|

ETFs put you in charge

|

|

February 20, 2001: 6:20 a.m. ET

Exchange-traded funds, trading like stocks, allow you to tailor your portfolio

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - You own the hottest technology fund on Wall Street, but the manager is ticking you off.

He's going heavy on semiconductors and ignoring biotechs. Or, he's crazy about business-to-business stocks and you love telecoms.

In the past, there wasn't much you could do about the individual stocks and sector weightings of a fund. You could write your manager a nasty letter, but you basically had to like it or leave it.

But now, exchange-traded funds -- or ETFs -- are putting fund investors in the driver's seat, allowing them to put some extra portfolio oomph on anything from energy to wireless stocks to the health care sector. But now, exchange-traded funds -- or ETFs -- are putting fund investors in the driver's seat, allowing them to put some extra portfolio oomph on anything from energy to wireless stocks to the health care sector.

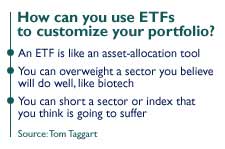

"ETFs are asset allocation tools," said Tom Taggart, a managing director at Barclays Global Investors in San Francisco. "When you're buying them, you're buying a specific slice of the market."

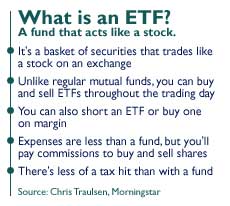

An ETF, simply put, is a basket of stocks. Some ETFs track an index, or a part of an index. Some invest in a particular sector. Unlike a mutual fund that gets priced once a day, an ETF trades like a stock on an exchange.

Like a stock, an ETF's price rises and falls all day long. They have ticker symbols. And like a stock, you can buy an ETF on margin or short it. Most ETFs trade on the American Stock Exchange.

They have fewer expenses than a traditional mutual fund and a smaller tax bite, though you will pay a commission to buy and sell shares.

They have strange names like Qubes (cubes), SPDRs (spiders), DIAMONDs and HOLDRs. They have strange names like Qubes (cubes), SPDRs (spiders), DIAMONDs and HOLDRs.

ETFs shook up the fund industry when big money managers like Barclays introduced new products in recent years, according to Chris Traulsen, an analyst at fund-tracker Morningstar. The topic was a major theme at Morningstar's last investing conference, one of the highlights of the fund calendar.

The Investment Company Institute, the fund industry's trade group that tracks flows and asset size, this month announced plans to start tracking ETFs.

In a few short years, dozens of different products have hit Wall Street, allowing investors to put their money in pretty much any corner of the market.

Put your money in biotechs – or a cube

The most popular ETFs are Qubes (QQQ: Research, Estimates), which invest in the stocks of the Nasdaq 100 index, according to Morningstar. It uses a Unit Investment Trust structure, meaning it can reinvest dividends immediately, Morningstar said.

Check tech stocks on CNNfn.com.

Barclays has 60 iShares ETFs, including the iShares Nasdaq Biotechnology Index Fund (IBB: Research, Estimates), Taggart said. While a traditional biotech mutual fund might own some tangential biotech stocks that provide equipment, Barclay's iShare only invests in companies that have their hands in research.

"The Nasdaq fund tracks 76 companies that are directly related to curing human disease," Taggart said. "The Nasdaq fund tracks 76 companies that are directly related to curing human disease," Taggart said.

Morningstar's Frank Stanton said the Barclays' Nasdaq ETF is for "daredevils looking to invest in one of the most volatile sector of the market" who want a low-cost option. But anyone not prepared for huge swings should consider a more diversified biotech ETF, he said.

Some like spiders and snakes

You can overweight any one of the nine sectors of the S&P 500 by investing in a Select Sector SPDR Fund, said Greg Ehret, a principal at State Street Global Advisors.

One of the most popular has been The Energy Fund (XLE: Research, Estimates), fueled by rising oil prices that last year hit a 10-year high.

More recently, The Cyclical/Transportation Fund (XLY: Research, Estimates), The Financial Fund (XLF: Research, Estimates) and The Technology Fund (XLK: Research, Estimates) have been most heavily traded, he said.

"It's a lot easier to get comfortable about what sector you want to invest in, rather than what company," Ehret said. "It's a lot easier to get comfortable about what sector you want to invest in, rather than what company," Ehret said.

A person might want exposure to the S&P 500 but they'll be leery about technology. They could buy an S&P 500 ETF and then short a technology ETF, Ehret said.

(When you short a stock, you're betting the price will fall. You "borrow" the stock from your broker and sell it. If you're right and the price falls, you buy the stock at the lower price, repay your broker and pocket the difference).

You can also use ETFs to diversify. Let's say you work for a big brokerage house. The company matches part of your 401(k) contributions – but in its own stock. You're worried your nest egg is too concentrated in the stock. So you hedge your bets by shorting a financial services ETF, Ehret said.

Check your mutual funds on CNNfn.com.

Mutual fund giant Vanguard Group also has plans to get into the ETF ring. It has plans to sell Vanguard Index Participation Receipts, or VIPERs, of its existing index funds, said spokesman John Demming.

"The reason we're offering them is to draw out the short-term traders from corresponding Vanguard funds," Demming said. The company hasn't rolled them out yet because of a lawsuit filed by S&P.

A variation on a theme: HOLDRs

Yet another option is Merrill Lynch's HOLDRs, which are baskets of 20 stocks.

You can own a HOLDR as one asset, or unbundle the stocks and trade them separately to fill your own investing and tax needs, Merrill Lynch said. Merrill Lynch contends that HOLDRs aren't ETFs because you own the underlying stocks, though Morningstar tracks HOLDRs on its ETFs page.

"The difference with HOLDRS is you own the underlying stocks. That means that you can take possession of the stocks at any time and sell the losers." said Mitch Cox, First Vice President in Merrill Lynch's Investor Strategies Group. "You can't do that with ETFs. It's a nice story about investor control."

| |

MOST POPULAR ETFS TRACKED BY MORNINGSTAR MOST POPULAR ETFS TRACKED BY MORNINGSTAR

|

|

| |

|

NASDAQ 100 Trust Shares

SPDRs

DIAMONDS Trust, Series 1

MidCap SPDRs

Financial Select Sector SPDR

Biotech HOLDRs

|

|

|

For example, perhaps you owned Nortel Networks (NT: Research, Estimates) last week when the company warned of lower first-quarter earnings and job cuts. The news sent the optical networking sector plummeting. If you had owned Nortel in a HOLDR, you could have sold the Nortel shares out of the basket.

"Different combinations of HOLDRS allow investors to weight their overall portfolios to suit their specific needs," Cox said. "It gives you a diversified, tax-efficient way to get (sector) exposure."

Among the 10 most popular ETFs tracked by Morningstar are Merrill Lynch's Semiconductor HOLDR (SMH: Research, Estimates); the Biotech HOLDR (BBH: Research, Estimates); the Broadband HOLDR (BDH: Research, Estimates) and the B2B Internet HOLDR (BHH: Research, Estimates.

|

|

|

|

|

|

|