|

Schwab to slash work force

|

|

March 22, 2001: 12:46 p.m. ET

Online broker to cut up to 13% of jobs to reduce operating costs

|

NEW YORK (CNNfn) - Online and discount brokerage Charles Schwab Corp. said Thursday it plans to slash 2,750 to 3,400 jobs, or 11 percent to 13 percent of its total staff, to reduce operating costs.

"With a slowing economy and weakening corporate earnings, our clients are facing the most challenging market environment in many years," Schwab president and co-chief executive David Pottruck said in a statement.

"Given our outlook regarding the potential duration of these uncertainties, we are taking additional measures to enhance our financial performance," Pottruck said.

Schwab, which says it has $725 billion in client assets, warned last week it will miss Wall Street profit forecasts for the first quarter and said it would consider job cuts to reduce operating expenses. Schwab, which says it has $725 billion in client assets, warned last week it will miss Wall Street profit forecasts for the first quarter and said it would consider job cuts to reduce operating expenses.

The San Francisco-based company already has tried cost-cutting measures, including requiring employees to take three Fridays off one month this year. The company scrapped that plan after it raised some legal questions.

Schwab is also considering reducing its administrative office space and taking some hardware systems offline. It expects the restructuring to save it $40 million to $45 million beginning in the third quarter of 2001.

Schwab plans to offer a severance package for employees that could include up to 10 months of their base salary and cash covering a portion of the premium needed to continue insurance benefits.

Chairman and co-CEO Charles Schwab and his wife also plan to set up a $10 million education fund to offer stipends of up to $20,000 for affected employees' tuition.

The company's board must approve the severance package in April.

Schwab also said it expects to report operating income in the first quarter of about 8 cents per share -- down from 23 cents a share in the year-earlier period -- and revenue of about $1.2 billion, down from $1.7 billion a year ago.

Analysts on average had estimated the company would post earnings of 11 cents per share, according to Wall Street research firm First Call.

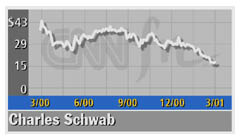

Shares of Schwab (SCH: Research, Estimates) were down 88 cents to $15.02 in afternoon trading, a new 52-week low for the stock, which has a 52-week high of $44.75.

|

|

|

|

|

|

|