|

Wall St. drifts on rate cut

|

|

May 15, 2001: 4:33 p.m. ET

Rate cut cheered but concerns return about slowing economy and earnings

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - The wind was taken out of the sails on Wall Street Tuesday, as investors worried the economy may continue slowing after the Federal Reserve cut short-term interest rates by half a percentage point and did not slam the door on future rate cuts.

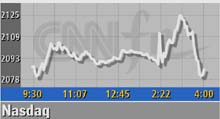

Immediately following the announcement, stocks staged a broad rally, but within 10 minutes reversed course before winding up nearly unchanged from where they were pre-Fed – all within 40 minutes of the Fed's move.

Investors had hoped for the rate cut and also for the Fed to remain vigilant in its stance toward further rate cuts. But leaving the door open left some investors jittery.

"The market's tepid reaction to today's Fed action signals investors aren't sure what's coming next," wrote John Forelli, portfolio manager with Independence Investment Advisors, in a note to clients. "We'll be slogging through bad earnings reports and it will be pretty awful."

The Nasdaq composite index gained 3.78 points to 2,085.70, while the Dow Jones industrial average slipped 4.36 points to 10,872.97. The S&P 500 added 0.51 to 1,249.43. The Nasdaq composite index gained 3.78 points to 2,085.70, while the Dow Jones industrial average slipped 4.36 points to 10,872.97. The S&P 500 added 0.51 to 1,249.43.

In other markets, Treasury securities fell. The dollar rose against the yen but declined versus the euro.

Market breadth was positive. On the Nasdaq, advancers beat decliners 2,105 to 1,751 as more than 1.67 billion shares changed hands. Winners outpaced losers on the New York Stock Exchange 1,909 to 1,175 as more than 1.04 billion shares were traded.

"The market likes this but it's not going to create the impetus for another leg upwards right away," said Barry Hyman, chief investment strategist with Ehrenkrantz King Nussbaum.

And most analysts said the whipsaw action was not unexpected, given the recent gains just last month. In April, the Nasdaq rose 15 percent, the Dow gained 8.6 percent, and the S&P 500 advanced 7.6 percent. And most analysts said the whipsaw action was not unexpected, given the recent gains just last month. In April, the Nasdaq rose 15 percent, the Dow gained 8.6 percent, and the S&P 500 advanced 7.6 percent.

"The equity markets have run up so much in anticipation of this that you're getting a sigh of relief rather than a significant rally," said Shannon Reid, portfolio manager with Evergreen Select Strategic Growth Funds, which manages $800 million in assets.

In the last minutes of trading technology stocks faltered, after spending most of the session modestly higher, as investors became nervous about the future of corporate earnings. And in a slowing economy, profits may continue to fall short of expectations.

"Today's interest rate cut sent the signal that this downturn in the economy is not over," Jim Saxton, chairman of the Joint Economic Committee, told CNNfn's Street Sweep. "For some investors, that is very worrisome."

With several tech firms still posting results, ears will tune in to guidance for broader signs of recovery.

"What's going to be more important are the comments that managements make on a number of earnings reports," Reid said. "What management says with regard to the outlook for information technology spending will have much more of a bearing on the Nasdaq tomorrow, rather than the rate cut which had already been anticipated."

Digesting the Fed move

The Federal Open Market Committee, the Fed's monetary policy-making arm, announced its interest rate decision around 2:15 p.m. ET. And investors were relieved with the outcome.

"I think the market got everything they were anticipating, which was a 50 basis point cut (half a percentage point) and a willingness on the part of the Fed to continue accommodation if they saw the need for it," Reid said.

This vigilance came as a surprise but remained a double-edged sword because it could also signal further economic trouble ahead.

"They (the Fed) did indicate that there could be further cuts and that was something Wall Street was starting to believe wasn't going to be the expected outcome," said Hyman. "This is part of the recovery process. It's not going to happen immediately but this is the Fed understanding the weakness in the economy."

Now that the Fed has indicated it will remain aggressive, the concern has resurfaced that the economy may still have a long road to recovery. This could lead to another quarter of bad corporate results before things start turning around.

With the focus turning toward corporate guidance, there will be a plethora of reports to digest.

Semiconductor maker Applied Materials (AMAT: up $0.20 to $49.89, Research, Estimates) reports its results after the closing bell. The company is expected to post an earnings drop to 33 cents a share from 53 cents a year earlier. Semiconductor maker Applied Materials (AMAT: up $0.20 to $49.89, Research, Estimates) reports its results after the closing bell. The company is expected to post an earnings drop to 33 cents a share from 53 cents a year earlier.

Also due to report after the bell are fiber-optics maker Brocade Communications (BRCD: up $2.41 to $42.50, Research, Estimates), chipmaker QLogic (QLGC: up $1.01 to $42.51, Research, Estimates), networking equipment maker Sycamore Networks (SCMR: down $0.07 to $9.32, Research, Estimates), and retailer Abercrombie & Fitch (ANF: up $0.38 to $39.73, Research, Estimates).

Among Dow issues, Johnson & Johnson (JNJ: down $0.71 to $97.08, Research, Estimates) and Merck (MRK: down $0.79 to $75.90, Research, Estimates) led the declines, while IBM (IBM: up $1.02 to $113.58, Research, Estimates), 3M (MMM: down $0.15 to $118.15, Research, Estimates) and United Technologies (UTX: up $0.52 to $79.40, Research, Estimates) attracted buyers. Among Dow issues, Johnson & Johnson (JNJ: down $0.71 to $97.08, Research, Estimates) and Merck (MRK: down $0.79 to $75.90, Research, Estimates) led the declines, while IBM (IBM: up $1.02 to $113.58, Research, Estimates), 3M (MMM: down $0.15 to $118.15, Research, Estimates) and United Technologies (UTX: up $0.52 to $79.40, Research, Estimates) attracted buyers.

"I think most folks know what they want to buy," Charles Payne, president of Wall Street Strategies, told CNNfn's Market Call. "Certain stocks are starting to creep higher and you want to be ahead of the curve."

Tech stocks such as Qualcomm (QCOM: up $2.58 to $59.50, Research, Estimates), Cisco Systems (CSCO: up $0.17 to $18.74, Research, Estimates), Dell Computer (DELL: up $0.30 to $24.49, Research, Estimates), and Yahoo! (YHOO: up $0.96 to $18.06, Research, Estimates) helped boost the Nasdaq.

Retailers rise, signaling consumer interest

With the Fed meeting out of the way, investors are turning their attention more fully toward corporate profit growth and how it will be affected in the current economic environment, which seems to be strengthening.

There are signs that consumer spending might be rising, as two leading retailers posted results in line or better than expected.

Wal-Mart Stores (WMT: down $2.35 to $52.00, Research, Estimates) and Home Depot (HD: up $0.95 to $50.10, Research, Estimates) reported higher fiscal first-quarter profits, with Wal-Mart meeting Wall Street forecasts while Home Depot topped expectations.

"It's good to remember that it's the consumer that's going to turn this economy around -- and if the consumer is out there spending, that's a good sign," said Art Hogan, chief market analyst with Jefferies & Co.

| |

RETAIL STOCKS RETAIL STOCKS

|

|

| |

|

Click below to see how the rest of the retail sector is performing

Retail Sector

|

|

|

Deere (DE: down $2.49 to $38.52, Research, Estimates), the agricultural equipment maker, reported fiscal second-quarter earnings that were well below Wall Street estimates. The company also said the U.S. economic slowdown would lead to a reduced production schedule, hurting earnings in the second half of the fiscal year.

|

|

|

|

|

|

|