|

Tax-friendly funds beckon

|

|

February 21, 2001: 7:37 a.m. ET

Nouveaux investors learn the hard way that taxes make a difference

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - For many investors, the year 2000 will perhaps best be remembered for the lessons learned.

As the tech bubble burst, so too did the nation's appetite for risk. Valuations fell back down to earth and nouveaux investors, who believed double- and triple-digit returns were par for the course, got a taste of tough love. When the dust finally settled, the Nasdaq's 39.2 percent slide shattered the age of innocence that had come to define the 1990s.

None in the investment community, however, felt the impact of the market's punishing blows quite so poignantly as mutual fund shareholders, many of whom are just now coming to grips with the double whammy of negative returns and large capital gains distributions, on which they owe taxes.

"Investors who had been less aware of mutual fund taxes had a rude awakening in 2000, when many funds had low or negative returns but still paid out large taxable distributions," said Duncan Richardson, senior vice president of Eaton Vance and portfolio manager of the Eaton Vance Tax-Managed Growth Fund. "Many shareholders who, in the past, might have been dismissive about fund taxes were horrified to learn they will be paying taxes on fund investments on which they lost money last year."

A combination of factors, he notes, including strong built-up gains from previous years, high portfolio turnover in a volatile market and a lack of sensitivity to tax considerations on the part of fund managers, conspired to catch shareholders off-guard.

They're paying attention now.

A new investment ethic

Interest in tax-managed mutual funds has skyrocketed in recent months as investors ferret out new ways to mitigate risk and boost returns.

A survey released last week by Eaton Vance Corp. reveals the vast majority of investors (84 percent) consider the impact of taxes on their mutual funds to be "important." The survey, conducted independently by Penn Schoen and Berland Associates, also found that nearly 60 percent said the impact of taxes on their returns has "increased in importance" over the past year.

(Click here to check your mutual funds.)

But Sarah Libbey, senior vice president of Fidelity Personal Investments, said last year's market losses aren't the only reason for the newfound interest.

| |

|

|

| |

|

|

| |

"I guess the main tip is that as much as we all wish we didn't have to pay taxes, don't seek out tax-efficient funds solely to avoid taxes. Make sure it is a product that meets your goals in your portfolio.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Sarah Libbey, Fidelity |

|

Publicity surrounding the Securities and Exchange Commission's new disclosure rules, she said, also brought tax efficiency to the forefront of investors' minds. The new rules will require fund companies to disclose after-tax returns beginning early next year.

At the same time, many funds in the nascent tax-friendly investment arena are just now beginning to prove their worth.

"A lot of the tax-managed stock funds haven't been around for much more than three years and they've got track records now," she said. "They are showing up when investors look for 1-, 3- and 5-year returns."

Performance history

To be sure, taxes take a heavy toll on fund performance. Industry watchdogs estimate mutual fund shareholders surrender between 2 percent and 3 percent of their earnings each year to Uncle Sam. Over a 20-year period, that can really add up.

In response to growing demand, most major fund families now offer some type of tax-efficient fund, including Fidelity Investments, T. Rowe Price, Putnam Investments, Vanguard and Eaton Vance.

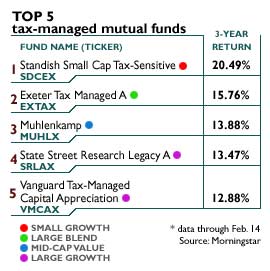

The latest Morningstar data reveal the category as a whole – including the universe of all tax-managed funds – returned less than 1 percent (0.38 percent) for the most recent 12-month period and 6.93 percent for the last 3 years. The few in the category that have been around for 5 years returned 8.69 percent for that period.

That compares with a loss of 4.2 percent for the S&P 500 index during the last 12 months and gains of 10.3 percent for the 3-year period. The broader index returned 16.7 percent over the last 5 years.

"This category has performed very well," said Russel Kinnel, Morningstar's director of fund analysis. "It's one of the best and most innovative things the fund industry has come up with and partly that's because they do such a crummy job with the rest of their funds on taxes."

Getting started

If you've considered buying a tax-managed mutual fund, but aren't sure how to get started, you're not alone.

The Eaton Vance study reveals that 26 percent of investors are unfamiliar with the concept of "tax-efficient" investing, and one in three investors (33 percent) is unable to cite any investments that offer high tax efficiency.

Experts say you'll want to begin by identifying what you're looking for.

