NEW YORK (CNN/Money) -

Shareholders of Conoco Inc. and Phillips Petroleum Co. overwhelmingly approved the companies' proposed $15.6 billion merger Tuesday, removing another hurdle before the companies can create the nation's third-largest oil corporation.

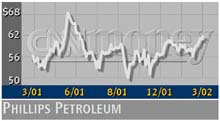

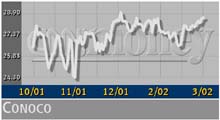

Phillips (P: up $0.82 to $62.22, Research, Estimates) said that 97 percent of the 328 million shares voted were cast in favor of the merger, and Conoco (COC: up $0.37 to $28.85, Research, Estimates) said more than 96 percent of the shares voted by its stockholders were cast in favor of the deal.

The shareholders' approval came a week after the European Union signed off on the marriage. Canada also has approved it, making the U.S. Federal Trade Commission (FTC) the last hurdle for the merger.

The FTC issued a "second request" in February seeking more information on the transaction, but both companies are hopeful the merger will close in the second half of 2002.

The new company, ConocoPhillips, would assume Conoco's home in Houston, leaving in limbo the 2,400 Phillips employees in Phillips' hometown of Bartlesville, Okla.

Oklahoma politicians lobbied the new company to be based there, but executives from both companies decided it made more sense to locate in Houston, the nation's fourth-largest city and energy-industry hub.

Only Exxon Mobil Corp. (XOM: up $0.33 to $43.82, Research, Estimates) and ChevronTexaco Corp. (CVX: up $0.20 to $89.30, Research, Estimates) would be larger than ConocoPhillips in the United States, and it would be the sixth-largest investor-owned oil company worldwide.

The company would control or have stakes in 19 refineries worldwide with a capacity of 2.6 million barrels a day. It would be the top U.S. refiner and would be behind 17,000 U.S. gas stations flagged by the respective corporate names, along with the Circle K and 76 brands.

Joint oil reserves of the new company would be about 8.7 billion barrels. The companies estimate the deal will save them $750 million annually once redundancies and an undetermined number of workers are cut.

| |

RELATED STORIES

RELATED STORIES

| |

| | |

| | |

|

Though both companies describe the deal as a merger of equals, Phillips shareholders would own 56.6 percent of ConocoPhillips, with Conoco shareholders coming away with 43.4 percent.

Phillips Chairman and Chief Executive Officer James J. Mulva would be president and chief executive of the combined company. His lieutenants will be a mix of current Phillips and Conoco executives.

Conoco Chairman Archie W. Dunham is delaying his retirement to serve as chairman of the new company until he steps down in 2004, when Mulva would add that title to his others.

-- from staff and wire reports

|