|

Riverstone leads IPO week

|

|

February 10, 2001: 7:00 a.m. ET

First Cabletron business IPO should gain lots of attention

|

NEW YORK (CNNfn) - The calendar for initial public offerings this week is again light and well behind the blistering pace of 2000, but the new issues market is far from dormant.

The market is alive for strong deals from solid companies, according to analysts.

Last week's debut of KPMG Consulting Inc. proved that a company with a proven track record could enjoy a 30 percent first-day pop, even with the largest offering ever for the Nasdaq. Offerings with such a high number of shares often find it difficult to see big openings.

"February is going to be an extremely weak month," said Irv DeGraw, research director at WorldFinanceNet.com. "But some of the companies that go out are going to be a lot more interesting and a lot more valuable."

DeGraw said "profit is still the price of admission" for the IPO market, but investors won't value "songs" – companies with all promise and no performance.

Take me to the Riverstone

Next week is highlighted by Riverstone Networks Inc., a company with no profits yet but plenty of investor and media interest.

Riverstone, an Internet infrastructure equipment maker, is the first of Cabletron Systems Inc.'s (CS: Research, Estimates) businesses to go public, led by Morgan Stanley Dean Witter.

In June, Cabletron unveiled plans to transform itself into a holding company and spin out its four units in IPOs -- Riverstone Networks, Aprisma Management Technologies, Enterasys Networks and GlobalNetwork Technology Services.

David Menlow, president of IPOFinancial.com, is not sure the deal will get the same first-day gain as KPMG (KCIN: Research, Estimates).

"The growth is there, but more so this a chance for investors to sink their teeth into the Cabletron wonder story," Menlow said.

But Riverstone's balance sheet makes DeGraw a little unsure. The Santa Clara, Calif.-based company had revenues of more than $23 million in 2000, but lost more than $37 million.

"They have a phenomenal growth rate, attractive outlook, and an extraordinary cash burn," DeGraw said. "They are a momentum play at a time when the market is very skeptical about momentum plays." "They have a phenomenal growth rate, attractive outlook, and an extraordinary cash burn," DeGraw said. "They are a momentum play at a time when the market is very skeptical about momentum plays."

"There's a good deal of uncertainty about Riverstone," he said.

Riverstone makes equipment such as routers and switches, that direct optical and electrical data across the Internet.

The company targets services providers such as British Telecom (BTY: Research, Estimates), Earthlink (ELNK: Research, Estimates) and Telia. Riverstone Networks is a wholly owned subsidiary of Cabletron, which will have an 86 percent stake after the IPO. Rochester, N.H.-based Cabletron plans to distribute shares to Cabletron shareholders but has not detailed timing of the distribution.

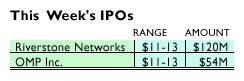

Riverstone plans to raise $120 million, pricing 10 million shares between $11 and $13 per share. It will trade on the Nasdaq as "RSTN."

The holdover and the day-to-day

Lead underwriters CIBC World Markets are hoping to bring pharmaceutical company OMP Inc. out this week after it failed to price the week before.

OMP, which specializes for treatment skin health and restoration, is looking to raise $54 million, with 4.5 million shares priced between $11 and $13. The underwriters cut the price range by $3 on Feb. 7.

"This is a carryover that's already been knocked down and it didn't get any better with age," DeGraw said.

He said the company is primarily in the distribution of licensed drugs, not a drugmaker, and has good channels, but it has not proven it can run profitably.

OMP is looking to trade as "OMPI" on the Nasdaq.

Listed as a day-to-day possibility is biotech company Xenogen, which has been on deck since mid-January.

"If they don't make it this week they will probably be pulled off the calendar altogether," DeGraw said.

Xenogen, led by UBS Warburg, plans to sell 7 million shares at $9, raising $63 million. It planned symbol is "XGEN" on the Nasdaq.

|

|

|

|

|

|

|