Tax-managed funds are defined any number of ways, from an equity fund that employs a buy-and-hold strategy to minimize capital gains, to one that invests strictly in municipal bonds, which are free of federal and, in some cases, state income tax.

"A tax-managed fund is simply a fund who's goal it is to maximize after-tax returns, whereas most funds are focused on pretax returns," Kinnel said. "I think the one thing that probably all of them have is the idea of selling losers to offset gains. If you've just realized profits on one stock you'll sell a few dogs."

As a general rule, these types of funds also charge a redemption fee to investors who get into and out of the fund in less than 5 years, he notes, since early outflows can force managers to sell underlying securities (or stocks) they wouldn't otherwise be ready to dump. The capital gains triggered by that sale get passed along to the remaining shareholders.

The tax bite

Unless they reside in a 401(k) or another type of retirement plan, mutual funds are taxed in two ways.

You are taxed on any capital gains you receive when you redeem your shares, or sell your stake in the fund. But you'll also be taxed annually during the years you own it as a shareholder.

According to Vanguard Group's education center, most funds distribute earnings to shareholders in the form of distributions, which are taxed as either income or capital gains.

Any interest or dividends you receive are treated as ordinary income and taxed at your regular rate of 15 percent to 39.6 percent. The same goes for funds that sell shares at a gain in less than a year, in which case your returns are taxed at the short-term capital gains rate, equivalent to your ordinary income tax rate.

Funds also, however, distribute to shareholders any investment profits they enjoy during the year from the sale of securities held for more than 12 months, and that money is taxed at the lower capital gains rate of 10 percent to 20 percent, depending on your income bracket.

Therefore, Vanguard points out, it's wise for investors in the upper tax brackets to seek out funds where distributions result from capital gains rather than income.

(Click here for more from CNNfn's Retirement section.)

How to pick 'em

You'll also want to look into a fund's turnover rate, which measures the frequency with which the fund manager buys and sells securities. That results in capital gains distributions.

The lower the turnover rate, the lower your tax bite.

But Kinnel points out investors shouldn't get too hung up on turnover rates alone. Some turnover is good, where fund managers are selling losers to offset the winners.

"I would say look to after-tax returns first, because turnover is not as telling as after-tax returns," he advises. "Look at the fund's record, and if it's an actively managed fund you want to be sure there's not going to be a big strategy shift if there is a manager change."

Lastly, he notes, you want to buy into a fund family in which you have confidence.

Kinnel said he likes Third Avenue Value (TAVFX), which is sold as a tax-managed fund but also has a group of associate managers on board who share the lead manager's philosophy.

"Putnam (PTHAX) looks like a safe bet, too," he said.

Maximize your returns

The Vanguard Group suggests a few other key strategies for maximizing tax efficiency.

1.) Choose index funds. These funds buy and hold securities in a specific market index, which results in lower turnover than actively managed funds and are less likely to pass along taxable gains to investors.

2.) Go with large caps. Compared with large-capitalization funds, Vanguard notes, small-cap funds as a group tend to realize more capital gains. Small-cap stocks tend to "graduate" into larger-cap stocks over time and must be sold because they no longer belong in a small-cap fund. However, small-cap stocks generally have lower dividends.

3.) Weigh growth vs. value. Value funds usually have higher dividends than their growth-focused counterparts, which are taxed at your ordinary income tax rate. They also tend to pass along more realized capital gains, since a successful value manager generally buys out-of-favor stocks and then sells them when they become winners. In contrast, a growth manager picks stocks that are believed to offer good growth potential and may sell them when their prospects fade. As a result, you might prefer to hold value funds in your retirement accounts, Vanguard notes, where their dividends and capital gains will not be taxed every year, and growth funds in your taxable accounts.

Libbey, of Fidelity, said the best advice when shopping for mutual funds is to pick what works best for you. The year 2000 was a rough one, to be sure, but don't let that dictate your long-term strategy going forward.

"I guess the main tip is that as much as we all wish we didn't have to pay taxes, don't see out tax-efficient funds solely to avoid taxes," she said. "Make sure it is a product that meets your goals in your portfolio. If you choose a muni-bond fund, make sure that makes sense. And as far as stock funds go, a good growth-oriented tax-managed fund might make sense as a core holding in your portfolio, but there is also the ability to look at after-tax returns on other funds to compare."

|

|

|

|

|

|

|