|

Will the Patriots unleash the bears?

|

|

February 4, 2002: 1:22 a.m. ET

Unexpected New England win bodes badly for stocks, some say.

By Staff Writer Jake Ulick

|

NEW YORK (CNN/Money) - If the U.S. stock market falls for a third straight year in 2002, cast some blame on the New England Patriots.

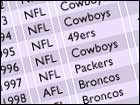

That's according to one quirky, though surprisingly accurate forecasting tool called the Super Bowl Indicator, which holds that a win by a member of the American Football League, before it merged with the National Football League, means a bad year for the markets.

The Patriots, an original AFL team, beat the favored St. Louis Rams in Super Bowl XXXVI Sunday, a potential bad market omen, according to an indicator struggling with a short-term losing streak of its own.

Call it coincidence, but since the first modern football championship in 1967, the forecasting tool has done pretty well over time. Until recently.

"I don't pay much attention to it," said Eugene Profit, the president of Profit Funds, and a man who played for New England in the 1980s.

The Baltimore Ravens, an original NFL team once known as the Cleveland Browns, won the Super Bowl last year. But stocks fell anyway. Stocks also declined in 2000, when the Rams won. The 1999-98 victories by the Denver Broncos should have sunk the market. Stocks rose instead.

Statisticians have to go back to 1997, when an original NFL team, the Green Bay Packers, won, to find the most recent year when the market was in sync with the Super Bowl Indicator.

Still, from 1967 though 2000, the Standard & Poor's 500 index rose an average of 18.6 percent -- about twice the normal annual return -- during years when an NFL team won, according to Ed Yardeni, an economist at Deutsche Bank. The index fell 0.2 percent when AFL teams won. And before 1998, the Indicator and the S&P 500 were out of sync only three times.

That's a 90 percent success rate.

"It's one of these wonderful economic coincidences," said Ed White, manager of the GW&K Multicap Growth Fund, who was rooting for the Patriots.

The indicator's good record masks some problems. During the 34 years between 1967 and 2001, the S&P rose 27 times and fell only 8 times. And the old NFL teams, which outnumber the old AFL teams, tend to win, having taken 26 of the victories since the first Super Bowl.

So, it's easy to conclude that the Super Bowl Indicator is merely the result of two concurrent trends: One, the stock market tends to rise; and two, old NFL teams generally win championships.

"This is a marginal indicator," said Judd Brown, director of operations at the Stock Trader's Almanac. "It is fun, it is interesting, but it is far from anything more than coincidence."

The market, for example, also tends to rise when the New York Yankees win the World Series, if only because they've done so 26 times.

Two simultaneous events may appear related even though they have nothing to do with one another. ABC Sports discovered that the Washington Redskins' last home game before a presidential election has a perfect 15-0 record of "predicting" the White House outcome.

That was even the case in 2000, when Washington's loss to the Tennessee Titans accurately anticipated the Supreme Court-determined victory of the challenger, George W. Bush. A Redskins victory has meant the incumbent party takes the White House.

The Super Bowl indicator comes with its own striking, if quirky, parallels between markets and football.

The Miami Dolphins, for example, are bad for stocks. In 1973, when the team won its first Super Bowl, the S&P 500 went on to fall 14.7 percent. The next year, the S&P recorded its worst loss ever, 26.5 percent, after the Dolphins beat the Minnesota Vikings.

Miami losses, by contrast, have always been good years. The S&P 500 saw double-digit gains in 1972, 1983 and 1985, when the Dolphins lost Super Bowls.

In future seasons, bulls may want to root for San Francisco. When the 49ers won in 1982, the S&P rose 21.4 percent. Their 1985 Super Bowl victory came during a year when the S&P jumped 32.2 percent. And the S&P gained 37.5 percent in 1995, the last time San Francisco won.

And how about the Bears? They're bullish, like most original NFL teams. Chicago's only Super Bowl victory, in 1985, came before the S&P went on to jump 18.5 percent.

Regardless of Sunday's outcome, analysts have reason to bet that stocks will rise.

The Federal Reserve cut interest rates 11 times in 2001 to get consumers and businesses spending again. Corporate profits are expected to rebound this spring following a five-quarter slump. And then there's history. Stocks, which fell over the last two years, haven't had three straight losing years since 1941.

In 1941, the market had a different whimsical indicator called "the hemline theory," which held that rising skirt lengths presage rising markets. And vice versa.

"Wishful thinking," say the editors of 'Barron's Dictionary of Financial and Investment Terms.'

"If you play it out long enough it blows up," said David Dreman, chairman and CEO of Dreman Value Management LLC.

A few more inaccurate years and the Super Bowl Indicator may blow up as well.

|

|

|

|

|

|

|