|

AMAT beats, warns

|

|

February 13, 2001: 6:26 p.m. ET

Chip-equipment maker beats the Street; sees weakness in current quarter

|

NEW YORK (CNNfn) - Applied Materials on Tuesday reported a fiscal first-quarter profit that exceeded Wall Street's recently lowered expectations.

But executives at the No. 1 supplier of equipment used to manufacture semiconductors ratcheted down their financial targets for the current quarter, saying they expect softness in demand for chips to persist at least through the first half of 2001.

"Our business environment changed dramatically around us in the course of just a few weeks," James Morgan, Applied Materials' chairman and chief executive, told analysts during a teleconference Tuesday evening.

"It looks like at least a six-month slowdown," Morgan added.

After the close of trading Tuesday, the Santa Clara, Calif.-based company logged a profit of $558 million, or 66 cents per share, during the period ended Jan. 28.

That's up from $327 million, or 39 cents per share, in the same period a year earlier, and is 4 cents better than the 62 cents per share analysts had generally expected according to a survey conducted by earnings tracker First Call.

At $2.73 billion, Applied Material's fiscal first-quarter revenue was up 59 percent from the same period a year earlier and slightly ahead of the $2.69 billion analysts had been looking for, according to the First Call survey. At $2.73 billion, Applied Material's fiscal first-quarter revenue was up 59 percent from the same period a year earlier and slightly ahead of the $2.69 billion analysts had been looking for, according to the First Call survey.

Late last month, Applied Materials warned that its latest quarterly revenue and earnings would be below previous forecasts, blaming weaker demand for chips, which became especially pronounced in December.

The company said its total new orders in the fiscal first-quarter amounted to $2.43 billion. That's down 33 percent from $3.6 billion for the prior quarter and down just slightly from the $2.45 billion in new orders it logged in the year-ago period.

The company's gross margin also declined, coming in at 48.8 percent, down from 51.7 percent for the prior quarter and down from 49.8 percent in the same quarter a year earlier.

Joseph Bronson, Applied Materials' chief financial officer, said a slowdown in the U.S. economy combined with softer demand for semiconductors had prompted many of its customers to reevaluate their capital spending, either deferring, or trimming the size of, planned projects.

Moving into the fiscal second quarter, which ends in April, Bronson said the company expects that trend to continue, resulting in lower fiscal second-quarter sales and profits than previously anticipated.

Applied Materials now is aiming for second-quarter revenue in a range between $1.9 billion and $2 billion, compared with the most recent consensus revenue estimate of sales of roughly $2.4 billion.

Earnings in the fiscal second quarter are expected to be between 32 cents and 37 cents per share, compared with analysts' previous expectations for a profit of 49 cents per share, according to First Call's survey.

Click here to check on chip stocks

Bronson also said Applied Materials now is forecasting total semiconductor sales in 2001 to grow about 10 percent to 12 percent, below previous estimates, while chipmakers' capital spending will decrease about 20 percent.

Although they said they remain confident about the chip industry's long-term prospects for growth and said they expect to emerge from the current downturn in a stronger position, executives said they are taking a number of cost-cutting measures to maintain profitability.

These include: trimming its temporary work force and deferring all salary increases; reducing salaries for all executives at the corporate vice president level and above, including members of the company's board, by 10 percent; implementing five mandatory "shutdown days" in the second quarter; and reducing travel and other discretionary expenses.

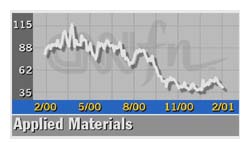

Applied Materials (AMAT: Research, Estimates) shares fell $2.75 to $41.25 on the Nasdaq ahead of the earnings news. They spiked higher in after-hours trade shortly after the announcement, but then fell another 62 cents to $40.62 after the company's teleconference.

Kulicke & Soffa cuts work force

In related news Tuesday, Kulicke & Soffa, which also makes chip equipment, said it will cut its work force by about 7 percent, citing lower orders over the last few months.

The Willow Grove, Penn.-based company said it will lay off roughly 300 people. Most of the layoffs will take place in the current quarter and they will include positions in the equipment segment, which has experienced weakened business conditions, Kulicke & Soffa said.

In a statement, C. Scott Kulicke, the company's chairman and chief executive, said the job cuts are part of a broader plan aimed at reducing costs in a declining-revenue environment.

"Looking ahead, we do not anticipate a return to a more robust business cycle before the end of the 2001 calendar year," Kulicke said. "The steps we are taking today should position the Company to better serve customers and at the same time, maintain shareholder value."

After falling 38 cents to $13.81 on the Nasdaq, Kulicke & Soffa (KLIC: Research, Estimates) shares slid another 81 cents to $13 in after-hours trade.

|

|

|

|

|

|

|