|

Delta expects 1Q loss

|

|

March 13, 2001: 4:36 p.m. ET

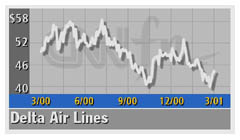

Reduced schedule, weaker economy, strike concerns cited; stock falls

|

NEW YORK (CNNfn) - Delta Air Lines Inc., the nation's third-largest airline, warned investors Tuesday it expects to report a first-quarter loss rather than the profit forecast by Wall Street.

Delta shares dropped more than 5 percent after the company said in a filing with the Securities and Exchange Commission a reduced flight schedule, weakening economy and "customer avoidance" due to strike concerns cut operating revenue by $300 million to $350 million.

The Atlanta-based company said it projects a loss of between $85 million and $110 million, or 70 to 90 cents per share. Analysts surveyed by First Call had expected a profit of 46 cents per share.

Click here to see other airline stocks

Delta (DAL: Research, Estimates) shares fell $1.64 to close at $41.46 Tuesday on the New York Stock Exchange. Over the past 52 weeks the shares have been as low as $39.63 and as high as $58.31.

Delta also said it expects its second-quarter results to take a $100 million to $250 million hit for the same reasons.

Analysts said the profit warning was expected, as estimates headed south for many airlines amid U.S. economic weakness and labor problems with certain unions. But they were surprised at the amount of Delta's shortfall.

"The magnitude of Delta's profit warning is substantially larger than we would have originally forecast," said Samuel Buttrick of UBS Warburg in a research note. "We would have guessed that a more probable guidance range would be zero to 20 cents profit."

Buttrick lowered his first-quarter estimate for Delta to a loss of 70 cents from a profit of 60 cents. Michael Linenberg of Merrill Lynch, which dropped its rating on Delta to accumulate from intermediate-term buy, lowered his first-period estimate to a loss of 85 cents from a 40-cent profit.

Robert Milmore, an analyst at Arnhold & S. Bleichroeder, said the big risk for airlines is economic weakness.

"I don't think anyone has a grasp of how much the economy is going to slow," Milmore added. "I think there's downside risk for the first quarter for a lot of carriers."

Labor dispute could cost airlines

Milmore said that unresolved labor disputes also could pose problems for Delta and other carriers. Delta is in a showdown with its pilots over pay, job protection and other benefits, and its pilots union has voted to approve a strike.

"You don't want these (labor issues) to drag on, especially toward the peak summer travel season," Milmore said. "During that time, any type of labor unrest can disrupt your entire network."

Delta spokesman  Russ Williams said Tuesday that the carrier's advance bookings suggest fears of a strike may be driving some passengers away. Russ Williams said Tuesday that the carrier's advance bookings suggest fears of a strike may be driving some passengers away.

Delta began negotiations with the Air Line Pilots Association (ALPA), which represents about 9,800 pilots, in September 1999.

When a 90-day deadline to reach a settlement under mediation expired Feb. 28, Delta and the union asked the National Mediation Board to make an offer of arbitration, a move that brings the sides closer to a 30-day "cooling-off" period, after which the pilots could strike.

Mediators have yet to rule on the request, and have scheduled a session with both sides for Thursday.

Karen Miller, a spokeswoman for ALPA, said the pilots union is concerned that customers may be booking away. "But we also see a very simple remedy, and that's that management comes to the bargaining table ready to negotiate and reach a deal," she added.

-- from staff and wire reports

|

|

|

|

|

|

|