|

Fed chief sees slowdown

|

|

February 13, 2001: 4:02 p.m. ET

Greenspan says 'downside risks predominate' in U.S. economy

|

NEW YORK (CNNfn) - Federal Reserve Chairman Alan Greenspan warned Tuesday that U.S. economic growth has slowed substantially and "downside risks predominate" in the coming months. But the Fed chief also said he saw some hopeful signs that the economy will emerge quickly from the slowdown.

In his semiannual economic report to Congress, Greenspan released new Fed projections that U.S. gross domestic product growth would slow to about 2 percent to 2.5 percent this year, forecasting a "substantial slowdown, on balance, for the year as a whole." That's well below the Fed's forecasts last July of as much as a 3.75 percent annual advance in GDP, the broadest measure of the nation's economic growth.

|

|

VIDEO

|

|

Watch part of Alan Greenspan's economic report to Congress. Watch part of Alan Greenspan's economic report to Congress. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Greenspan noted that the slowdown has triggered inventory imbalances by businesses and that consumer confidence has diminished, although he said confidence "at least for now" is at levels that have been historically compatible with economic growth.

The Fed chief told the Senate Banking Committee (637K WAV) (637K AIFF) that "for the period ahead, downside risks predominate. In addition to the possibility of a break in confidence, we don't know how far the adjustment of the stocks of consumer durables and business capital equipment has come." But he said the economy could be headed for a rebound once inventories were brought in line with sales.

Click here to read Greenspan's testimony

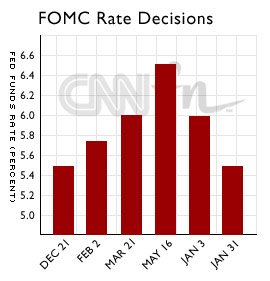

Greenspan's comments leave open the door for further interest-rate cuts to spur economic growth. The Federal Reserve lowered interest rates twice last month to boost economic activity – the biggest rate reduction in one calendar month since Greenspan took the helm of the central bank in 1987. Many experts expect a further interest rate cut at the next Fed policymakers meeting in March.

"Greenspan is obviously trying to find a middle ground between sounding overly bearish on the economy and spooking consumer confidence, but still leaving the door open for further rate relief," Doug Porter, senior economist at BMO Nesbitt Burns, told Reuters.

"That he says 'the downside risks predominate,' however, suggests we can expect further interest-rate cuts over the course of the spring," Porter said. "I would expect a 50 basis point (half-percentage point) cut at the next meeting."

But some analysts said Greenspan's remarks didn't send as sharp a signal as some investors hoped about the Fed's rate-cutting stance. After climbing higher in early trading, stocks turned lower in the afternoon. Bond prices also fell.

Greenspan's remarks show that "the economy seems to have bottomed out, and that's probably going to give the Fed license to move back to a more normal pace of cutting rates," Vincent Boberski, senior economist at Dain Rauscher Wessels, told CNNfn's Market Coverage. He predicts the Fed will cut rates by a quarter point at its regularly scheduled March meeting, and by another quarter point by the end of June.

In light of the slowdown, the central bank increased its estimate for unemployment slightly, to around 4.5 percent by the end of this year. Last July, the Fed had estimated unemployment would climb to around 4.2 percent by the end of 2001, a level it reached in January.

The Fed projected that inflation will lessen further because of the economic weakness, with an inflation gauge tied to the GDP rising by between 1.75 percent and 2.25 percent this year, down from an estimate of 2.5 percent the Fed had made in July.

Hopeful signs?

Greenspan did not say the economy is in recession – generally defined as two consecutive quarters of negative growth -- and pointed to several signs for hope that the economy will bounce back relatively quickly from the current slowdown.

He said consumer confidence, while lower, remains at moderate levels, and said that the recent decline in energy prices and further decreases anticipated by futures markets should boost purchasing power.

Greenspan also said that while productivity growth has slowed, it is still continuing and remains above its pace of a decade ago. Higher productivity is the key factor supporting rising living standards.

"If the forces contributing to long-term productivity growth remain intact, the degree of retrenchment will presumably be limited," he said. "Prospects for high productivity growth should, with time, bolster both consumption and investment demand."

Earlier Tuesday, the government reported that U.S. retail sales rose 0.7 percent in January, the largest increase since September and a big recovery compared with December's 0.1 percent gain. Earlier Tuesday, the government reported that U.S. retail sales rose 0.7 percent in January, the largest increase since September and a big recovery compared with December's 0.1 percent gain.

Greenspan's speech avoided mention of his comments last month advocating tax cuts as a way to spend part of the projected budget surplus. Although Greenspan did not comment directly on President Bush's $1.6 trillion, 10-year-tax plan during his earlier testimony, those comments helped the new president make a case for tax reduction.

But the Senate committee Tuesday launched a barrage of questions about the Fed chairman's stance on tax cuts. At one point, Sen. Paul Sarbanes, D-Md., grilled the Federal Reserve chairman on whether he was alarmed by the size of Bush's tax cut because it is based on budget projections from the Congressional Budget Office -- numbers that have proved unreliable over the years.

"I'm not going to comment on anybody's particular tax cut or structure of it," Greenspan replied.

However, Greenspan did reiterate his belief that lawmakers should shy away from policies that "could readily resurrect the deficits of the past."

|

|

|

|

|

|

|