|

Bull run grips Wall St.

|

|

May 16, 2001: 4:39 p.m. ET

Betting on stronger economy, profits, Dow pierces 11,000, Nasdaq up 3%

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - A broad rally on Wall Street Wednesday sent stocks sharply higher as investors looked beyond the second and third quarter, betting that the aggressive interest rate cuts by the Federal Reserve would stimulate the economy.

The Dow Jones industrial average surged more than 300 points, closing above 11,000 for the first time in eight months, as investors snapped up a basket of blue chip issues.

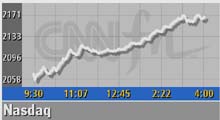

And the Nasdaq composite index rallied more than 3 percent as technology stocks surged.

The gains came one day after the Federal Reserve gave investors what they wanted by cutting interest rates by a half-percentage point, its fifth cut in five months. The Fed also kept the door open for further rate cuts if warranted.

The Dow Jones industrial average rallied 342.95 points, or 3.15 percent, to 11,215.92 -- its first close above 11,000 since Sept. 14, 2000, and its fifth-largest one-day point gain. The Dow Jones industrial average rallied 342.95 points, or 3.15 percent, to 11,215.92 -- its first close above 11,000 since Sept. 14, 2000, and its fifth-largest one-day point gain.

Since the end of March, the blue chip index has gained nearly 2,000 points. But the day's advance also brings it to the same level it was at just over two years ago.

On the Dow, 3M (MMM: up $7.95 to $125.50, Research, Estimates), Johnson & Johnson (JNJ: up $2.69 to $99.77, Research, Estimates), Merck (MRK: up $2.20 to $78.10, Research, Estimates), Alcoa (AA: up $2.51 to $44.51, Research, Estimates), and Procter & Gamble (PG: up $2.31 to $68.29, Research, Estimates) led the advancers.

The Nasdaq composite index gained 80.82 points, or 3.88 percent, to 2,166.40, while the Standard & Poor's 500 advanced 35.54 to 1,284.98.

The markets initially opened modestly lower, but within two hours institutional money poured in and the buyers never looked back.

"It's pretty evenly divided between short-covering and a lot of big money moving back into the market," said Jim Gribbell, portfolio manager with David L. Babson, which manages $65 billion in institutional assets. "There are a lot of big institutions that have had cash on the sidelines and are putting money into the market pretty aggressively because they don't want to fight the Fed."

While defensive issues led Wall Street's rally, buying in the tech sector gained momentum. On the Nasdaq, Cisco Systems (CSCO: up $1.26 to $20.00, Research, Estimates), Qualcomm (QCOM: up $5.26 to $64.76, Research, Estimates), and Applied Materials (AMAT: up $4.21 to $54.10, Research, Estimates) all gained. While defensive issues led Wall Street's rally, buying in the tech sector gained momentum. On the Nasdaq, Cisco Systems (CSCO: up $1.26 to $20.00, Research, Estimates), Qualcomm (QCOM: up $5.26 to $64.76, Research, Estimates), and Applied Materials (AMAT: up $4.21 to $54.10, Research, Estimates) all gained.

"You're getting money flowing back into some of these big stocks and the tone is good," said Richard Cripps, chief market strategist with Legg Mason Wood Walker. "What's powering it is optimism that at some point and time, we're going to get this final turn in earnings -- it's buying with the thought that you don't fight the Fed."

Analysts were also optimistic that the rally could be sustained in the near term. "The volume isn't overly heavy but there are a lot of orders on the trading desks backing up what's out there right now," said Gribbell. "There's a lot of committed capital on trading desks that's trying to be put to work."

Market breadth was positive. On the Nasdaq, advancers beat decliners 2,329 to 1,557 as more than 2.05 billion shares changed hands. Winners outpaced losers on the New York Stock Exchange 2,080 to 1,014 as more than 1.34 billion shares were traded.

In other markets, Treasury securities gained. The dollar rose against the yen but declined versus the euro.

Gauging the economy

Investors had hoped for a half-percentage-point rate cut and continued vigilant guidance that the Fed is willing to cut further if warranted. They got what they wanted.

"A number of people were looking for the good news that occurred," said Michael Holland, chairman of Holland & Co. "When the dust settles, people also say, history argues for the market going up. So people who may have been inclined to sell just don't."

