|

U.S. techs trot higher

|

|

January 26, 2001: 4:36 p.m. ET

Betting the worst is over and rate cuts are coming, bargain hunters emerged

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - Investors went bargain hunting in the technology sector Friday, lifting the Nasdaq composite index, as concerns about revenue growth were shrugged off and confidence rose that the Federal Reserve would cut interest rates at its upcoming monetary policy-making meeting.

"Earnings continue to remain strong, even for the technology companies, so I think, with the Federal Reserve saying we're afraid of a recession more than inflation, you're seeing bargain hunters coming in," said Michael Carty, principal with New Millennium Advisors.

But cyclical stocks took a beating amid concerns about how much these issues would bee affected if the economic slowdown continues. But cyclical stocks took a beating amid concerns about how much these issues would bee affected if the economic slowdown continues.

"It's going to take us a few months to figure out how much the economy is slowing," said Bryan Piskorowski, market analyst with Prudential Securities.

Federal Reserve Chairman Alan Greenspan's testimony before the Senate Budget Committee Thursday did little to inspire investor confidence. Greenspan's comment that the U.S. economic slowdown has reduced growth "very close to zero" raised concerns that tax cuts may limit the pace of possible interest rate cuts.

Lower rates tend to spur spending by businesses and consumers, boosting economic growth and corporate earnings. Analysts expect the Fed to cut rates by a quarter to a half percentage point next week.

But Weatherly Securities chief market strategist Barry Hyman warned that the volatile times are not over.

"It's going to be a tough, choppy period of time here as we start looking for some stabilization rather than improvement," he said. "We're going to end the earnings concerns very soon and then we'll have the Fed, and then we're going to have this horrendous political process of seeing how Congress can rationalize a tax cut."

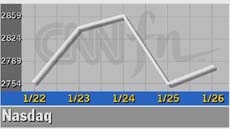

The Nasdaq composite index rose 27.02 points, or around 1 percent, to 2,781.30, erasing earlier 2 percent losses. The Dow Jones industrial average slid 69.54 at 10,659.98, while the S&P 500 shed 2.56 to close at 1,354.95. The Nasdaq composite index rose 27.02 points, or around 1 percent, to 2,781.30, erasing earlier 2 percent losses. The Dow Jones industrial average slid 69.54 at 10,659.98, while the S&P 500 shed 2.56 to close at 1,354.95.

For the week, all three major stock indexes edged higher. The Dow Jones industrial average rose 0.6 percent, while the Nasdaq advanced 0.3 percent. The S&P 500 gained 0.9 percent over the last five sessions.

Stocks have held up well this year, and, as corporate quarterly results reports wind down, Richard Cripps, chief market strategist at Legg Mason, told CNNfn's market coverage he sees the market consolidating. (521K WAV) (521K AIFF).

Market breadth was negative on the New York Stock Exchange with decliners beating advancers 1,437 to 1,399, as more than 1.08 million shares were traded. On the Nasdaq, losers beat winners 1,893 to 1,871, as more than 2.16 billion shares changed hands.

In other markets, the dollar rose against the euro and the yen. Treasury securities were mixed.

Corporate results yield bargains

As corporate results roll in, it isn't all bad news.

Qualcomm (QCOM: Research, Estimates) jumped $7.06 to $81 after the wireless equipment maker reported fiscal first-quarter earnings late Thursday that were better than analysts' expectations despite softer-than-expected sales, and said it should meet future earnings forecasts.

JDS Uniphase (JDSU: Research, Estimates), the telecom equipment maker, rose $4.44 to $59.63 after it reported fiscal second-quarter earnings late Thursday that topped analysts' estimates on stronger-than-expected sales. But the company warned that revenue growth for the current quarter will be slightly below expectations due to decreased spending by telecom service providers.

| |

CORPORATE RESULTS CORPORATE RESULTS

|

|

| |

|

Click below for a full look at today's quarterly results

Earnings Calendar

|

|

|

Aside from quarterly results, tech stocks were helping keep the Dow from steep losses. IBM (IBM: Research, Estimates) gained $3.19 to $114.44 and Microsoft (MSFT: Research, Estimates) jumped $2.19 to $64.

PMC-Sierra and Ericsson still under pressure

But another day and more negative guidance tempered gains in the tech sector.

Communications chipmaker PMC-Sierra (PMCS: Research, Estimates) plunged $21.88 to $74 after saying earnings will be well below forecasts. But the company did meet estimates for its fourth quarter.

PMC's biggest customer, Cisco Systems (CSCO: Research, Estimates), fell 94 cents to $38.38.

Ericsson (ERICY: Research, Estimates) tumbled $1.75 to $11.25 after the world's leading developer of cellular networks and third-biggest handset maker said it will quit mobile phone production and announced a fourth-quarter profit below expectations.

The Dow headed lower as investors sold cyclical issues amid worries that the economic slowdown may continue to slide. The Dow headed lower as investors sold cyclical issues amid worries that the economic slowdown may continue to slide.

"We need some positive catalysts to build some confidence up," Linda Jay, NYSE floor trader with RPM Specialists, told CNNfn's Market Call.

Explaining the selling on the Dow, Weatherly Securities' chief investment strategist Barry Hyman said, "I do believe it's the weakening economy, where cyclical stocks can only gain strength on the anticipation of an economy solidifying, and any evidence of an economy slowing more than expected is not good news."

Among the "old economy" losers, United Technologies (UTX: Research, Estimates) fell $2.44 to $73.13, DuPont (DD: Research, Estimates) shed $1.06 to $40.94, and Home Depot (HD: Research, Estimates) slid $1.25 to $44.75.

One Dow component, aerospace parts maker Honeywell (HON: Research, Estimates), posted a fourth-quarter profit of 70 cents a share, missing expectations by a penny and down from the 78 cents a share earned a year earlier. Honeywell shares shed 94 cents to $46.38.

"We knew it was going to be a rocky opening after yesterday's earnings reports but I think it was a very encouraging day," Marc Klee, manager of John Hancock's global technology fund, told CNNfn's Street Sweep. "Valuations are reasonable but the fundamentals are going to get better."

|

|

|

|

|

|

|