|

BT may unwind Concert

|

|

September 24, 2001: 6:47 a.m. ET

British Telecom may face `substantial' costs from possible closure of Concert

|

LONDON (CNN) - British Telecommunications has warned it may incur "substantial" cost if it closes its Concert joint venture with AT&T.

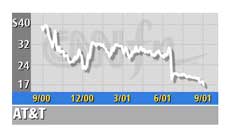

BT, Britain's second largest phone company, said on Monday it is still in talks with AT&T (T: Research, Estimates) about the future of the business. BT's losses in Concert were £81 million in the first-quarter ending June 30.

The joint venture provides data communications to hundreds of the world's largest multinationals. The joint venture provides data communications to hundreds of the world's largest multinationals.

"In the event than an unwinding of the Concert joint venture is agreed, and depending on the way that it is implemented, the financial effects on the group are likely to include cash and non-cash restructuring cost which could be substantial," BT said.

Finance Director Philip Hampton said BT is unlikely to write off the entire £1.4 billion book value of its Concert stake. BT has ruled out injecting its European corporate Internet business Ignite into Concert and expects a decision on its investment by the end of the year.

BT also said it would take a £500 million charge in the six months to September 30. The charge includes a write down of the value of AT&T Canada, which is 9 percent owned by BT and 20 percent by AT&T. AT&T Canada is listed and companies typically adjust their accounts to take into consideration the falling value of those assets.

Shares in BT fell 15 pence, or 4 percent, to 358.5 pence in midday London trade. The stock has fallen more than 30 percent this year and more than 73 percent from a peak of 1,339 pence in December 1999, on concern about the company's mounting debt mountain.

BT has made inroads with a radical plan to cut debts. It hopes to reduce debts to £15 billion to £17 billion by March 31, 2002. The company expects to sell and lease back property by December 31, which should yield £2.3 billion.

The company also unveiled the prospectus for the demerger of it mobile phone business mmO2, which will be listed in London and New York if shareholders approve the plan. The company also unveiled the prospectus for the demerger of it mobile phone business mmO2, which will be listed in London and New York if shareholders approve the plan.

MmO2, which operates services in the UK, Ireland, Germany, and the Netherlands, will start trading as a separate company on November 19. The mobile phone unit will take on £500 million of BT's debt but has an agreement with banks to lend £3.5 billion.

Investors forced the company's beleaguered management to consider radical options that included the demerger of its mobile phone business, to reduce debts that at one stage stood at about £28 billion. That it has done partly through the disposal of assets and partly by selling stock worth £5.9 billion.

MmO2 has been valued at between £8 billion and £15 billion, by analysts who are concerned that the business will need to spend £8.5 billion to roll out high-speed wireless networks that would allow email, internet and video services.

|

|

|

|

|

|

|