|

Pru won't admit AGC defeat

|

|

April 6, 2001: 4:02 p.m. ET

British insurer to wait before seeking other deals, won't raise $41-a-share offer

|

NEW YORK (CNNfn) - Prudential Plc refused to admit defeat Friday, reaffirming its intent to stick with its $41-a-share offer for American General Corp.

The British insurer will not be raising its bid and the merger agreement with American General "remains in full force and effect," a spokesman said.

"We have a merger agreement with American General that is legally binding," said Prudential spokesman Steve Colton.

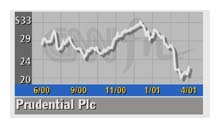

On March 12, Prudential offered 3.66 of its shares for each American General share. At that time, the deal valued Houston-based American General (AGC: down $0.36 to $42.29, Research, Estimates) at $49.52 a share but Prudential shares have since dropped and the transaction is now worth $41 a share. The British insurer is not related to Prudential Insurance Co. of America.

Earlier this week, American International Group trumped the Prudential offer with a $46-a-share bid, or about $23.2 billion, for American General.

Since London-based Prudential (PUK: unchanged at $22.65, Research, Estimates) will not raise its bid, most analysts believe they are out of the running for American General. Since London-based Prudential (PUK: unchanged at $22.65, Research, Estimates) will not raise its bid, most analysts believe they are out of the running for American General.

"AIG is a better offer," said analyst Vanessa Wilson of Deutsche Bank Alex. Brown Inc. "AIG is a bigger, more substantial company."

"It will be hard for American General to turn AIG down," said analyst Ed Spehar of Merrill Lynch.

Prudential is not in a position to take on AIG, which had $42.43 billion revenue last year. New York-based AIG (AIG: down $0.89 to $76.55, Research, Estimates), one of the world's largest insurers, employs about 55,000 worldwide, and has interests in consumer finance, aircraft leasing and data processing. It has operations in 130 countries and generates more than half its revenue overseas.

Only General Electric has the financial resources to mount a successful campaign, but GE (GE: down $0.93 to $41.17, Research, Estimates) is still consumed with its Honeywell acquisition, said analyst Colin Devine, of Salomon Smith Barney.

Prudential will most likely just take its $600 million cash break-up fee and move on. But the British insurer will probably wait a bit before looking to acquire another company, Prudential's Colton said.

"We already have a good business in the U.S. with Jackson National Life, which we are looking to grow," Colton said. "We would always consider an acquisition, but only if it makes economic sense and the circumstances are right."

Analysts picked John Hancock Financial Services Inc. and Lincoln National as likely targets in the U.S. Boston-based John Hancock (JHF: down $0.34 to $36.87, Research, Estimates) offers both insurance and investment products to retail and institutional customers. The insurer had $7.6 billion revenue in fiscal 2000 and a market cap of $11.5 billion.

However, Hancock, which demutualized into a publicly traded company last year, is still in lock up until next January. "There are ways to get around that, though," said Salomon's Devine.

Analysts also tapped Lincoln National Corp. as another potential acquisition target. Prudential would gain a top-ranked annuity business with Philadelphia-based Lincoln National (LNC: down $0.98 to $42.70, Research, Estimates), which had nearly $7 billion revenue last year.

Prudential would have received $130 million in expense savings with American General but could get $200 million with Lincoln National, Devine said.

Neither AIG nor American General could be reached for comment.

|

|

|

|

|

|

|