|

Online investors: MIA

|

|

April 11, 2001: 8:18 a.m. ET

Trading volume drops precipitously, but online investors are expected to return

|

NEW YORK (CNNfn) - It hasn't been a great year for either Internet companies or for brokerage firms. Imagine being an Internet-based brokerage house. Yes, 2001 has been a tough year for the online brokerage houses who are suffering through layoffs and dramatically lower trading volumes. But are they out of the game? Don't bet on it.

"We believe investors are increasingly self directed," said Datek Online Holdings spokesman Michael Dunn. In spite of the volatile market, one in which many people have lost lots of money, Jersey City, N.J.-based Datek still believes a good share of the trading public wants to make its own investment decisions and trade online.

| |

|

|

Online investing lying low, but don't be surprised to see them resurface when market ticks up. | | |

Yet, trading volume is down at all the major online brokerage houses. At the same time, however, they are all adding plenty of new accounts, which leads analysts to speculate that while more people are opening online accounts, they are simply trading less.

And a recent survey by J.D. Power and Associates supports the idea that while overall online trading is down, the online traders could come back. In that survey, the majority of online investors who have not yet closed their accounts said they will stay in the market and plan to continue using online brokerage accounts. The study, released at the end of March, revealed that 30 percent of the online traders surveyed intend to increase their trading activity in the next six months.

Accounts growing, activity shrinking

Dunn pointed out that Datek added 80,000 new customers in the first quarter of 2001. During that same time, Datek averaged 97,000 trades daily, down from 121,000 in the first quarter of 2000. The number of active accounts grew to 772,000 on March 31, 2001 from 457,000 on March 31, 2000.

Sure, transactions are down, Dunn acknowledged, but companies like Datek are betting that, come the upswing, individual investors will be back online. There is good reason to believe this, said Dunn, because investors have more information available to them online than ever.

Furthermore, many of the online brokerages have improved technology so that trades can be executed more quickly, more accurately and more securely than ever before.

Likewise, at San Francisco-based Charles Schwab Corp., customers are making fewer trades in the beginning of 2001 compared with the previous year. Schwab (SCH: up $1.14 to $17.56, Research, Estimates) customers made daily average trades of 189,000 during February, 2001, down 32% from the February of 2000. At the same time, however, new customers were opening accounts at the rate of about 100,000 a month. According to the company, many of the new accounts were putting their money into money market accounts and not trading.

At E*Trade Group (ET: up $0.20 to $7.75, Research, Estimates) based in Menlo Park, Calif., the number of active accounts has grown 75 percent in the past year, adding 11 percent to total assets. At Ameritrade Holding, average daily volume was down in February to 114,000 from 131,000 in January 2001. The company has added about 40,000 new accounts monthly so far in 2001.

Dealing with the pain

Optimistic as they are about the future, most of the online brokers have announced layoffs and other restructuring to deal with decline in trading volume.

Schwab, the nation's largest online broker, announced late last month it was laying off 11-to-13 percent of its work force, or between 2,750 and 3,400 jobs, to reduce operating costs. Last week, it announced it was cutting 200 jobs in Europe, nearly one-fourth of its European staff due to the slowdown in the market.

Other online brokers also have reduced staff including New York-based TD Waterhouse Group Inc., the nation's No. 2 discount broker, which said last month it also plans to cut employees through attrition. TD Waterhouse (TWE: up $0.25 to $10.69, Research, Estimates) also reported that new accounts grew five percent in February over January 2001.

Ameritrade (AMTD: up $0.15 to $5.15, Research, Estimates), meanwhile, has lowered its revenue outlook for 2001 and now expects revenue of between $470 million and $600 million, well below the $570 million-to-$650 million it previously forecast for fiscal 2001.

Where have all the investors gone?

Many investors have simply taken a beating and, until some of their holdings come back, may just low for a while, said Dan Burke, an analyst with Boston-based Gomez Advisors.

"We're not seeing the kind of transaction rates we used to," said Burke. "It's just hard for people to get excited about trading when Cisco is trading at $13."

Burke asserted that it's not just the online brokerage houses that suffer when the market turns sour. Clients at full-service firms, too, tend to disappear at times like these either because they have been burned, or because they don't want to invest when so many stocks seem to be heading south.

Although the full-service firms don't release information on trading activity of their retail accounts or the number of active retail accounts, there is some evidence that all is not well at the full-service firms.

Merrill Lynch recently announced it was cutting 2,000 jobs in its U.S. private client group. In January, New York-based Merrill (MER: up $1.51 to $60.51, Research, Estimates) eliminated 60 positions in its research group.

Bear Stearns Cos. Inc., too, recently laid off 400 employees, or more than three percent of its work force, as part of a restructuring effort. And, although it has not confirmed layoffs are in the works, Morgan Stanley Dean Witter & Co. confirmed that division managers were making headcounts and that may result in some job losses.

Shares are down, hopes remains high

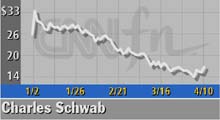

All this has not been good for the stocks of the online brokers. Shares of Schwab have been marching downward since peaking around $40 a share last August, closing Tuesday at $16.42. Likewise, it's been all downhill for shares of Ameritrade and TD Waterhouse since last September.

Ameritrade, based in Omaha, Neb., was trading a touch over $20 a share in early September of 2000. On Tuesday it closed at $5.05 a share. TD Waterhouse, too, was trading over $20 a share in September and has since lost about half its value. It closed on Tuesday at $10.52 a share.

Russell Keene, an analyst at New York investment bank Keefe Bruyette & Woods Inc., said trading volume of individual investors tend to reflect the Nasdaq. When it's down, so are they.

But Keene is also one of those who believes they will eventually resurface and the evidence, he said, is in the fact that people are continuing to open accounts with the online brokers.

"The accounts that are being added are clearly not as profitable, but the net new money is still very important," said Keene. "What that tells me is that there is still room for them to cannibalize the traditional brokerages."

|

|

|

|

|

|

|