|

Fed: Slowdown not over

|

|

February 28, 2001: 4:21 p.m. ET

Greenspan signals Fed ready to cut rates, but gives no indication when

|

NEW YORK (CNNfn) - Federal Reserve Chairman Alan Greenspan told Congress Wednesday that the "retrenchment" hitting the U.S. economy "has yet to run its full course," but he gave no indication that the central bank has any immediate plans to lower interest rates again to stimulate growth.

|

|

VIDEO

|

|

Watch heated exchange between U.S. Rep. Barney Frank, D-Mass., and Federal Reserve Chairman Alan Greenspan. Watch heated exchange between U.S. Rep. Barney Frank, D-Mass., and Federal Reserve Chairman Alan Greenspan. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Greenspan's comments, in testimony to the House Financial Services Committee, signaled that the Fed remains watchful about the extent of the economic slowdown and is ready, if need be, to enact another interest rate cut to ward off recession. Earlier in the day, the government revised gross domestic product figures for last year's fourth quarter showing that the economy grew at its slowest pace in more than five years.

But, disappointing investors who have been hoping for another rate cut as early as this week, Greenspan suggested that cheaper borrowing costs may not be imminent. He reiterated his long-held position that the central bank prefers to announce rate shifts at its regularly scheduled policy meetings. The next meeting is March 20, but a rate shift could come at any time.

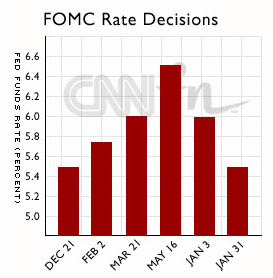

The Fed already lowered interest rates twice last month, including a surprise rate cut Jan. 3, in an attempt to boost economic activity.

| |

|

|

| |

|

|

| |

Changes in consumer confidence will require close scrutiny in the period ahead, especially after the steep falloff of recent months.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Alan Greenspan

Federal Reserve Chairman |

|

Stocks tumbled after Greenspan's comments. The Dow Jones industrials closed down 141 points to 10,495, while the ailing Nasdaq composite dropped 55 points to end the day at 2,151. Bonds traded flat.

"I don't think he gave the market as definite a picture as it wanted, and we're seeing the consequences of that now," Milton Ezrati, senior economic strategist at Lord Abbett & Co., told CNNfn's The Money Gang.

Greenspan told Congress that, on the positive side, the sharp economic slowing at the end of 2000 "seemed less evident" in January and February. But, he said, "even after the policy actions we took in January, the risks continue skewed toward the economy's remaining on a path inconsistent with satisfactory economic performance."

In a rare move, Greenspan revised his semi-annual report to Congress this week to address the latest worries about the health of the economy. His earlier testimony, delivered two weeks ago, was more upbeat.

The central bank chief said Wednesday that "although the sources of long-term strength of our economy remain in place," excess inventories built up by companies facing a slowdown in demand "have engendered a retrenchment that has yet to run its full course."

However, "if the forces contributing to long-term productivity growth remain intact, the degree of retrenchment will presumably be limited," he said.

The central bank is keeping a close eye on consumer confidence, which it sees as a key factor in preventing a recession. Since Greenspan delivered his earlier testimony, consumer confidence registered its fifth monthly decline, falling to a 4-1/2-year low in data released Tuesday. The stock market also has tumbled further in the past few weeks, giving Americans more cause for concern about the nation's economic outlook.

Greenspan said earlier this month that consumer confidence, while slipping, still remains at levels consistent with growth. But the Fed chief deleted that line from his updated testimony.

"Changes in consumer confidence will require close scrutiny in the period ahead, especially after the steep falloff of recent months," Greenspan said. The automobile and housing markets indicate that consumer confidence, although lower, has not evaporated, he said.

Waiting for a rate cut

Many investors have been betting that the Fed will reduce rates again in the next couple of weeks amid signs of further deterioration of the economy. The Fed cut interest rates by a full percentage point last month -- the first time the central bank has moved so quickly during Greenspan's 14-year tenure.

But Greenspan signaled that investors may have to wait a few weeks for another cut.

"We have obviously specified implicitly that we prefer to act within our scheduled meetings," Greenspan said in response to a lawmaker's question about whether another cut was possible between meetings. "But we have also shown over the years that when we perceive that actions are required between meetings we have never hesitated to move."

Analysts say the central bank likely wants to review key data on the manufacturing sector, scheduled for released Thursday, and the February employment report next week before deciding whether to reduce rates again. Analysts say the central bank likely wants to review key data on the manufacturing sector, scheduled for released Thursday, and the February employment report next week before deciding whether to reduce rates again.

"Given the fact the economy is doing a bit better following the steep slowdown late last year, the Fed is not ready to pull the trigger right away," Gary Schlossberg, senior economist at Wells Capital Management, told Reuters. "But clearly the Fed is not done with easing just yet."

Click here for CNNfn's economic calendar

But others played down the significance of a rate cut. Stocks are not expected to register any lasting gains until corporations are able to boost their earnings growth, something that will not happen immediately even if rate reductions are forthcoming, said Bruce Bartlett, portfolio manager at OppenheimerFunds.

"The very short-term outlook continues to be more of the same – choppiness," he said. "Once the market starts to anticipate that earnings growth will stabilize or turn upwards again, then the market will be in a better position to make a significant advance."

Bush presses tax cut

A day earlier, President Bush promoted his tax-reduction plan in a speech to Congress. Members of the House committee asked Greenspan about the tax plan during Wednesday's question-and-answer session, trying to elicit his opinion on the Bush plan. But Greenspan repeatedly has declined comment on the specifics of Bush's proposals.

Greenspan surprised many lawmakers in January when he gave his blessing to cutting taxes, saying the government's budget surplus projections have grown so large there should be money available both to eliminate the public debt and provide a significant tax cut. However, Greenspan also said that rate reductions by the central bank are more effective than tax cuts in promoting economic growth.

-- from staff and wire reports

|

|

|

|

|

|

|