|

Loudcloud IPO up 3%

|

|

March 9, 2001: 4:34 p.m. ET

Netscape co-founder Andreessen's company near flat; Starband pulls IPO

By Staff Writer Luisa Beltran

|

NEW YORK (CNNfn) - Loudcloud Inc., the IPO from Netscape co-founder Marc Andreessen, rose a meager 2.6 percent Friday, a far cry from Andreessen's last trip to the public markets.

Andreessen was behind the IPO of Netscape, the Internet browser whose 1995 debut is credited with launching a slew of high-powered Internet stocks. Netscape shares nearly tripled that year, rising $44.75 to $72.76 from their $28 share price.

The connection with Andreessen, who will serve as Loudcloud's chairman, was expected to insure a warm reception for the IPO.

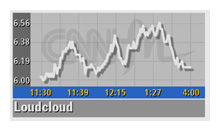

Instead, Loudcloud received a muted response amid a tumbling Nasdaq Friday, rising by 16 cents to close at $6.16 after hitting a high of $6.56 on the Nasdaq. Encore Acquisition Co., Friday's other IPO, rose 55 cents, or nearly 4 percent, to close at $14.55 on the New York Stock Exchange.

A sales warning from leading chipmaker Intel helped spark a tech sell-off on the Nasdaq, which fell 115.95, or 5.35 percent, to close at 2052.78 Friday.

A chilling effect

Loudcloud's dismal performance is expected to have a severe impact on similar companies hoping to go public, and such Internet companies will now have a tough time raising financing, said Ben Holmes, president of IPOpros.com.

"Loudcloud was probably the last of the Internet follies, the last of precarious Internet deals," he said. "The door for equity financing is closing for deals like this."

Loudcloud set terms for the IPO Thursday, after cutting its price range, raising $150 million. The company sold 25 million shares at $6 each via lead underwriters Goldman Sachs and Morgan Stanley.

The IPO has undergone a number of revisions. The Internet services company adjusted its terms again Thursday, raising the number of shares it planned to offer by 5 million to a total of 25 million but cutting its expected price range to $6, according to an SEC filing. On Feb. 16, the last time the company revised its terms, Loudcloud planned to offer 20 million shares at $8-to-$10 each. The IPO has undergone a number of revisions. The Internet services company adjusted its terms again Thursday, raising the number of shares it planned to offer by 5 million to a total of 25 million but cutting its expected price range to $6, according to an SEC filing. On Feb. 16, the last time the company revised its terms, Loudcloud planned to offer 20 million shares at $8-to-$10 each.

Little more than a year old, Sunnyvale, Calif.-based Loudcloud (LDCL: Research, Estimates) helps maintain a customer's Internet operations across various locations, providing hardware, software and networking equipment services to businesses.

Loudcloud is not profitable, with $107.6 million in losses on $6.6 million revenue for the nine months ended Oct. 31.

"There is no market for Loudcloud's goods and services anymore," Holmes said. "They built a risky financial structure for this deal and they are burning money now. This is a foist job."

The 29-year-old Andreessen was also chief technical officer of America Online, which is now AOL Time Warner (AOL: Research, Estimates), the parent of CNNfn. Ben Horowitz, Loudcloud's CEO, is also a former Netscape/AOL executive.

After the IPO, Andreessen will hold a 11.8 percent stake, Horowitz will have 5.7 percent and Morgan Stanley & Co. will own 1.6 percent.

Encore presentation

Encore Acquisition Co. raised $101.1 million Thursday, selling 7.15 million shares at $14 each, the middle of its range, via lead underwriter Goldman Sachs. Fort Worth, Tex.-based Encore Acquisition (EAC: Research, Estimates) is an energy company that acquires and develops oil and natural gas reserves in North America, including reserves in Montana, North Dakota, Texas and New Mexico.

Unlike Loudcloud, Encore is profitable with $3.4 million in net income on $129.5 million in revenue for the year ended Dec. 31.

Starband and UTI pulls

Starband Communications Inc. pulled its planned IPO Friday, the high-speed Internet provider said in an SEC filing.

Mclean, Va.-based Starband is a joint venture between Microsoft Corp. (MSFT: Research, Estimates), EchoStar Communications Corp. (DISH: Research, Estimates), and Gilat Satellite Networks Ltd. (GILTF: Research, Estimates). Starband provides two-way high-speed Internet services via satellite to small office/home office customers.

Starband had planned to raise $287.5 million via lead underwriter Merrill Lynch & Co. but had yet to determine the amount of shares or price range. Trading was to be under the Nasdaq symbol "STRB."

UTI Corp., a medical device manufacturer, also withdrew its planned offering Friday. The company had planned to price its deal Thursday and trade Friday but pulled the IPO due to poor market conditions, said Bill Gaffney, UTI's vice president of marketing.

The company had expected to sell 6.25 million shares at $15 to $17 each via lead underwriters Credit Suisse First Boston. UTI had expected to trade under the Nasdaq symbol "UTIC."

|

|

|

|

|

|

|