NEW YORK (CNN/Money) -

The top 20 institutional shareholders of Hewlett-Packard Co. approve of the company's buyout offer for rival Compaq Computer Corp., a member of HP's board of directors said Monday.

But Wells Fargo's proxy committee decided to vote the shares they represent against the deal. The proxy committee vote was deciding the vote to be cast on behalf of HP shareholders who chose to have Wells Fargo vote on their behalf.

Dissident HP board member Walter Hewlett has launched an increasingly bitter proxy fight to block the $22 billion stock deal, and the expected outcome of a shareholder vote scheduled for next week remains too close to call.

"We believe we have the support of most of our 20 largest shareholders," said Phil Condit, chairman of aerospace giant Boeing Co. and an HP board member, during a teleconference Monday.

Both sides in the proxy battle -- which has become bitterly personal between Hewlett and HP's CEO Carly Fiorina -- have claimed significant shareholder support for their side. Hewlett, the son of one of HP's co-founders, together with other descendents of the founding partners, control roughly 18 percent of HP's voting shares.

A handful of HP's institutional investors, including the California Public Employees' Retirement System, or CalPERS -- have said they plan to vote against the proposal when it is put to shareholders next Tuesday. A vote by Compaq shareholders is scheduled for next Wednesday.

Although CalPERS' stake represents less than 1 percent of HP's total outstanding shares, industry observers said the pension fund's decision was significant because it shows that not all institutional investors had been swayed by the recommendation of Institutional Shareholder Services -- which advises money managers on how to vote their shares.

Wells Fargo spokeswoman Mary Trigg told CNNfn the decision reflected the committee's skepticism about the likely success of a big technology merger.

"Pulling off any large mergers increases integration risk and history of large mergers between high tech companies has been prone to failure," Trigg said.

She noted the Institutional Shareholder Services recommendation cited this risk as well despite supporting the merger. Last week, ISS, which in theory holds sway over 23 percent of HP's shareholders, issued an opinion backing the plan.

The decision of the proxy committee, which is made up of representatives of Wells Fargo's various investment businesses, was announced in an internal memo. Triggs estimates the vote represents more than 4 million shares.

HP spokeswoman Rebecca Robboi said that Wells Fargo is only one shareholder and noted more than half a million hours had been put into planning the integration of the companies.

"We believe the good judgment of the rest of our shareholders will prevail and the merger will be approved,' Robboi said.

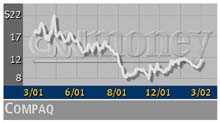

Opponents of the deal argue that it would increase HP's exposure to the flagging PC industry and low-end server business while jeopardizing its strong position in the printing and imaging business.

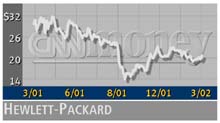

For their part, executives of HP (HWP: Research, Estimates) and Compaq (CPQ: Research, Estimates) say that a merger is necessary in order for them to become stronger players in an increasingly competitive industry. They argue that a merger would result in savings of $2.5 billion a year and assert that the combined company's fiscal 2003 operating earnings per share would rise about 12 percent.

Earlier Monday, long time HP director Richard Hackborn sent a letter to shareholders Monday encouraging them to vote in favor of the deal. He pointed out that in 1984, when HP first got into the laser printer business -- now one of its strongest product areas -- naysayers had raised similar concerns as those that have surfaced in the face of the Compaq proposal.

"Through it all, Bill and Dave would listen patiently, smile, nod, and then encourage us to proceed full-steam ahead," Hackborn wrote, referring to HP's co-founders Bill Hewlett and Dave Packard.

"They absolutely loved the business. They didn't have to say it, but we knew it to be true: that if they had stopped every single time somebody told them they wouldn't succeed, they never would have made it out of the garage," Hackborn added.

-- Reuters contributed to this report

|