|

Price of oil drops

|

|

May 2, 2001: 12:22 p.m. ET

Report eases fears of summer shortage, sending prices and oil stocks lower

|

NEW YORK (CNNfn) - Oil prices fell Wednesday afternoon, and shares of oil producers followed suit, after a report signaled that the supply of petroleum may not be as tight as previously thought.

The American Petroleum Institute late Tuesday reported a sharp rise of more than 8 million barrels in U.S. crude inventories, in the week ended April 27, bucking market forecasts of 3.5 million barrels. In addition, total gasoline inventories rose by 3.1 million barrels, as refiners continued to ramp up for the summer driving season.

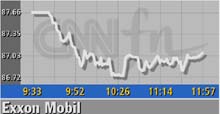

But the market appeared worried that supplies are too high. In New York, Light sweet crude futures for June delivery fell 67 cents, or 2.4 percent, to $28.27 per barrel in early afternoon trading. And shares of oil producers fell, including Exxon Mobil (XOM: down $1.90 to $86.90, Research, Estimates) , Texaco (TX: down $2.12 to $70.08, Research, Estimates), and BP Amoco (BP: down $1.44 to $52.80, Research, Estimates). But the market appeared worried that supplies are too high. In New York, Light sweet crude futures for June delivery fell 67 cents, or 2.4 percent, to $28.27 per barrel in early afternoon trading. And shares of oil producers fell, including Exxon Mobil (XOM: down $1.90 to $86.90, Research, Estimates) , Texaco (TX: down $2.12 to $70.08, Research, Estimates), and BP Amoco (BP: down $1.44 to $52.80, Research, Estimates).

Click here for a look at how other energy stocks are trading

The day's losses come amid a good time for the industry. Oil prices, which rose above $35 a barrel last fall, are still higher then they were at this time last year. Buoyed by strong profits, oil stocks have posted gains amid this year's market decline.

Just last week, Halliburton (HAL: down $1.88 to $40.58, Research, Estimates), the world's biggest oil field services company, said its first-quarter earnings from continuing operations more than tripled to $86 million.

But the rising gas and oil inventories caught some by surprise, ahead of the summer driving season, which has brought worries about a shortage.

In its most recent report, issued last week, the American Automobile Association said the average price of regular unleaded gasoline has jumped more than 15 cents per gallon to $1.587. The AAA said the large and rapid increase in fuel prices is mainly attributable to high crude oil prices, the industry's traditional switch from winter-grade to costlier summer grade fuels and industry reparations to re-introduce a variety of cleaner-burning reformulated gasoline.

-- Reuters contributed to this report.

|

|

|

|

|

|

|