analyst who tracks TI for Lehman Brothers, characterized the company's latest results as a "gigantic miss," even in the current environment, which has caused most big-name technology companies to come in short of their previous financial targets.

And the 10 percent revenue decline in the first quarter will shave at least 50 cents per share off the $1.50 per share in earnings analysts had genially been expecting TI to log for all of 2001, Niles said in an interview on CNNfn's Moneyline News Hour. (148K WAV) or (148K AIFF)

Although he did not provide a specific earnings-per-share estimate for the first quarter, Aylesworth said it will be below the Street's most recent consensus estimate of 34 cents per share.

He also declined to provide any financial guidance beyond the first quarter, citing the uncertainty in global economic conditions.

"We currently have limited visibility into 2001, and as a result, I will only comment on our expectations for the first quarter," he said.

For all of 2000, TI logged revenue of $11.8 billion, up 22 percent from $9.8 billion in 1999. Earnings in 2000 rose 38 percent to $2.17 billion, or $1.22 per share, compared with $1.58 billion, or 90 cents per share in 1999.

All of the company's most recent financial results have been restated to reflect its acquisition of communications chip maker Burr-Brown, which it took into the fold last August.

|

|

|

|

|

|

|