|

WorldCom takeover hinted

|

|

March 7, 2001: 2:16 p.m. ET

CEO of No. 2 long-distance phone carrier said to mull sale of firm

|

NEW YORK (CNNfn) - WorldCom Inc., the nation's second-largest long-distance phone company, soon could be looking for a buyer, according to a report Wednesday.

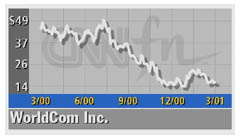

After several years as an acquirer, investors and industry observers now are buzzing about the potential for a WorldCom takeover, since its stock is hovering near its 52-week low, the Wall Street Journal said.

While nothing seems imminent at this point, the paper quoted people close to WorldCom CEO Bernard J. Ebbers as saying he has expressed interest in selling the telecom firm.

WorldCom declined to comment. WorldCom declined to comment.

Ebbers has distanced himself from WorldCom's day-to-day operations and is relying on the chief operating officers of its two business units, a source familiar with the situation told CNNfn.com. "He's putting more focus on the different units, but Bernie is still very much involved," the source said.

Last year, federal regulators rejected WorldCom's $129 billion bid to acquire Sprint Corp. (FON: Research, Estimates). In November, the phone company announced that it will split in two, and last week laid off about 6,000 people in preparation for its realignment.

WorldCom shares have dropped 73 percent from their 52-week high of $49.96. Its shares rose 94 cents to $17.62 in afternoon trading.

Sale still premature

Analyst Drake Johnstone of Davenport & Co. believes such a sale is nearly a year to a year and a half away. "Given the current market conditions, few companies are brave enough to risk an implosion to their stock price through a WorldCom acquisition," he said.

WorldCom needs to demonstrate that it can stabilize its revenue growth, he said, and hit its 12 percent growth target for 2001.

However, some analysts believe Ebbers will seek a sale to recoup shareholder losses. Ebbers is making it his personal responsibility to recoup losses suffered this year, analyst Pat Commack of Guzman & Co. said. Commack referred to Ebbers' apology at a November analyst conference where he admitted he "dropped the ball."

"Ebbers is on a mission," Commack said. "I've never heard of a CEO apologize personally and take responsibility. He is personally going to rectify the situation. And if he can't get it done himself, he will take offers."

Likely buyers for WorldCom include any of the local phone companies such as BellSouth Corp. (BLS: Research, Estimates), SBC Communications Inc., (SBC: Research, Estimates), Verizon Communications (VZ: Research, Estimates) and Qwest Communications International Inc. (Q: Research, Estimates).

Fiber-optic backbone companies like Global Crossing Ltd. (GX: Research, Estimates) and Level 3 Communications (LVLT: Research, Estimates) also are potential acquirers, analysts said.

"Buying WorldCom would give local phone companies ammunition," Commack said. "WorldCom will give anyone a global presence with its infrastructure into the cities."

|

|

|

|

|

|

|