|

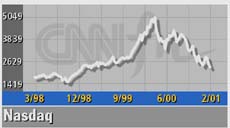

Nasdaq hits 26-month low

|

|

February 27, 2001: 5:11 p.m. ET

A new batch of weakening economic numbers sends investors fleeing stocks

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Nasdaq composite index tumbled to its lowest close since 1998 Tuesday on fears that the fast-weakening economy will further erode corporate profits.

Fresh data showed that consumer confidence fell, new home sales slipped, and orders for big-ticket items dropped. The news gave stock investors, already hit by slowing earnings, another reason to sell.

"It confirms the weakness in the economy, and that's not good for the market," John Forelli, senior vice president at Independence Investment Advisors, said of the soft economic data.

The selling follows a Monday rally that came on hopes that the Federal Reserve would cut interest rates this week -- before its regular meeting March 20. The selling follows a Monday rally that came on hopes that the Federal Reserve would cut interest rates this week -- before its regular meeting March 20.

But no inter-meeting cut came by Tuesday. And there's no guarantee that a surprise cut will occur at all, even after a key measure of consumer confidence slipped to its lowest level in four-and-a-half years.

"The confidence index was down, but it didn't plummet," Art Cashin, directors of trading at PaineWebber, told CNNfn's The Money Gang.

The Nasdaq fell 100.68 points, or 4.3 percent, to 2,207.79. The losses handed the Nasdaq its lowest close since Dec. 31, 1998, when the index closed at 2,192.69.

For the Nasdaq, the slide has been dramatic. After rising 86 percent in 1999, the index fell 39.2 percent in 2000 and is now down another 10.6 percent this year.

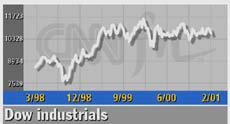

The Dow Jones industrial average held up better as investors seeking safety bought drug and tobacco shares. The Dow fell 5.65 to 10,636.88 while the S&P 500 lost 9.71 to 1,257.94.

More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 1,604 to 1,436 as more than 1 billion shares traded. Nasdaq losers beat winners 2,507 to 1,209 as nearly 1.8 billion shares changed hands.

In other markets, the dollar fell against the euro and yen. Treasury securities edged higher.

More weak numbers

A closely watched index of consumer attitudes tumbled for a fifth month in February, according to The Conference Board, a private research group.

Even amid a falling stock market and rising corporate layoffs, the size of the drop, to 106.8 from January's revised 115.7, surprised economists. The Nasdaq is down more than 56 percent from its high nearly a year ago. DaimlerChrysler, Dell Computer and Xerox have joined the drumbeat of companies trimming their payrolls.

Separately, orders for durable goods fell 6 percent in January. The number, the lowest level in a year and a half, dropped more than twice as fast as Wall Street expected. Separately, orders for durable goods fell 6 percent in January. The number, the lowest level in a year and a half, dropped more than twice as fast as Wall Street expected.

And new home sales fell 10.9 percent to an annual rate of 921,000 in January, the Commerce Department said, below forecasts.

The weak numbers only increased the calls for the Fed, which cut interest rates twice in January, to keep lowering borrowing costs to save the economy from recession.

"It now seems appropriate to start thinking about a fed funds rate as low as 4 percent by the summer," said Ian Shepherdson, chief U.S. economist at High Frequency Economics. The fed funds rate, the interest rate banks charge each other on overnight loans, stands at 5.5 percent.

Stocks rose Monday on growing hopes that the central bank would cut interest rates between meetings. Much of the optimism came from Wayne Angell, an economist a Bear Stearns and former Fed governor, who put an 80 percent chance on a rate cut this week. Angell stood by that prediction Tuesday.

But the session's losses accelerated as a rate cut Tuesday became unlikely.

In Nasdaq stocks, Cisco Systems (CSCO: Research, Estimates) lost $2.19 to $23.88 while Qualcomm (QCOM: Research, Estimates) declined $6.56 to $56.50. On the Dow, IBM (IBM: Research, Estimates) fell $2.71 to $102.59.

IBM was one of 30 tech stocks whose profit forecasts were cut by Goldman Sachs Tuesday.

The next clues on Fed thinking could come Wednesday, when Chairman Alan Greenspan testifies and answers questions before a Congressional committee. The next clues on Fed thinking could come Wednesday, when Chairman Alan Greenspan testifies and answers questions before a Congressional committee.

Whatever comes from that gathering, analysts agree that lower rates will eventually come. But timing them is tricky.

"The difficulty for the market is guessing which day," Greg Jones, economist at Briefing.com, told CNNfn's Street Sweep.

At the same time, cheaper borrowing costs often take months to affect corporate profits, which are already struggling. Average earnings among companies in the S&P 500 are expected to slip 3.6 percent this quarter, according to First Call. That would be the worst performance since the summer of 1998.

Independence Investment Advisors' Forelli sees the market struggling until companies' profits turn around -- something he expects may not happen until at least the third quarter this year.

"We're not going to see much positive news coming out," Forelli said.

Among the negative news, Nike (NKE: Research, Estimates) tumbled $9.57 to $39.60. The sports apparel maker said it expected third-quarter earnings per share of 34 cents to 38 cents. That's as much as 38 percent below previous estimates.

JDS Uniphase (JDSU: Research, Estimates), tumbled $4.81 to $27.81 as the maker of fiber-optic equipment said it will cut 3,000 jobs, or 10 percent of its work force. JDS joins other fiber-optic companies -- including Lucent Technologies and Nortel Networks -- in announcing layoffs.

Microsoft (MSFT: Research, Estimates) shed 19 cents to $59.38. The software maker's lawyers appeared before an appeals court for a second day to argue against a Justice Department ruling to break the company in two.

Microsoft stock, which began the year at $43.38, has put in a strong run in 2001, rising nearly 36.8 percent. Microsoft stock, which began the year at $43.38, has put in a strong run in 2001, rising nearly 36.8 percent.

Not all tech stocks fell. Texas Instruments (TXN: Research, Estimates) rose 85 cents to $30 one day after saying sales in the current quarter will tumble 20 percent because of weakening demand for its semiconductors.

And Federated Department Stores (FD: Research, Estimates), which owns Macy's and other department stores, rose $1.66 to $47.37 after saying fiscal fourth-quarter net income fell to $332 million, or $1.65 a share, topping forecasts.

Home Depot (HD: Research, Estimates) rose for a second day, gaining 85 cents to $44.60.

Investors also found safety in tobacco and drug stocks. Philip Morris (MO: Research, Estimates), last year's best performing member of the Dow industrials, rose $1.76 to $48.26. Merck (MRK: Research, Estimates) advanced 58 cents to $79.71 and Johnson & Johnson (JNJ: Research, Estimates) gained 20 cents to $95.95.

|

|

|

|

|

|

|