NEW YORK (CNN/Money) -

Hewlett-Packard Co. again came under verbal fire Wednesday from the dissident board member trying to block its proposed $22 billion buyout of Compaq Computer Corp., as the outcome of next week's shareholder vote became even more uncertain.

During a teleconference with analysts and the news media Tuesday, Walter Hewlett, the son of one of HP's founding partners, said merging the two companies would be tantamount to "selling 35 percent of our best business to invest in our worst business."

He also lashed out at HP CEO Carly Fiorina, suggesting that she was not a competent top executive to begin with and that she would not remain CEO should shareholders disapprove of the transaction when it is put to a vote next Wednesday.

"She has made this a referendum on herself," Hewlett said, "I expect to be on the search committee for a new CEO. This time around we do not want someone learning on the job."

That was the latest volley in what has been an increasingly bitter and personal proxy fight.

The rhetoric from Hewlett's camp, who launched his proxy fight in late December, has become increasingly fiery and targeted specifically at Fiorina as he tries to lure investors over to his side. For its part, HP has attempted to discredit Hewlett's arguments, characterizing him as a "musician and academic" whose arguments should not be taken seriously.

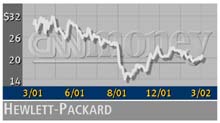

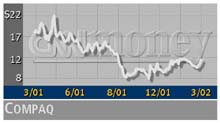

Opponents of the deal argue that it would increase HP's (HWP: Research, Estimates) exposure to the flagging PC industry and low-end server business while jeopardizing its strong position in the printing and imaging business.

Executives of HP and Compaq (CPQ: Research, Estimates) say a merger is necessary in order for them to become stronger players in an increasingly competitive industry. They also claim it would result in annual savings of $2.5 billion and the combined company's fiscal 2003 operating earnings per share would rise about 12 percent.

Both sides in the proxy battle have claimed significant shareholder support for their side.

HP board member Phil Condit, the chairman of aerospace titan Boeing Co., on Monday said he believes 20 of HP's largest shareholders favor the deal.

But in addition to Hewlett and other descendents of HPs founding partners who together control roughly 18 percent of the company's stock, several of HP's institutional investors have said they plan to vote against the deal.

The California Public Employees' Retirement System, or CalPERS, and Wells Fargo were the latest to come out against the deal. Most of the large investors who have voiced their opposition to the deal so far have expressed concerns about integrating the vast operations of the two companies.

Just minutes before Hewlett began his teleconference Tuesday evening, HP issued a press release listing several "key questions" the company said Hewlett has left unanswered.

Echoing its previous responses to Hewlett's criticism of the deal and alternative proposals, HP questioned how he would be able to double HP's margins to support his promised $14-to-$17 share price increase.

HP also asked how the merger would reduce HP's price-to-earnings ratio, as Hewlett has claimed, since Compaq has had a higher ratio than HP in the previous six-month, one-year and three-year periods.

The company also asked how Hewlett would "restructure the PC business for profitability," as he has suggested it do, and how many layoffs such a move would require.

Additionally, HP asked for details on Hewlett's discussions with Lew Platt on reassuming the chief executive position if the Compaq transaction fails. Last week, Hewlett asked Platt to rejoin the company in the event that the merger was voted down and Fiorina left.

"On what authority did you have these discussions?" HP asked. "Have you discussed this plan in private meetings with HP shareowners?"

|