|

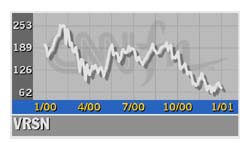

VeriSign shreds estimates

|

|

January 24, 2001: 5:38 p.m. ET

Web software, services firm nearly doubles the Street's expectaions

|

NEW YORK (CNNfn) - VeriSign Inc. on Wednesday turned in a fourth-quarter operating profit that was nearly twice what analysts had expected.

Excluding extraordinary charges, VeriSign (VRSN: Research, Estimates) said it earned $45.5 million, or 21 cents per share, during the three-month period ended Dec. 31.

That's compared with net income of $4.5 million, or 4 cents per share, during the same period a year earlier and nearly double the 11 cents per share in profit analysts had expected, according to earnings tracker First Call.

VeriSign (VRSN: Research, Estimates), which provides data-authentication, secure-payment and domain-name registration services for Web sites, said its revenue for the quarter was $197.4 million. That's up more than 600 percent from the year-ago period, but includes revenue from Network Solutions, which VeriSign acquired last June.

The average fourth-quarter revenue estimate of seven analysts polled by First Call was $189.4 million.

Including acquisition-related and other charges, VeriSign logged a fourth-quarter net loss of $1.3 billion, or $6.64 per share, compared with net income of $4.5 million, or 4 cents per share during the same period a year earlier.

VeriSign shares rose $7 to $81.50 on Nasdaq ahead of the earnings news, which was released after the closing bell. They fell to $76.50 in after-hours trade.

Click here to see which stocks are moving after hours

Among VeriSign's business lines, the company said its core authentication services business, which includes digital certificate and managed public key infrastructure services, performed particularly strongly.

The company said it sold more than 85,500 certificates in the fourth quarter, representing a 135 percent increase from the fourth quarter of 1999. For the year, VeriSign said it sold more than 275,000 certificates, up 133 percent over the 118,000 it sold in 1999.

As for its online payment-services business, VeriSign said it added more than 5,600 new customers in the quarter and now services more than 15,100 online merchants.

VeriSign said its domain-name registration business, which it acquired with its purchase of Network Solutions in June, added 4.3 million names in the fourth quarter, and more than 1.2 million renewed or extended domain names during the quarter.

The company said its registry ended 2000 with 28.2 million active domain names in its database, up 217 percent from 8.9 million names at the end of 1999, and 16 percent above the third quarter of 2000.

For all of 2000, VeriSign reported an operating profit of $129.1 million, or 72 cents per share, excluding extraordinary charges. Including the charges, the company's net loss for the year was $3.1 billion, or $19.57 per share.

VeriSign's total revenue in 2000, including the Network Solutions revenue, was $474.8 million, a 460 percent increase over $84.8 million in 1999.

|

|

|

|

|

|

|