|

Grove sees slow recovery

|

|

March 6, 2001: 6:40 p.m. ET

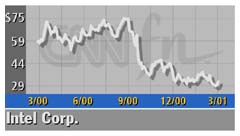

Intel chairman says tech sales rebound will trail economic recovery

|

NEW YORK (CNNfn) - Intel Corp. Chairman Andrew Grove said Tuesday he does not expect end demand for semiconductors to snap back rapidly, noting it will take some time for the downturn in the chip industry to end.

"I don't expect the end demand to snap back," Grove said on a conference call and Webcast hosted by Lehman Bros. and its semiconductor- and PC-company analyst Dan Niles. "We are in this state for some period of time."

Grove was not more specific on a time frame. He said that past investment had created not just a surplus in technology inventory but a surplus in the capacity of current computing systems, making it less likely for a quick round of new technology buying even when the economy starts to improve. Grove was not more specific on a time frame. He said that past investment had created not just a surplus in technology inventory but a surplus in the capacity of current computing systems, making it less likely for a quick round of new technology buying even when the economy starts to improve.

"When the demand [for technology] softened somewhat, it...exposed the fact we had built up excess capacity in the system," he said.

The semiconductor industry has undergone a vicious reversal of fortune since the fall of 2000, with virtually every type of semiconductor company warning that first- and even second-quarter sales in 2001 will be less than forecast. But most are holding out hope the second half of the year will see more robust growth in the U.S. economy.

While the short term may be rough sledding, Grove, an American business icon and Time magazine's "Man of the Year," remains bullish about the long-term future of the high-technology industry.

"This industry is the fundamental industry of our times -- not just chips, not just Intel, but the high-technology industry," Grove said. "For those of you that have a stake in there, I'd like to share my confidence and enthusiasm for this industry long-term. So keep the faith." "This industry is the fundamental industry of our times -- not just chips, not just Intel, but the high-technology industry," Grove said. "For those of you that have a stake in there, I'd like to share my confidence and enthusiasm for this industry long-term. So keep the faith."

Grove also defended the 33-year-old chipmaker's plans to spend $7.5 billion this year on capital spending, more than double the amount it spent just two years ago. He cited a downturn in the chip industry in the 1970s when Intel pared back on capital spending, but Japanese chipmakers did not.

When demand did snap back, Intel did not have the capacity in place to build enough memory chips to meet demand, Grove said. Intel later exited the dynamic random-access memory, or DRAM, business, partially as a result.

"My biggest regrets were always that we were too conservative on capital," Grove said on the conference call. "As a result we weren't ready to follow the demand curve when it snapped back."

Intel and the chip industry are undergoing one of the biggest changes in decades. Not only are chipmakers such as Intel moving to new process technology, called 0.13 micron, they are also simultaneously moving to dinner-plate-sized silicon wafers from salad-plate-sized ones.

Click here for a look at computer chip stocks

"We are in the middle of a very important technology cycle," Grove said. "The companies who cut back on investment now, when the recovery comes, will be stuck with 8-inch capacity...compared to other players who moved to 12-inch."

One problem for Intel is that personal computers have had trouble making the case that the new Pentium 4 chip offers significantly better performance than the Pentium III chip already on the market. One improvement, Grove said, is the greater ability to process digital media files, such as downloaded songs or videos.

But Grove said he doesn't believe the recent court decisions against the music download site Napster will have anything more than negligible impact on sales of Pentium IV computers.

"What Napster has done, whether or not it is a continuing company, is demonstrate in an incredible way the desirability of digital music," he said. "The digital transmission of content is going to happen. How it's going to happen, I don't know. But the genie is out of the bottle."

Shares of Intel slipped 38 cents to $31.13 in after-hours trading Tuesday following his 4:15 p.m. ET call, after gaining $1.13 to close regular-hours trading at $31.50.

-- from wire and staff reports

|

|

|

|

|

|

|