The day's economic reports supported the Fed's stance, with the Consumer Price Index (CPI) edging higher in the United States last month and builders breaking ground on new homes and apartments at a healthy pace, according to government reports.

The CPI, the government's main inflation gauge, rose 0.3 percent after rising 0.1 percent in March. Analysts polled by Briefing.com expected a 0.4 percent increase. Excluding often-volatile food and energy prices, the "core" CPI grew by 0.2 percent, matching forecasts. Separately, the Commerce Department said housing starts rose 1.5 percent to an annual rate of 1.60 million last month, matching forecasts, while building permits fell 2.5 percent to a rate of about 1.59 million.

"You have two very powerful opposing forces in the market," said Babson's Gribbell. "You have the Fed being very aggressive, lowering interest rates and throwing liquidity back into the market. And you have underlying business trends throughout most of the economy that are awful in many industries and show no signs of improvement. You have to take a side."

Corporate profits and guidance

Analysts said investors should take the Fed's vigilant position in stride because it is not a surprise. And the fact that the quarter ending in June will be ugly in terms of corporate profitability also comes as little surprise.

But, with the second quarter of 2001 only half over, investors still are concerned about how many companies may warn and how severe the negative guidance may be.

"Some of these CEOs are saying we're getting some visibility, but no one is pounding the table," Charles Payne, president of Wall Street Strategies, told CNNfn's Market Call.

Babson's Gribbell agreed. "There is no visibility – management teams are coming out and saying we have no visibility but we think the second quarter is the bottom but they have no idea."

Analysts said investors are starting to price in a "worst case scenario" so negative guidance may be buffeted. Several high profile companies posted mixed results and mixed guidance.

Applied Materials (AMAT: up $4.21 to $54.10, Research, Estimates) reported fiscal second-quarter earnings at the low end of analysts' estimates and warned that third-quarter sales and earnings will be below forecasts, though it expects a pick-up in business later in the year.

Sprint (FON: down $0.16 to $21.42, Research, Estimates) cut the second quarter and 2001 profit guidance for its non-wireless operating group for the second time in a month, saying it expects to see continued higher bad debt from wholesale customers and reduced wholesale demand.

Sycamore Networks (SCMR: down $0.09 to $9.23, Research, Estimates), the maker of optical networking equipment, missed forecasts by a penny a share in reporting a fiscal third-quarter loss late Tuesday. Sycamore also warned of revenue weakness in the current quarter.

Federated Department Stores (FD: up $2.29 to $46.38, Research, Estimates), parent of such merchants as Macy's and Burdines, reported fiscal first-quarter earnings of 42 cents a share, six cents above the First Call analysts' consensus. The company also said it expects to meet earnings expectations for its full fiscal year. Federated Department Stores (FD: up $2.29 to $46.38, Research, Estimates), parent of such merchants as Macy's and Burdines, reported fiscal first-quarter earnings of 42 cents a share, six cents above the First Call analysts' consensus. The company also said it expects to meet earnings expectations for its full fiscal year.

Campbell Soup (CPB: up $0.05 to $30.00, Research, Estimates) reported a 6 percent drop in fiscal third-quarter earnings per share Wednesday and a 12 percent drop in net earnings, yet matched Wall Street's expectations as U.S. soup business volume increased.

Krispy Kreme Doughnuts (KREM: up $7.00 to $56.40, Research, Estimates) reported higher-than-expected first-quarter earnings, and raised its profit estimates for fiscal 2002 and 2003.

Dow component Hewlett-Packard (HWP: up $1.34 to $26.74, Research, Estimates) reported its fiscal second-quarter results after the bell, which were in line with expectations. The computer and printer maker posted a decline in earnings to 15 cents a share from 44 cents a year earlier, according to analysts surveyed by First Call.

Companies weren't the only ones doing the warning Wednesday. Goldman Sachs downgraded three chipmakers, Vitesse Semiconductor, (VTSS: up $1.84 to $31.30, Research, Estimates), PMC-Sierra (PMCS: up $2.33 to $37.89, Research, Estimates), and Applied Micro Circuits (AMCC: up $0.96 to $23.04, Research, Estimates), to "market outperform" from "trading buy."

|

|

|

|

|

|

|