|

U.S. growth slows

|

|

January 31, 2001: 3:58 p.m. ET

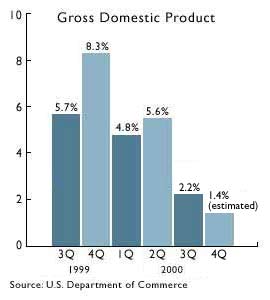

GDP annual rate of 1.4% weakest in more than five years, government says

|

NEW YORK (CNNfn) - The U.S. economy grew at a 1.4 percent rate in the fourth quarter, the slowest quarterly reading in more than five years, the government said Wednesday, providing fresh evidence that the United States may be on the verge of dipping into a recession.

The GDP figure was weaker than a 2.2 percent growth rate in the third quarter, and fell short of forecasts for a 2.3 percent quarterly increase for the October-December period, according to analysts surveyed by Briefing.com.

The GDP reading is the latest sign that the U.S. economy has slowed significantly in recent months. Hours after the data were released, the Federal Reserve, as expected, cut a key interest rate by a half-percentage point, the second aggressive rate reduction in less than a month. The Fed has been looking at an array of data on employment, manufacturing and consumer confidence showing that the economy has dropped off dramatically.

GDP, the total output of goods and services, is the broadest measure of the nation's economy. The latest figure is the slowest pace since a 0.8 percent reading in the second quarter of 1995, when the economy also was coping with overstocked inventories, and marks a stark drop-off from torrid growth of 5.6 percent in last year's second quarter.

Special Report: Eyes on the Fed

Meanwhile, the price deflator -- a key measure of inflation -- came in at 2.1 percent for the fourth quarter, above the third-quarter reading of 1.6 percent, but matching estimates.

Home sales rise

Separately, sales of new homes rose a surprisingly strong 13.4 percent in December, showing a resilient market for new housing even as economic growth slows. The number of new, single-family homes sold in December rose to a seasonally adjusted annual rate of 975,000, the Commerce Department said, the highest reading since November 1998. The figure was also higher than analysts' forecasts of about 895,000.

Experts said they don't think inflation is as big a threat as the potential for the country to fall into recession, defined as two consecutive quarters of negative growth. Federal Reserve Chairman Alan Greenspan last week warned Congress that growth in the current first quarter is probably "very close to zero."

The Fed's series of interest-rate increases from June 1999 until May 2000, intended to prevent the red-hot economy of the late '90s from overheating, have taken their toll on the nation's economic growth. Experts say the Fed now is cutting rates aggressively to inject life into the staggering economy. The Fed's series of interest-rate increases from June 1999 until May 2000, intended to prevent the red-hot economy of the late '90s from overheating, have taken their toll on the nation's economic growth. Experts say the Fed now is cutting rates aggressively to inject life into the staggering economy.

"This report just puts together all the news that people had been looking at for the last several weeks," James Glassman, chief U.S. economist at J.P. Morgan Chase, told CNNfn's Before Hours. "The Fed is going to do what it takes because they fear that maybe growth in the first quarter is close to zero."

Consumer spending falls off

The GDP report showed that growth in consumer spending -- which fuels about two-thirds of the country's economy -- slowed to a 2.9 percent pace in the fourth quarter of 2000 from 4.5 percent in the third quarter. Analysts had predicted a drop-off in consumer spending, after a lackluster holiday shopping season that underscored consumers' cautious outlook.

The report comes a day after data was published showing that consumer confidence has dropped to its lowest level in four years as Americans become more uneasy about the health of the economy.

Businesses added to inventories at a $67.1 billion rate in the fourth quarter, down from $72.5 billion in the third quarter and $78.6 billion in the second quarter. The steady scaling-back of additions to inventory has drained a potent source of economic growth, since it means factories produced less in response to a slower shopping pace.

-- from staff and wire reports

|

|

|

|

|

|

|