|

Why 'Out' is the wrong call

|

|

October 5, 2001: 12:24 p.m. ET

Baseball won't get better eliminating teams, despite some franchises' woes

A twice weekly column by Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - The Montreal Expos play their last game of the season Sunday. Fortunately for them, it won't be a home game. And if some in baseball have their way, it'll be their last game ever.

Talk for the last year among some leading owners is that it's time for contraction, time for Major League Baseball to close two of its more troubled franchises. Baseball Commissioner Bud Selig told me this past week that there is still a distinct chance that baseball will begin next season with fewer franchises than the 30 it has today.

| |

|

|

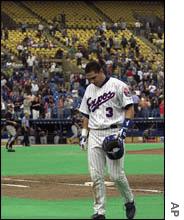

Expos second baseman Jose Vidro walks off the field after what could be the team's last home game in Montreal. Some have called for the team to be eliminated or moved before next season. | |

"That's a very viable option. It could be as soon as next year," he said, although he added, "No decisions have been made yet."

Nor is a disband decision likely to come. In fact, there's a better chance of the Expos winning the World Series next year than there is of them or any other team being disbanded.

That's because contraction would be fraught with more questions than answers about how it would be accomplished, such as which would be the second team disbanded to keep the majors with the necessary even number of teams required for the everyday nature of baseball's schedule. And it would spark a war with the players' union that the game can not endure at this tenuous time in the game's, and the nation's, history.

It also would solve none of baseball's economic problems of some teams trying to compete with a fraction of other teams' revenue base and payroll, and with all but a handful of teams claiming to be losing money.

Baseball owners likely only raised the threat of contraction, with the elimination of 50 player jobs, as a form of pre-negotiation saber rattling and leverage. But it's not a threat that the union is taking very seriously. Union officials said they don't even want to comment on the possibility of contraction because they say the talk of such a move is already dead.

There are plenty of other markets that could support baseball and even in the unlikely event that the union would accept elimination of two teams, elected officials would be quick to challenge such a move.

"Attorneys General in various states looking to get baseball or keep teams would sue baseball on grounds that they're a monopoly and restricting output," said Andrew Zimbalist, a professor of economics at Smith College and author of "Baseball and Billions," a look at the economics of the game. "It has an antitrust exemption, but it's challengeable."

Contraction not worth the costs

Perhaps the most serious barrier to contraction is that the remaining 28 team owners would likely have to dig into their own pockets to pay about $8 million to $10 million each to buy out any franchises that are closed. And from a pure dollars and cents standpoint, that just doesn't make sense.

Baseball shares only 20 percent of its key local revenue, such as ticket sales, concessions and local television contracts, So the Expos aren't digging too deeply into any team's pockets now, despite the moaning.

Despite the insurmountable problems with contraction, there are probably more people calling for the Expos' demise than going to their games. The 33-year old team sold a franchise-record low 619,541 tickets this year, an average of only 7,648 paying fans per home game.

That average put it below the typical crowd at 13 minor league parks, including such "major" markets as Dayton, Ohio, Round Rock, Texas, and Kane County, Ill.

New home tough to find

One thing stopping baseball from moving teams such as the Expos to new markets is the desire of existing teams to keep strong markets, such as Sacramento, Calif., open, so they can use the threat of relocation to win new stadiums or other concessions from public officials at their current homes.

While few believe baseball has a future in Montreal, the team was among the leaders in attendance as recently as 1982, when it drew 2.3 million fans, topping both division winners that year. But while the team won't come near a fraction of that if it returns to Montreal next year, finding a new home in the short-term will not be easy.

There are few major league-ready stadiums sitting empty waiting for a team today. There's one in Washington D.C., and talk of trying to build a new park in the Northern Virginia suburbs. But the Baltimore Orioles have vowed to fight a team moving there, and with the U.S. economy heading into recession, it will be tougher to find examples of municipal largess in the construction of new stadiums.

Click here to see CNNSI's baseball coverage

Selig has his hands full trying to get owners to agree on some form of revenue sharing to limit the disparity between teams, and figuring out what to do about a collective bargaining contract that ends with the conclusion of the World Series. He told me that the Sept. 11 attack has not changed the game's basic economic problems, that they will still need to be addressed once the season ends.

But things have changed. The owners would be foolish to think that fans will sit still for a labor battle or push for a new park they might have accepted as business as usual before the attack.

So figure that the Expos will be back next year, and likely playing in Montreal. Unless baseball wants to try a truly radical solution that makes more financial sense -- a season-long road trip.

|

|

|

|

|

|

|