|

Cisco will cut 16% of staff

|

|

March 9, 2001: 4:30 p.m. ET

Job cuts prompted by sudden and sharp downturn in equipment sales

|

NEW YORK (CNNfn) - Cisco Systems Inc., the once fast-growing computer networking company, is planning to cut as many as 8,000 jobs, or roughly 16 percent of its total workforce, the company said Friday.

The magnitude of the cuts is far greater than earlier reports, which, citing unnamed sources, pegged the total number of job cuts at 2,000.

But in a release issued late Friday afternoon, Cisco said it will cut between 5,500 and 8,000 jobs through layoffs and attrition between now and July. As a result of the layoffs, the company said it expects to take a charge of $300 million to $400 million by the end of the fourth quarter of fiscal 2001.

The job cuts will affect 2,500 to 3,000 temporary and contract workers; and 3,000 to 5,000 regular employees through voluntary attrition and layoffs, Cisco said.

Cisco currently has a total head count of 48,000, which includes about 5,000 temporary workers.

"We're taking these steps because of the continuing slowdown in the U.S. economy and initial signs of a slowdown expanding to other parts of the world," John Chambers, Cisco's president and chief executive, said in a statement. "We're taking these steps because of the continuing slowdown in the U.S. economy and initial signs of a slowdown expanding to other parts of the world," John Chambers, Cisco's president and chief executive, said in a statement.

"We also now believe that this slowdown in capital spending could extend beyond two quarters," Chambers said.

Cisco is the latest big-name tech company to announce cost-cutting measures that include job cuts. In addition, Cisco said it will aggressively cut discretionary spending such as contract services, travel, and marketing expenses.

The San Jose, Calif.-based company had been on a growth tear in recent years amid soaring sales of its networking equipment, which is used to route the flow of data over the Internet and telecommunications networks.

But Cisco has been stung by a sharp and sudden slowdown in technology spending, especially among telecommunications service providers in the United States.

Last month, Cisco shocked the Street when it reported quarterly earnings that fell short of the Street's expectations, the first miss for the company in nearly seven years

Executives at Cisco also have reined in their aggressive revenue-growth targets, encouraging analysts to be "more conservative" in setting their estimates for the company over the next two quarters.

The company is aiming for annual revenue growth of 40 percent for the fiscal year ending in July where previously it had been striving for growth nearer 55 percent.

Other technology firms, including Intel, which warned Thursday of a quarterly shortfall and said it would cut about 6 percent of its workforce, have signaled that the magnitude of the slowdown in their businesses is more extensive than they had foreseen at the beginning of the year.

And executives at Cisco sent similar signals on Friday, although they did not explicitly say they expect revenue and earnings to come in below their previous forecasts.

"While Cisco is only five weeks into the third quarter and it is premature to quantify the impact of this current business climate, we do expect a wider range of estimates for the remainder of this fiscal year," said Larry Carter, the company's chief financial officer.

Check on networking stocks

The Street's most recent earnings estimate for the current quarter ending in April is for a profit of 14 cents per share on revenue of roughly $6.5 billion, according to a survey conducted by earnings tracker First Call. For the fiscal year, the current expectation is for a profit of 64 cents per share on $26.5 billion in sales.

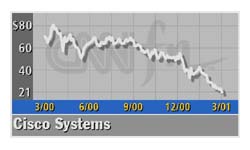

Shares of Cisco fell $2.19 to $20.62 on Nasdaq Friday, a 9.6 percent decline. They have fallen 72 percent from a 12-month high of $82.

|

|

|

|

|

|

|