|

American Express warns

|

|

April 2, 2001: 12:34 p.m. ET

Financial services firm says losses in its high-yield portfolio hit 1Q results

|

NEW YORK (CNNfn) - American Express Co. warned Monday it will miss first-quarter forecasts as the financial services firm records heavy losses on investments in high-yield junk bonds – a victim of the sagging economy.

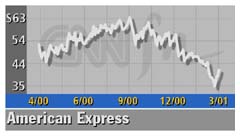

Shares of American Express (AXP: Research, Estimates), a component of the Dow Jones industrial average, lost $2.00 to $39.22 in early afternoon trading, a drop of about 5 percent.

The company said the shortfall is due to write-down and sale of certain high-yield securities held in the investment portfolio of its subsidiary, American Express Financial Advisors. The company said it will earn about 39 cents a share in the quarter, off 18 percent from the 48 cents it earned a year ago. Analysts surveyed by earnings tracker First Call had expected EPS to increase to 51 cents.

"The high-yield losses announced today reflect the continued deterioration of the high-yield portfolio and losses associated with selling certain bonds," the company said. "The high-yield losses announced today reflect the continued deterioration of the high-yield portfolio and losses associated with selling certain bonds," the company said.

The company said high-yield investments make up about 11 percent of American Express Financial Advisors' portfolio. Credit Suisse First Boston Analyst Moshe Orenbuch said that's nearly twice the industry average.

"We've been saying for a long time that they were more pro-cyclical than the average credit card company," Orenbuch said. "They're more dependent on the stock market because of financial advisors,"

Analysts said the warning is not surprising given that American Express has been warning about such losses since the fourth-quarter, but what did surprise some, said Lehman Brothers Analyst Bruce Harting, is that the numbers came in a bit higher than expected.

Harting said the company invests about 10 percent of its $40 billion portfolio for life insurance in high-yield junk bonds, which left it more vulnerable to a market downturn than others.

"I don't think anyone is surprised they're taking hits on high yield bonds. They've been giving very clear hints," Harting said. "What surprised some people is that the stock has a certain aura. It's a kind of fail-safe. Most people just think of the credit card business, but they also have American Express Financial Advisors, and part of that business is life insurance."

Even without the high-yield losses, the unit's first quarter earnings fell about 30 percent, due to weaker investment product sales and management fee revenues, as well as higher compensation for advisors as part of the firm's new salary structure.

The company said earnings at its Travel Related Services unit are expected to increase 13 to 15 percent.

"That performance reflects a slowdown in worldwide billed business growth, particularly in the latter part of the quarter as the economy and spending by corporations weakened globally," the company said.

American Express shares jumped Friday after a report in BusinessWeek that the company was an acquisition target of Citicorp (C: Research, Estimates). Morgan Stanley Dean Witter (MWD: Research, Estimates) and American International Group (AIG: Research, Estimates) also are in the running for American Express, according to rumors reported by the magazine. Officials of the companies declined to comment on the report.

|

|

|

|

|

|

|