|

Utility sector shake-up

|

|

January 30, 2001: 11:31 a.m. ET

After a 60% return last year, analysts predict sector will stay strong in 2001

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - So much for the "widows and orphans" theory.

Utility stocks, which have long been favored for their safe-haven status, are giving investors a run for their money.

After an 8.8 percent decline in 1999, the natural gas and electric companies that comprise the S&P utility index returned a jaw-dropping 60 percent last year alone -- a record for the 25-year old sector scorecard.

Those gains padded investors' portfolios even as the broader S&P 500 index shed more than 10 percent of its value and the Nasdaq composite index plunged 39 percent.

And, not to be accused of gathering moss, the utility index is down about 9 percent so far this year.

"We think the volatility is here to stay," said Paul Fremont, a utilities analyst with Jefferies & Co. "I think [investors] should either concentrate on those companies that are pure distribution or look elsewhere for safety."

Not your father's utility

Historically, utilities have been viewed as defensive stocks, returning steady-if-not-staggering profits, strong dividends and peace of mind. Those who bought into the sector did so to hedge their bets against market downturns. Others were simply risk-averse.

Performance in the sector charted a predictable pattern, doing well when the economy slowed and poorly when the economy sped up -- when high-risk, high-reward investments, such as technology and telecommunications, proved too enticing for investors to pass up.

But that was before deregulation. But that was before deregulation.

Dozens of states, including California and Pennsylvania, have shattered the monopolies that once dominated the natural gas and electric industries. In short, lawmakers have introduced competition on the retail level and opened up choices for consumers hoping that prices will drop.

But they've also introduced a new element of risk.

"Because of their high yields and stable cash flows, utilities are defensive stocks. But with deregulation, part of the business -- the power generation piece -- is exposed to supply and demand concerns where it wasn't before," said David Kiefer, a portfolio manager for the Prudential Utility Fund.

(Check your mutual funds.)

Kiefer, of Prudential Utility Fund, notes that deregulation has affected only those companies that generate power using natural gas, coal, nuclear fuel or other forms of energy.

The companies involved in the transmission, or the moving of electricity from the generation plant to the wholesale purchaser, and "distribution," in which the power is delivered to the end-user, are unaffected and should continue to provide a lower-risk safe haven for investors.

(Click here to check utility sector stocks.)

What changed?

So what happened last year to cause a run-up in the utility sector's stock? And more importantly, what's likely to happen for the rest of the year?

For starters, analysts say investors dumped their tech stocks last year and flocked to natural gas and electric companies seeking low multiples and potential for growth.

"The group did so well last year because there was a general realization about summertime that there's a shortage of power in this country and that was highlighted by the price increases in the west," said Ronald Tanner, a utilities analyst with Legg Mason.

"There were a whole bunch of companies that won the generation (rights) in California and those stocks skyrocketed," he said. "Mainly they were the subsidiaries that own a regulated utility, but also have nonregulated generation (facilities). Those stocks really took off."

Among those companies were AES Corp. (AES: Research, Estimates); Duke Energy (DUK: Research, Estimates) and Southern Co. (SO: Research, Estimates)

Utilities are off so far this year, due largely to concerns bred by the California energy crisis. The shortage of electricity led to days of rolling blackouts and forced many of the state's energy providers to default on their bonds. That, in turn, prompted a string of downgraded credit ratings by Standard & Poor's this month.

Click here for CNN.com's special report on the California power crisis.

Among the stocks getting hammered are California-based PG&E Corp. (PCG: Research, Estimates) and Southern California Edison.

A decade of change

Contrary to popular belief, however, volatility, is not new to utility stocks.

Over the last 10 years, utility stocks have returned a solid 14.8 percent, while the S&P 500 index returned 17.5 percent, according to Ibbotson Associates, a Chicago-based investment consulting firm.

| |

|

|

| |

|

|

| |

"The one thing I noticed about that comparison is that utilities didn't do all that poorly, with a total return over the period of 14.8 percent. But they did it in high style. It was the best of times."

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Clay Singleton, Ibbotson Associates |

|

Some of the largest utility stocks in the index include Enron Corp. (ENE: Research, Estimates); Duke Energy (DUK: Research, Estimates) and Dynegy (DYN: Research, Estimates).

But total returns don't tell the whole story.

Clay Singleton, a vice president at Ibbotson Associates, said the standard deviation for utilities surged to 21.3 percent for utility stocks during the same 10-year period, compared to 15.3 percent for the overall S&P 500. Standard deviation measures the range of returns for a stock or index during a stated period of time, a reflection of its inherent risk.

"The one thing I noticed about that comparison is that utilities didn't do all that poorly, with a total return over the period of 14.8 percent," Singleton notes. "But they did it in high style. It was the best of times; it was the worst of times. And it surprised me. Like a lot of people, I always thought of utilities as widow and orphan stocks."

Looking ahead

If you're a long-term investor wondering whether to buy, sell or hold, analysts paint a bad-news, good-news picture for the industry.

The bad news they say, is that the days when "any utility would do" are over. These days, the dual impact of volatility and deregulation require investors to choose their stocks with care.

If you're seeking stability, you should look to companies that continue to focus on the still-regulated transmission and distribution end of the business.

But if you're looking to cash in on the industry's newfound status as a free market commodity, you should buckle up now.

"We've gotten to the point now where these companies are well positioned in the generation side to make money, but you're going to have to follow the industry closely to know which ones and when to get out of them," Kiefer said. "It may sound self-serving, but I really believe that investors should probably not buy individual utility stocks and let a professional money manager do it for them."

He also notes that despite the downturn so far this year, the sector is poised to outperform the S&P 500 "for the next few years."

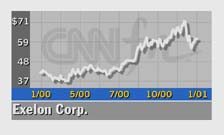

The top five holdings in Kiefer's fund: Exelon Corp. (EXC: Research, Estimates); El Paso Energy Corp. (EPG: Research, Estimates); Kinder Morgan (KMI: Research, Estimates); Williams Cos. (WMB: Research, Estimates) and Northeast Utilities (NU: Research, Estimates).

Jefferies & Co.'s Fremont said he believes that, in coming months, utility stocks will ebb and flow in accordance with broad investment trends.

| |

|

|

| |

|

|

| |

"We started with widows and orphans, then we started deregulating and developing non-regulated generation and that'll split off and we'll be back to where we were, stocks that are less volatile, with good dividends and more predictable earnings."

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Ronald Tanner, Legg Mason |

|

"To the extent that the Nasdaq takes off, that could mean people will switch out of utilities and into higher growth investments," he said. "However, if the Nasdaq weakens because of the growing risk of recession, I think [the utility sector will] continue to outperform."

His top picks include Public Service Enterprises (PEG: Research, Estimates), Reliant Energy (REI: Research, Estimates) on the power generation side of the business, and Enstar Energy East for its distribution network.

Full circle

Legg Mason's Tanner adds that the earnings prospects of key participants remain strong, due largely to the continued shortage of power supply relative to demand. But he said, too, that the industry is just beginning to evolve and the end result may look a lot like the steady-as-she-goes utilities of years gone by.

"I think we're going to see more pure play distribution companies that will be more defensive than they have been in the past," Tanner said. "Companies which have regulated utilities and a lot of non-regulations generation will split into two so that the generation business trades on its own merits at higher multiples with higher growth rates."

If and when that happens, investors may once again be able to count on utility stocks for the stability they provide.

"I think we're going full circle," Tanner said. "We started with widows and orphans, then we started deregulating and developing non-regulated generation and that'll split off and we'll be back to where we were, stocks that are less volatile, with good dividends and more predictable earnings."

|

|

|

|

|

|

|