|

AIG to push AGC bid

|

|

April 4, 2001: 11:41 a.m. ET

Rival $23B stock bid seen sinking previous offer from U.K.'s Prudential

|

NEW YORK (CNNfn) - American International Group Chairman Maurice Greenberg said Wednesday he is ready to sit down with American General Corp. Chairman Robert Devlin to discuss a $23 billion merger proposal, even as Prudential PLC protested AIG's rival bid for the Houston-based insurer.

But some investors expressed doubts about Prudential's planned takeover of American General as well as the British-based insurer's ability to compete in a bidding war with AIG.

"I find it difficult to see that the Pru will be able to make this deal stick," said David Griffiths, investment manager at Aegon Asset Management. "They can't pay any more, they don't have the support of shareholders – the share price is telling you that – and they don't have the capital to add any cash to it, which is precisely why they needed to do the deal in the first place."

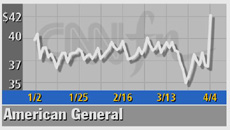

AIG (AIG: Research, Estimates) made an unsolicited, all-stock offer late Tuesday to buy the financial services firm American General for $46 a share, or about $23.2 billion. American General previously had agreed to be acquired by Prudential. AIG (AIG: Research, Estimates) made an unsolicited, all-stock offer late Tuesday to buy the financial services firm American General for $46 a share, or about $23.2 billion. American General previously had agreed to be acquired by Prudential.

American General is based in Houston while AIG is headquartered in New York. Prudential PLC, based in London, is not related to Prudential Insurance Co. of America.

"I know how good it (American General) is for AIG. I think it's a great fit for AIG," Greenberg told analysts during a conference call Wednesday. "As far as Devlin coming to New York, he and I haven't discussed that yet. He and I will meet and discuss all those details."

During the call, Greenberg said he believes the merger would result in annual pretax savings of $200 million, and that American General would enable AIG to expand its retirement products offerings through SunAmerica, which AIG acquired two years ago for about $18 billion. Greenberg also said the merger would expand AIG's domestic platform for insurance products.

"We believe the combination of American General with AIG is a great platform," Greenberg said. "We have a very good, but small, domestic life insurance business, and this will enhance it. Home Life is not the business we would go out building today, but it has been a cash cow for American General and it enhances the kind of business we want considerably."

AIG's bid rivals that of Prudential (PUK: Research, Estimates), which had offered 3.66 of its own shares for every American General share on March 12, at the time valuing American General (AGC: Research, Estimates) at about $26.6 billion, or $49.52 a share.

Prudential shares have dropped sharply since it made the offer, which investors thought was too high, slashing the value of its bid. Its stock rose 7 percent to 795 pence in London as investors cheered the prospect of it being outbid, ironically making its paper offer worth about $21 billion. Prudential shares have dropped sharply since it made the offer, which investors thought was too high, slashing the value of its bid. Its stock rose 7 percent to 795 pence in London as investors cheered the prospect of it being outbid, ironically making its paper offer worth about $21 billion.

Prudential spokeswoman Geraldine Davies said the British company was committed to a deal and told CNN that American General would have to pay a $600 million break-up fee if it walks away from the merger agreement.

"We're still working on the merger," she said Wednesday. Prudential said earlier its merger agreement with American General "remains in full force and effect."

American General said AIG's offer will be "carefully considered."

Greenberg said in a letter to American General's Devlin Tuesday that AIG decided to step in after the steep price drop in Prudential stock and said its offer provides "demonstrably superior value."

American General has been considered a good takeover candidate because it holds leading market positions in both fixed and variable annuities. The company's 16,000 employees are located in 1,350 offices in 40 states.

AIG, one of the world's largest insurers, employs about 55,000 worldwide, and has interests in consumer finance, aircraft leasing and data processing. It has operations in 130 countries and generates more than half its revenue overseas.

"This makes a lot of sense," Deutsche Banc Alex Brown insurance analyst Vanessa Wilson told Reuters news service Wednesday. "It will be very accretive for AIG shareholders. American General shareholders are going to be very please and Prudential shareholders will be too."

Under its proposed transaction, each American General share would be exchanged for AIG common stock with a value of $46 a share, provided AIG shares continue to trade within a 5 percent collar during an agreed-on period before closing.

AIG shares were off $3.46 at $76.75 shortly after markets opened Wednesday. American General shares gained $5.40 to $42.20.

-- from staff and wire reports

|

|

|

|

|

|

|